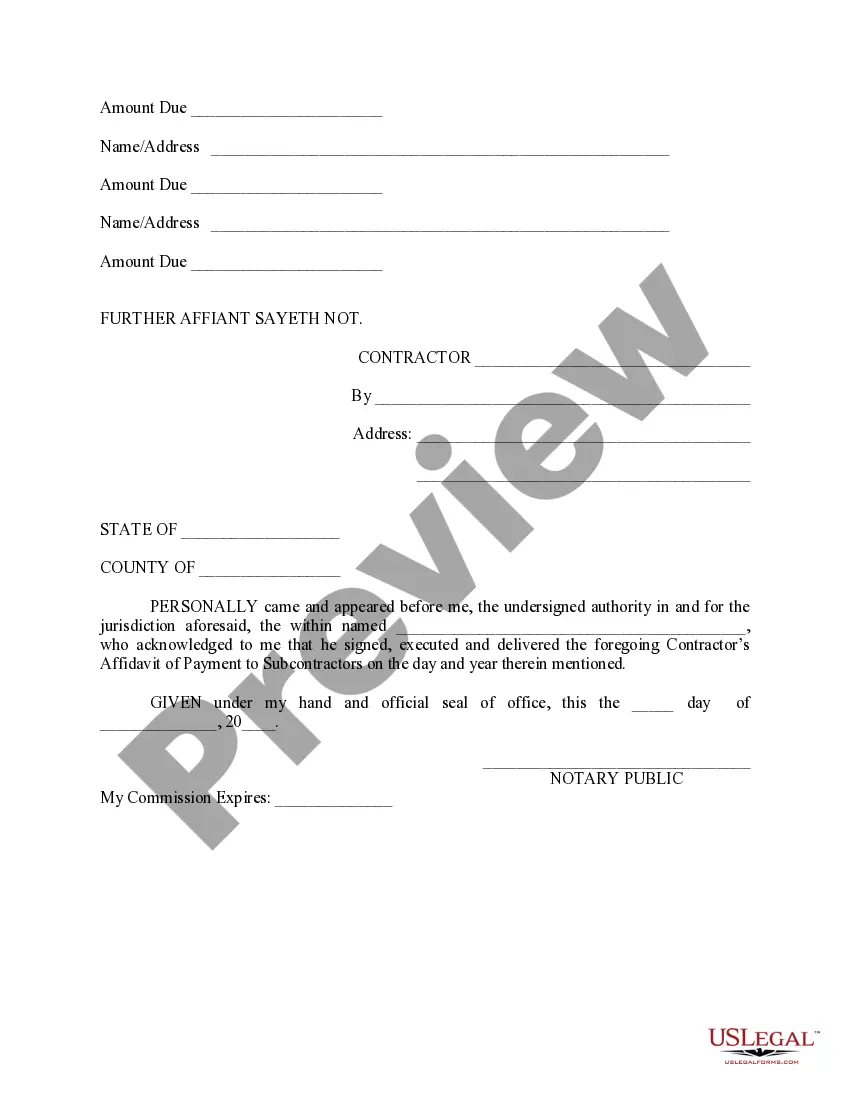

Puerto Rico Contractor's Affidavit of Payment to Subs

Description

How to fill out Contractor's Affidavit Of Payment To Subs?

You have the ability to dedicate hours on the web looking for the legal document template that meets the federal and state criteria you require.

US Legal Forms offers a multitude of legal forms that are assessed by experts.

You can obtain or print the Puerto Rico Contractor's Affidavit of Payment to Subs from our service.

If available, utilize the Preview option to review the document template as well.

- If you have a US Legal Forms account, you can Log In and click the Acquire button.

- Then, you can fill out, edit, print, or sign the Puerto Rico Contractor's Affidavit of Payment to Subs.

- Every legal document template you acquire is yours permanently.

- To retrieve an additional copy of any purchased form, go to the My documents section and click the relevant option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions listed below.

- First, ensure that you have selected the correct document template for the area/city you choose.

- Review the form description to confirm you have selected the correct form.

Form popularity

FAQ

6 Tips for Dealing With Subcontractor DefaultPrequalify Your Subs. Before you take pricing or solicit bids from subcontractors you need to make sure they are capable of completing the work, both physically and financially.Know the Signs.Craft a Plan.Put It in a Contract.Protect Yourself.Termination of Contract.

Form G702 (Application and Certificate for Payment) is used by subcontractors throughout America to make the procedure for receiving payments for work performed regulated and convenient for all parties to the process. Such forms indicate the amount of payment paid for the work done for a certain period.

This is a standard form for use when a surety company is involved and the owner/contractor agreement contains a clause whereby retainage is reduced during the course of the construction project.

6.2. The total "retention money" shall be due for release upon final acceptance of the works.

6 Tips for Dealing With Subcontractor DefaultPrequalify Your Subs. Before you take pricing or solicit bids from subcontractors you need to make sure they are capable of completing the work, both physically and financially.Know the Signs.Craft a Plan.Put It in a Contract.Protect Yourself.Termination of Contract.

Similarities. Independent contractors and subcontractors are both considered self-employed by the IRS. Both are responsible for making quarterly tax payments including self-employment tax.

Subcontracting and TaxesSubcontractors may qualify for certain tax deductions that can be claimed on their business expenses. These expenses have to be ordinary and necessary for the operation of a self-employed business.

The checklist will help a subcontractor identify and resolve potential legal problems before costly claims and lawsuits occur. However, no checklist can identify each and every legal issue flat a subcontractor can encounter.

AIA Document G706 is intended for use when the Contractor is required to provide a sworn statement verifying that debts and claims have been settled, except for those listed by the Contractor under EXCEPTIONS in the document. AIA Document G706 is typically executed as a condition of final payment.

Tip. Companies ask subcontractors to complete form W-9, which includes the worker's name, tax ID number and other information needed when the employer fills out form 1099-NEC. The employer sends form 1099-NEC to the subcontractor and the IRS.