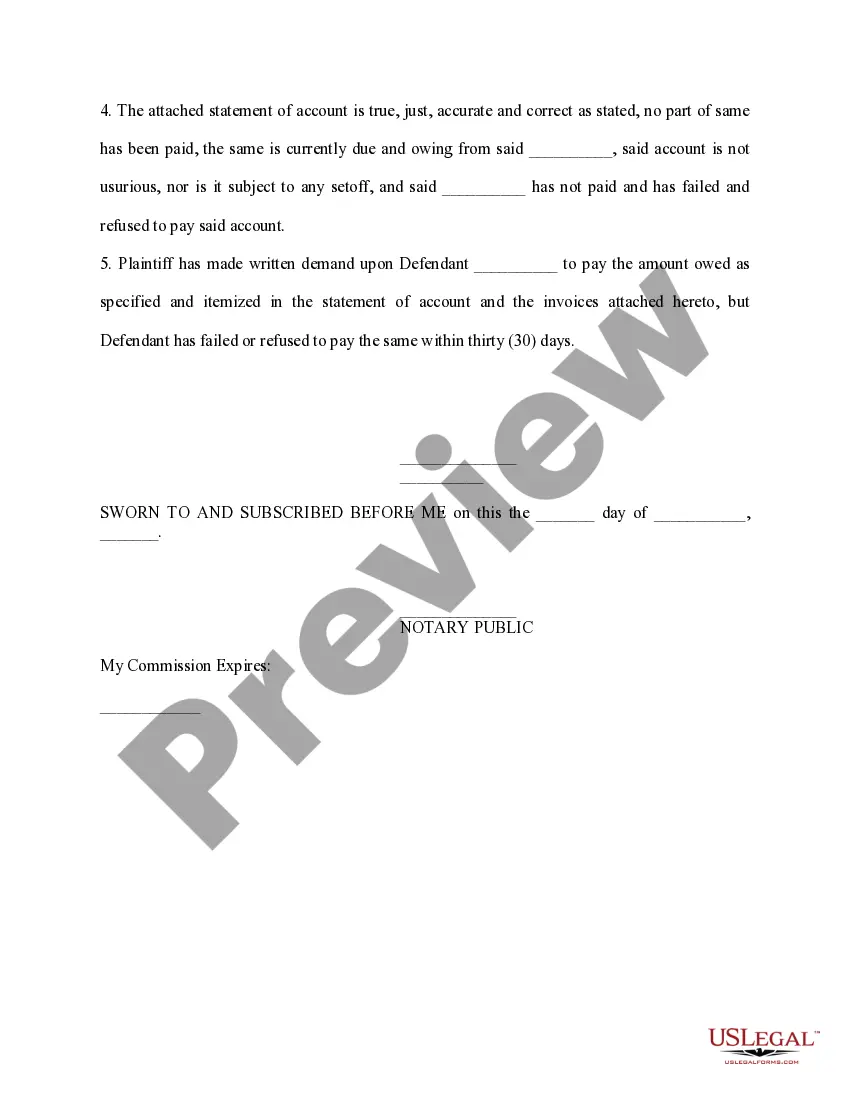

Puerto Rico Affidavit of Amount Due on Open Account

Description

How to fill out Affidavit Of Amount Due On Open Account?

Finding the right legal document design could be a have a problem. Of course, there are a variety of web templates available online, but how would you find the legal develop you will need? Use the US Legal Forms website. The support gives a large number of web templates, such as the Puerto Rico Affidavit of Amount Due on Open Account, which can be used for enterprise and personal requires. Every one of the varieties are checked by professionals and meet federal and state needs.

If you are already signed up, log in in your account and click on the Download option to find the Puerto Rico Affidavit of Amount Due on Open Account. Make use of your account to look with the legal varieties you have bought previously. Go to the My Forms tab of your own account and get another copy from the document you will need.

If you are a new user of US Legal Forms, listed below are simple recommendations for you to comply with:

- Initial, ensure you have chosen the proper develop for your personal city/area. You are able to look through the form using the Review option and browse the form explanation to make sure it is the best for you.

- When the develop does not meet your preferences, take advantage of the Seach field to discover the correct develop.

- When you are sure that the form would work, go through the Buy now option to find the develop.

- Choose the prices strategy you desire and type in the essential info. Make your account and buy the transaction utilizing your PayPal account or Visa or Mastercard.

- Choose the file file format and down load the legal document design in your system.

- Full, edit and print and indicator the acquired Puerto Rico Affidavit of Amount Due on Open Account.

US Legal Forms is definitely the most significant catalogue of legal varieties where you will find various document web templates. Use the company to down load appropriately-produced paperwork that comply with express needs.

Form popularity

FAQ

Having an offshore account simply means you're banking with a financial institution that's not in the country where you live. Anyone can open an offshore bank account with just a few hours of work.

Yes. Although that the Constitution of the Commonwealth of Puerto Rico provides that no person may be imprisoned for debt, the right to receive child support supersedes any other type of debt. Therefore, a person who fails to pay child support may be incarcerated.

Puerto Rico does not have a central bank and relies on the US Federal Reserve System (the Fed), the US central bank, as its central regulatory institution. It does not maintain its own reserves. Non-resident entities are permitted to hold fully convertible domestic and foreign currency bank accounts within Puerto Rico.

If you're a bona fide resident of Puerto Rico during the entire tax year, you generally aren't required to file a U.S. federal income tax return if your only income is from sources within Puerto Rico.

In Puerto Rico, child support takes into account the income from the parent's spouse. If one or both of the parents have a spouse, the spouse's income is factored into the amount the parent will pay for child support.

The opportunity to obtain a Puerto Rico bank account is open to all non-residents.

If you are a Puerto Rico bona fide resident, you must usually file a Puerto Rico tax return. If you are not a bona fide resident of Puerto Rico, you must file both a Puerto Rico tax return and a U.S. tax return. If you are a member of the United States Armed Forces, special tax rules may be applied.

You may think all banks are out of the question for non-residents. However, larger banks such as US Bank, TD Bank, Bank of America, Chase, and Wells Fargo will allow non-residents to set up a checking account and a savings account.

Who must file an income tax return in Puerto Rico? Every individual who during the taxable year has net income subject to alternate basic tax of $150,000 or more.

Self-employed persons in Puerto Rico use Form 1040 (PR) to compute self-employment tax.