Puerto Rico Partial Assignment of Life Insurance Policy as Collateral

Description

How to fill out Partial Assignment Of Life Insurance Policy As Collateral?

Are you inside a place that you will need paperwork for either company or individual uses nearly every day time? There are a lot of authorized papers themes accessible on the Internet, but locating ones you can rely is not effortless. US Legal Forms offers a huge number of form themes, much like the Puerto Rico Partial Assignment of Life Insurance Policy as Collateral, that are published in order to meet state and federal needs.

In case you are currently acquainted with US Legal Forms website and possess a merchant account, just log in. After that, you may download the Puerto Rico Partial Assignment of Life Insurance Policy as Collateral format.

Should you not offer an bank account and wish to start using US Legal Forms, follow these steps:

- Obtain the form you need and make sure it is for your right city/area.

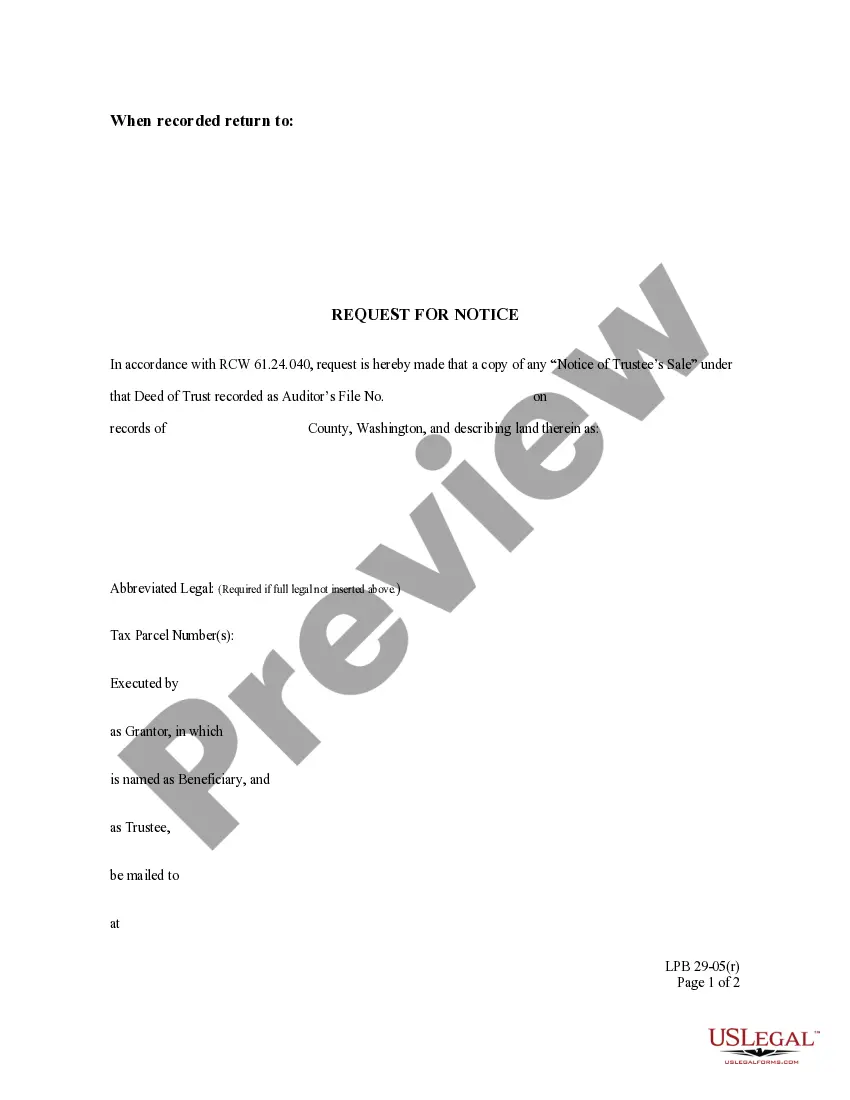

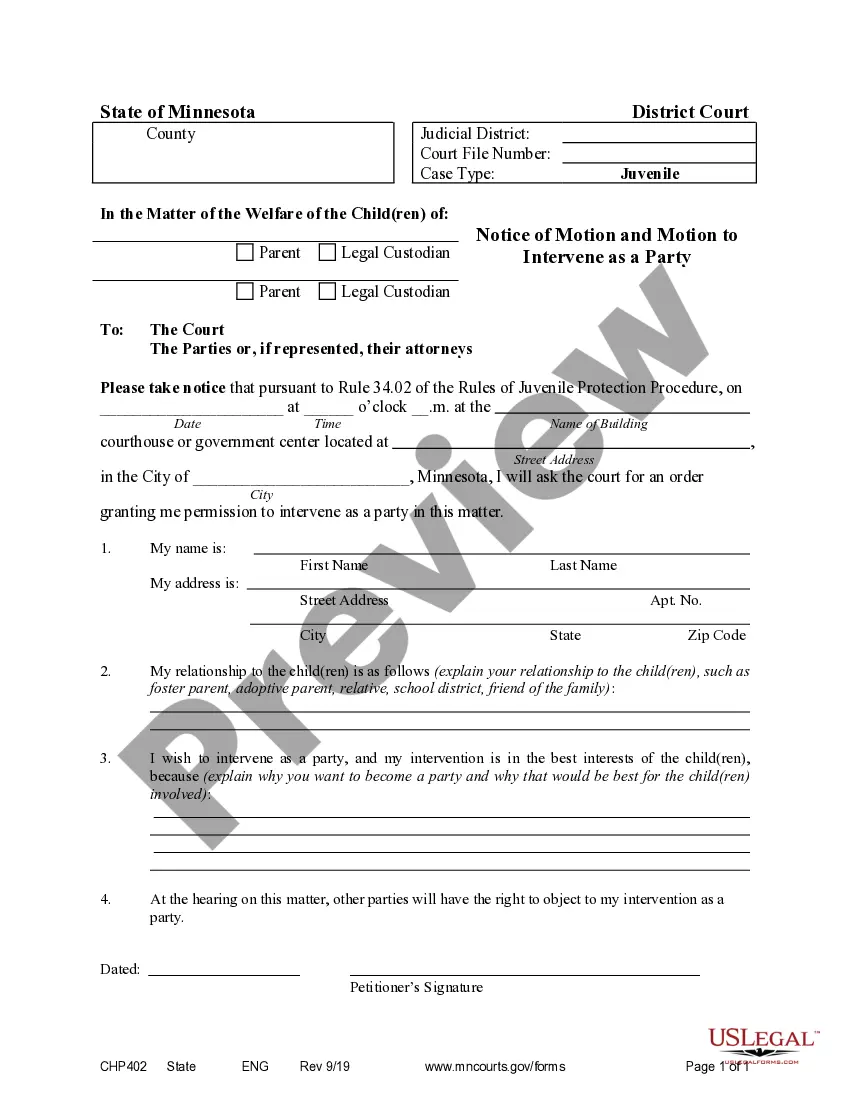

- Utilize the Preview switch to examine the shape.

- Look at the description to actually have selected the right form.

- If the form is not what you are looking for, utilize the Look for field to find the form that suits you and needs.

- If you obtain the right form, just click Purchase now.

- Opt for the prices strategy you desire, submit the necessary information and facts to make your money, and buy the order using your PayPal or Visa or Mastercard.

- Decide on a handy data file file format and download your backup.

Get each of the papers themes you may have purchased in the My Forms menus. You may get a additional backup of Puerto Rico Partial Assignment of Life Insurance Policy as Collateral any time, if possible. Just click on the needed form to download or produce the papers format.

Use US Legal Forms, the most substantial variety of authorized forms, to save lots of time as well as avoid errors. The assistance offers professionally manufactured authorized papers themes that you can use for a variety of uses. Generate a merchant account on US Legal Forms and initiate generating your life a little easier.

