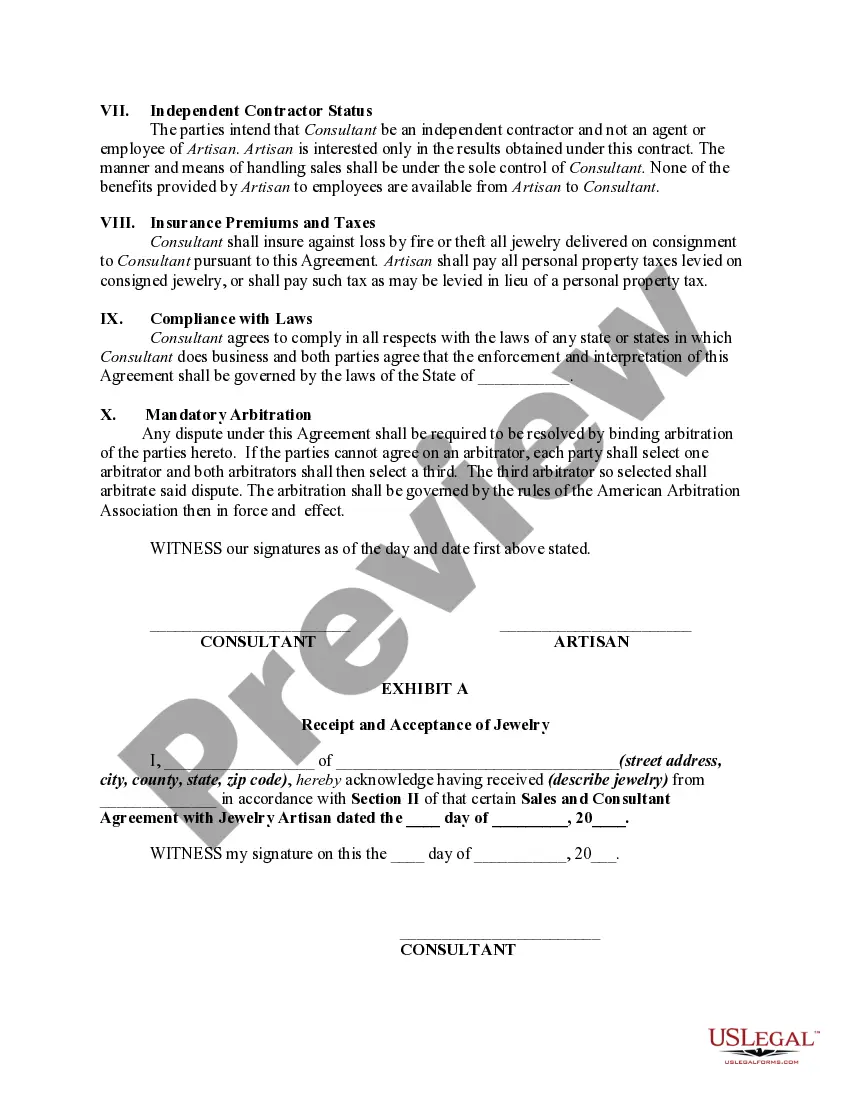

This form is a sample of an agreement to promote and sell jewelry between an artisan, who designs and creates fine jewelry, and an image consultant for various clients who have requested consultant's assessment of their wardrobe with regard to jewelry.

Puerto Rico Sales and Marketing Consultant Agreement with Jewelry Artisan

Description

How to fill out Sales And Marketing Consultant Agreement With Jewelry Artisan?

Selecting the finest legal document template can be a challenge. It goes without saying that various designs are available online, but how do you find the legal form you need.

Utilize the US Legal Forms website. This service offers numerous templates, such as the Puerto Rico Sales and Marketing Consultant Agreement with Jewelry Artisan, which you can utilize for both business and personal purposes.

All templates are reviewed by experts and meet state and federal regulations.

