Puerto Rico Officers Bonus in form of Stock Issuance - Resolution Form

Description

How to fill out Officers Bonus In Form Of Stock Issuance - Resolution Form?

If you need to finalize, acquire, or print sanctioned document templates, utilize US Legal Forms, the largest compilation of legal forms, available online.

Leverage the site’s straightforward and user-friendly search to find the documents you need.

A variety of templates for business and personal purposes are classified by categories and states, or keywords. Use US Legal Forms to acquire the Puerto Rico Officers Bonus in the format of Stock Issuance - Resolution Form in just a few clicks.

Every legal document template you purchase is yours indefinitely. You have access to every form you obtained within your account. Click on the My documents section and select a form to print or download again.

Complete and obtain, and print the Puerto Rico Officers Bonus in the format of Stock Issuance - Resolution Form with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal requirements.

- If you are an existing US Legal Forms user, Log In to your account and click on the Download option to receive the Puerto Rico Officers Bonus in the format of Stock Issuance - Resolution Form.

- You can also access forms you have previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Make sure you have selected the form for the correct area/state.

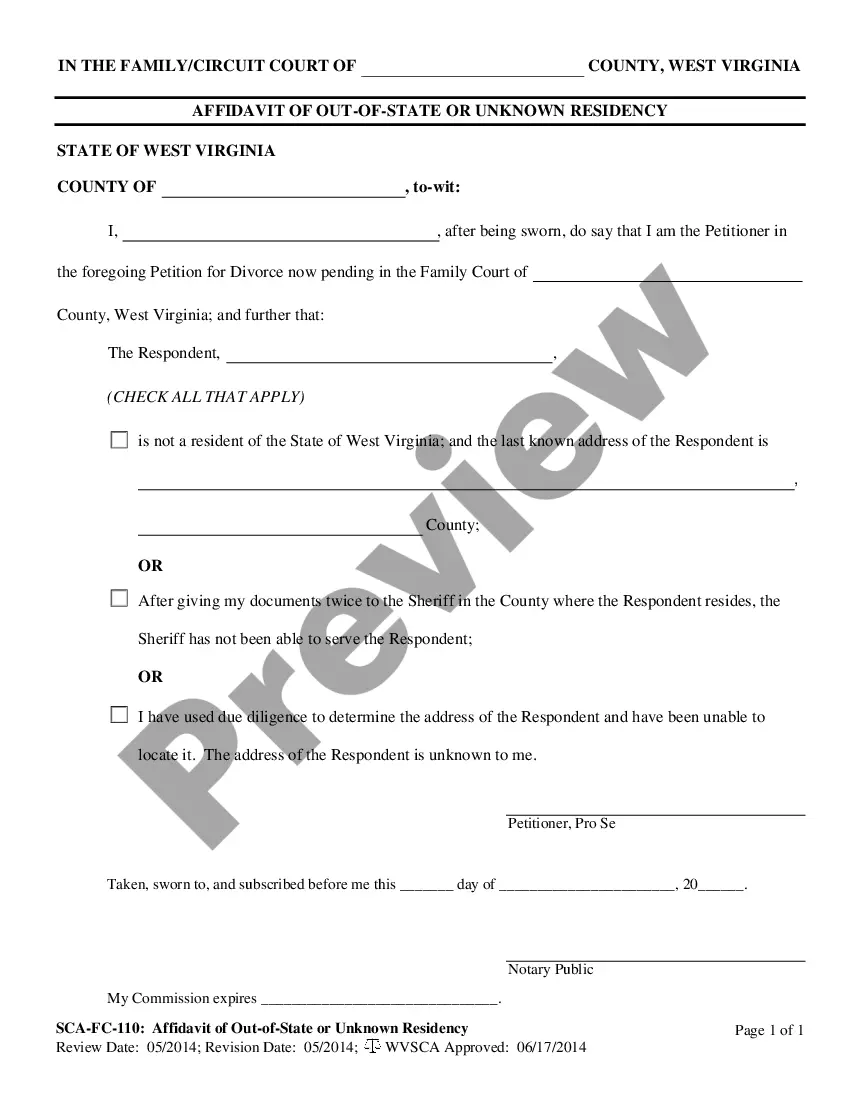

- Step 2. Use the Preview option to review the content of the form. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, make use of the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. Once you find the form you need, click the Buy now option. Choose the payment plan you prefer and fill in your details to register for the account.

