Puerto Rico Grant of Photography Concession in Amusement Park, Shopping Mall or a Similar Public Place

Description

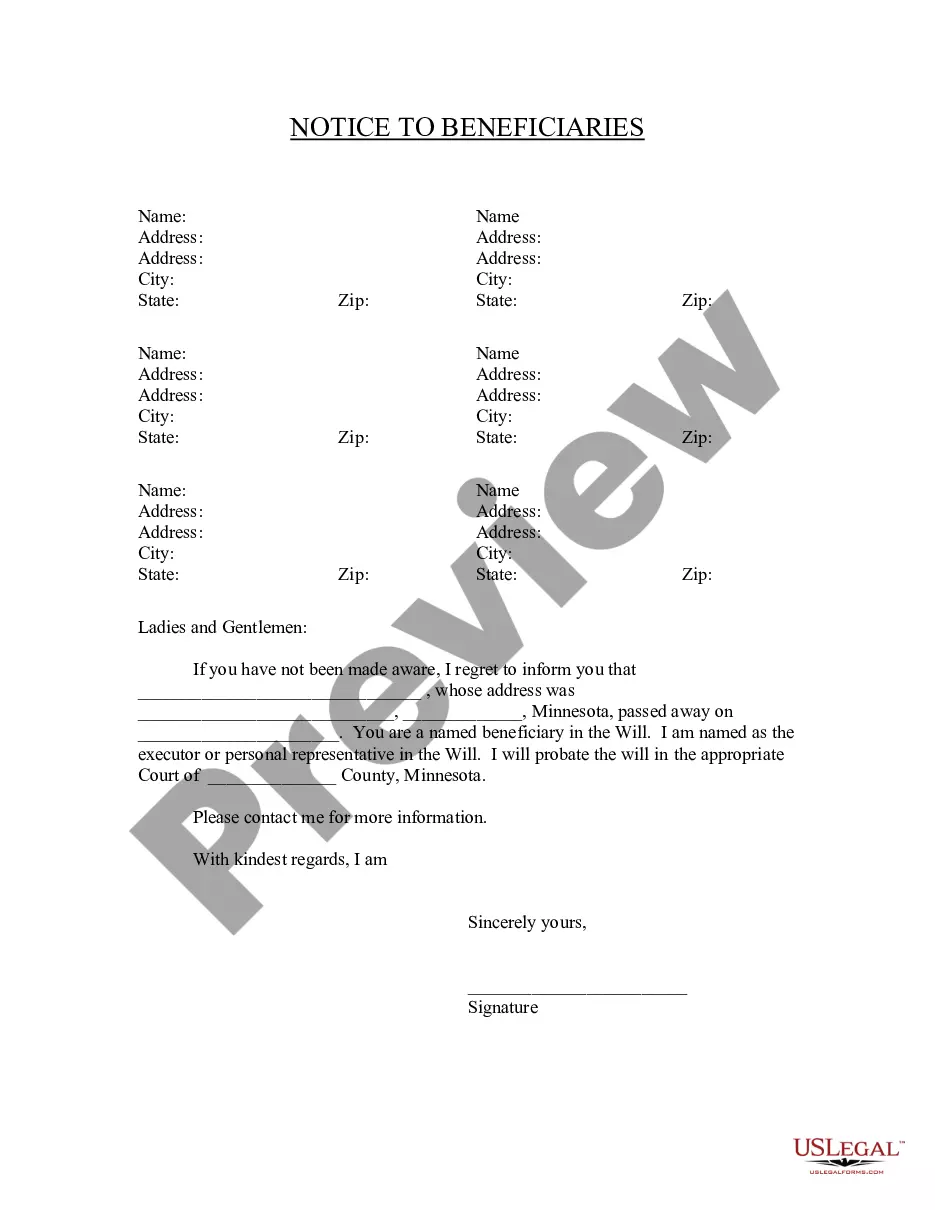

How to fill out Grant Of Photography Concession In Amusement Park, Shopping Mall Or A Similar Public Place?

Are you in a situation where you need documents for various business or personal purposes almost every day.

There are numerous legitimate document templates accessible online, but finding reliable versions can be challenging.

US Legal Forms offers a wide array of form templates, such as the Puerto Rico Grant of Photography Concession in Amusement Park, Shopping Mall, or a Similar Public Place, which can be customized to meet federal and state requirements.

Select a convenient document format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can obtain another copy of the Puerto Rico Grant of Photography Concession in Amusement Park, Shopping Mall, or a Similar Public Place whenever necessary. Just click on the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Next, you can download the Puerto Rico Grant of Photography Concession in Amusement Park, Shopping Mall, or a Similar Public Place template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is appropriate for your specific city/region.

- Utilize the Review button to verify the form.

- Examine the description to confirm that you have selected the correct form.

- If the form does not meet your expectations, use the Lookup field to find the form that fits your requirements.

- Once you locate the right form, click Acquire now.

- Choose the subscription plan you prefer, complete the required information to create your account, and pay for the transaction using PayPal or a credit card.

Form popularity

FAQ

Puerto Rico holds a unique position as an unincorporated U.S. territory. Under Internal Revenue Code (IRC) §933, Puerto Rico source income is excluded from U.S. federal tax.

To get started, you can hire an attorney to file the paperwork for Act 22, or, you can file yourself through Puerto Rico's Single Business Portal.

Well, here is where you must pay close attention. U.S. citizens who have lived all year on the island are exempt from filing taxes to the federal government of the United States as long as all of your income was from Puerto Rican sources only.

Puerto Rico is a US territory and not a state, so its residents don't pay federal income tax unless they work for the US government. Even so, workers there pay the majority of federal taxes that Americans on the mainland pay payroll taxes, social security taxes, business taxes, gift taxes, estate taxes and so on.

The new tax contributes 1% to the municipality level and 10.5% to the "state" level. The IVU was scheduled to expire on 1 April 2016, to be replaced with a value-added tax (VAT) of 10.5% for the state level, with the 1% IVU continuing for the municipalities.

Puerto Rico is an unincorporated territory of the United States and Puerto Ricans are U.S. citizens; however, Puerto Rico is not a U.S. state, but a U.S. insular area. Consequently, while all Puerto Rico residents pay federal taxes, many residents are not required to pay federal income taxes.

If you're a bona fide resident of Puerto Rico during the entire tax year, you generally aren't required to file a U.S. federal income tax return if your only income is from sources within Puerto Rico.

An individual is considered to be a bona fide resident of Puerto Rico if three tests are met. The individual must be present for at least 183 days during the taxable year in Puerto Rico or satisfy one of the other four presence tests (the presence test).

Excise tax: depends on the category of goods. Sales and use tax: 11.5 percent on most goods and services. 10.5 percent on goods and services not subject to municipal SUT.

Puerto Rico will soon be replacing its existing state-level sales and use tax with a value added tax (VAT) system.