If the form does not meet your requirements, use the Search field to find the appropriate document. Once you are sure the form is correct, click the Purchase now button to acquire the form. Choose the pricing option you prefer and enter the necessary information. Create your account and pay for the transaction using your PayPal account or credit card. Select the file format and download the legal document template to your system. Complete, modify, print, and sign the obtained Puerto Rico Sales and Marketing Consultant Agreement with Jewelry Artisan. US Legal Forms is the largest repository of legal forms where you can discover a variety of document templates. Utilize this service to download legally compliant documents that adhere to state regulations.

- If you are already registered, Log In to your account and click the Download button to access the Puerto Rico Sales and Marketing Consultant Agreement with Jewelry Artisan.

- Use your account to search through the legal forms you have purchased previously.

- Navigate to the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure you have selected the correct form for your city/county.

- You can review the form using the Review button and read the form details to confirm it is the right one for you.

Form popularity

FAQ

To register for sales tax in Puerto Rico, you must complete an application with the Puerto Rico Department of Treasury. Start by gathering necessary documents such as your business registration certificate. You can often register online or in-person, depending on your preferences. Using a Puerto Rico Sales and Marketing Consultant Agreement with Jewelry Artisan can simplify this process and ensure you meet all requirements.

Puerto Rico does not have a Value Added Tax (VAT) like many countries. Instead, it imposes a sales and use tax on goods and services. This system can significantly impact how businesses operate. Consulting a professional through a Puerto Rico Sales and Marketing Consultant Agreement with Jewelry Artisan can clarify your tax responsibilities and help optimize your financial strategy.

In Puerto Rico, several taxes are applicable, including income tax, property tax, and sales tax. The sales tax rate varies depending on the industry and applicable regulations. Understanding these taxes is crucial for business owners. A Puerto Rico Sales and Marketing Consultant Agreement with Jewelry Artisan can help you navigate these complexities and ensure you meet all your tax obligations effectively.

Puerto Rico is not entirely exempt from sales tax, but some exemptions apply. Certain goods and services may qualify for reduced rates or complete exclusions. It's vital to review specific regulations or seek guidance from a professional. A Puerto Rico Sales and Marketing Consultant Agreement with Jewelry Artisan can provide insights into tax obligations and exemptions for your business.

Filing a Puerto Rico sales tax return involves several steps. First, gather all necessary documentation, including sales records and tax calculations. Next, you can file online through the Puerto Rico Department of Treasury website or submit a paper return. Utilizing a Puerto Rico Sales and Marketing Consultant Agreement with Jewelry Artisan can help streamline this process by ensuring compliance with local regulations.

Certain items and services are exempt from sales tax in Puerto Rico, including some food items, prescription medicines, and certain educational materials. However, it is important to review any specific agreements, like your Puerto Rico Sales and Marketing Consultant Agreement with Jewelry Artisan, to determine if exemptions apply to the services you provide. Always consult local tax guidelines for accurate information.

The IVU tax, or Impuesto de Ventas y Uso, is a combined sales and use tax in Puerto Rico. This tax rates currently stand at 10.5% and applies to most retail sales, leases, and services. If you're involved in a Puerto Rico Sales and Marketing Consultant Agreement with Jewelry Artisan, you will need to incorporate the IVU tax into your financial calculations.

In Puerto Rico, professional services are generally subject to the sales tax. This includes services provided by consultants, such as those outlined in your Puerto Rico Sales and Marketing Consultant Agreement with Jewelry Artisan. It’s essential to understand these tax obligations to ensure compliance and proper budgeting.

Yes, Puerto Rico implements a 10.5% sales tax known as the IVU. This tax applies to most goods and services, which means you'll need to consider it when drafting your Puerto Rico Sales and Marketing Consultant Agreement with Jewelry Artisan. Failing to account for these taxes might lead to unexpected costs down the line.

Yes, services are typically taxable in Puerto Rico, unlike in many other states where only products are taxed. This includes a variety of professional services, which can impact business agreements significantly. If you are considering a Puerto Rico Sales and Marketing Consultant Agreement with Jewelry Artisan, make it a priority to review which services attract sales tax. Engaging with a reliable platform like uslegalforms can ease the process of understanding your tax obligations.