- Step 5. Process the transaction. You can use your Visa or MasterCard or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it onto your device.

- Step 7. Complete, edit, and print or sign the Puerto Rico Officers Bonus in the format of Stock Issuance - Resolution Form.

Form popularity

FAQ

Yes, Puerto Rico is a territory of the United States; however, tax rules differ from those of the mainland. Residents in Puerto Rico are considered US citizens, allowing them certain rights while providing unique tax benefits. This means that you can enjoy the perks of the Puerto Rico Officers Bonus in form of Stock Issuance - Resolution Form while minimizing federal income tax obligations. Understanding these distinctions is vital for maximizing your financial strategy.

To avoid capital gains tax in Puerto Rico, you must become a bona fide resident for at least 183 days during the tax year. Moreover, it’s crucial to establish strong ties to Puerto Rico, which often involves moving significant aspects of your life there. By adhering to these residency requirements, you can take full advantage of the Puerto Rico Officers Bonus in form of Stock Issuance - Resolution Form and other benefits. Make sure to keep proper records and consult with a tax advisor to stay compliant.

The Puerto Rico income tax loophole refers to unique tax incentives available to certain residents and businesses in Puerto Rico. This loophole allows individuals and companies to reduce or eliminate certain federal tax obligations, thus maximizing earnings from initiatives like the Puerto Rico Officers Bonus in form of Stock Issuance - Resolution Form. Essentially, by establishing residency in Puerto Rico, you can take advantage of these attractive tax benefits. Consulting with a tax professional can clarify how these provisions may benefit you.

Residents of Puerto Rico may not need to file a federal tax return if their income is solely from Puerto Rican sources. However, certain exceptions apply, especially if you have unearned income or income from outside Puerto Rico. It's important to consult with tax professionals to understand how the Puerto Rico Officers Bonus in form of Stock Issuance - Resolution Form affects your tax obligations and ensure compliance.

Form 482 in Puerto Rico serves as a guide for corporations reporting particular income and expenses. It details specific transactions that corporations must disclose, impacting their overall tax situation. Accurate completion of this form is essential when dealing with the Puerto Rico Officers Bonus in form of Stock Issuance - Resolution Form, ensuring transparency and adherence to regulations.

Puerto Rico form 482 is a tax form used by corporations to report income received from certain activities. This form captures essential information necessary for calculating tax liability, which includes disclosures related to stock issuance. Understanding this form is vital for managing the Puerto Rico Officers Bonus in form of Stock Issuance - Resolution Form and fulfilling tax obligations.

A 480.6 SP form pertains to the Puerto Rico tax system. It is a specific tax declaration for partnerships and corporations reporting income related to stock issuance. This form plays a crucial role in documenting the Puerto Rico Officers Bonus in form of Stock Issuance - Resolution Form, ensuring proper compliance and tax reporting.

Yes, if you plan to conduct business in Puerto Rico, you must register with the Department of State. This registration grants you legal permission to operate and ensures compliance with local business laws. Taking steps like registering enhances your credibility and prepares you for opportunities such as the Puerto Rico Officers Bonus in form of Stock Issuance - Resolution Form, allowing you to benefit from local incentives.

To change a registered agent in Puerto Rico, you need to file a formal declaration with the Department of State. This involves submitting the necessary paperwork that specifies the new registered agent's information. It's important to manage this change efficiently to ensure your business remains compliant with state regulations, particularly if you are utilizing features like the Puerto Rico Officers Bonus in form of Stock Issuance - Resolution Form.

To create an LLC in Puerto Rico, you must choose a unique name for your business and file the Articles of Organization with the Department of State. It is also vital to create an operating agreement that outlines the management structure and regulations for your LLC. Once you set up your business and understand options like the Puerto Rico Officers Bonus in form of Stock Issuance - Resolution Form, you'll have the tools necessary to operate successfully.