Form popularity

FAQ

Collateral assignment of life insurance is a method of providing a lender with collateral when you apply for a loan. In this case, the collateral is your life insurance policy's face value, which could be used to pay back the amount you owe in case you die while in debt.

A collateral assignment pledges a permanent life insurance policy's cash value and death benefits to another party and is most commonly used to secure a loan taken out by the policyowner. A collateral assignment primarily serves to protect the repayment interest of the lender.

A collateral assignment of life insurance is a conditional assignment appointing a lender as an assignee of a policy. Essentially, the lender has a claim to some or all of the death benefit until the loan is repaid. The death benefit is used as collateral for a loan.

Collateral assignment, on the other hand, is a temporary and often revocable arrangement. The policyholder retains ownership and control over the policy but agrees that the lender has a claim to a part of the death benefit if the loan is not repaid.

Under partial assignment, only the designated amount is paid to the assignee. Rest of the proceeds are paid to the nominee. If your expected insurance proceeds are more than the loan amount, you should opt for partial assignment.

People often assign their life insurance policies to banks. A bank becomes the policy owner in this case, while the original policyholder continues to be the life assured whose death may be claimed by either the bank or the policy owner.

Under partial assignment, only the designated amount is paid to the assignee. Rest of the proceeds are paid to the nominee. If your expected insurance proceeds are more than the loan amount, you should opt for partial assignment.

With an absolute assignment, the entire ownership of the policy would be transferred to the assignee, or the lender. Then, the lender would be entitled to the full death benefit. With a collateral assignment, the lender is only entitled to the balance of the outstanding loan.