Puerto Rico Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building

Description

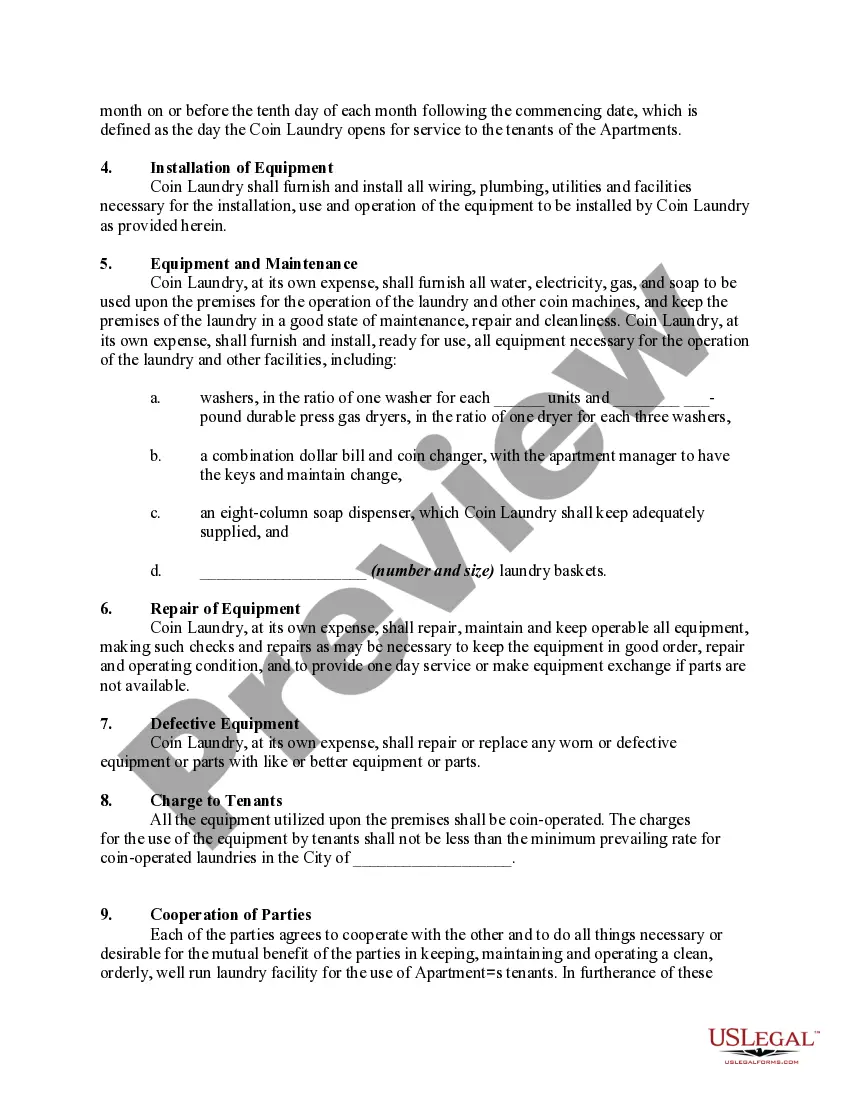

Coin-Operated Laundry in an Apartment Building.

How to fill out Agreement Granting Exclusive Right To Install, Operate And Maintain Coin-Operated Laundry In Apartment Building?

You can allocate time on the internet searching for the legal documents website template that complies with the state and federal requirements you need.

US Legal Forms offers thousands of legal forms that can be evaluated by professionals.

You can download or print the Puerto Rico Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in an Apartment Building from the platform.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- Afterward, you can fill out, alter, print, or sign the Puerto Rico Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in an Apartment Building.

- Every legal document template you acquire is permanently yours.

- To obtain another copy of a purchased form, visit the My documents section and click on the relevant button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your state/area of interest. Examine the form description to confirm that you have chosen the correct document.

- If available, utilize the Review button to look through the document template as well.

- If you wish to find another version of the form, use the Search field to locate the template that meets your needs and requirements.

- Once you have found the template you want, click Get now to proceed.

- Choose the payment plan you prefer, enter your details, and register for an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal form.

- Select the format of the document and download it to your device.

- Make changes to the document if needed. You can fill out, modify, sign, and print the Puerto Rico Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in an Apartment Building.

- Download and print thousands of document templates through the US Legal Forms website, which offers the largest collection of legal forms.

- Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

Anyone who earns income in Puerto Rico may be required to file a Puerto Rico tax return, including those involved in agreements such as the Puerto Rico Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building. In particular, residents and non-residents with income sourced in Puerto Rico must file. It’s wise to consult a tax professional to understand your specific obligations.

Yes, the United States has a unique tax relationship with Puerto Rico, although it is not classified as a tax treaty. Instead, Puerto Rico operates its tax system in a way that can benefit those who enter into agreements like the Puerto Rico Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building. This system allows for local businesses to thrive under specific tax provisions.

Section 6103 of the Internal Revenue Code outlines the confidentiality of tax returns and tax return information. It specifies when and how the Internal Revenue Service can disclose tax information, ensuring the protection of taxpayer privacy. Understanding this section is crucial, especially when dealing with agreements such as the Puerto Rico Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building.

Qualifying for Puerto Rico tax exemption involves meeting specific residency criteria and engaging in eligible business activities. For businesses operating under a Puerto Rico Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building, these exemptions can provide substantial savings. It's advisable to consult with an expert or utilize resources like uslegalforms to ensure compliance and fully leverage these opportunities.

The tax code for Puerto Rico is a unique set of regulations and laws that govern taxation on the island. It differs significantly from the U.S. federal tax code, making it essential for those with a Puerto Rico Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building to familiarize themselves with these rules. By understanding the tax code, you can maximize your benefits and minimize unnecessary taxes.

Section 6072.01 of the Puerto Rico Internal Revenue Code of 2011 focuses on the deadlines for filing tax returns for individuals and corporations. This information is particularly important for business owners who hold a Puerto Rico Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building. By understanding these deadlines, you can manage your finances more effectively and avoid penalties.

Section 6041 of the Internal Revenue Code relates to the reporting requirements for payments made in the course of business. If you're engaging in transactions under a Puerto Rico Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building, this section is critical. It requires you to issue forms to report payments exceeding a certain threshold, helping you stay compliant while operating your business.

To avoid capital gains tax in Puerto Rico, you generally need to be a bona fide resident for at least 183 days. This residence requirement is crucial for individuals looking to benefit from tax incentives associated with a Puerto Rico Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building. Being a resident not only helps in tax matters, but it can also enhance your opportunities for business growth.

Section 1062.03 of the Puerto Rico Internal Revenue Code of 2011 pertains to the tax treatment specific to businesses in Puerto Rico, including those operating under a Puerto Rico Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building. This section outlines the deductions and requirements businesses must comply with to remain eligible for tax benefits. Understanding these provisions can help you better navigate your tax obligations in Puerto Rico.