This form is used when all activities and operations on the Contract Area have ceased, and the Agreement is deemed, as of the Effective Date stated above, to have terminated, and the Contract Area, and all interests in it, are no longer subject to the terms and provisions of the Agreement.

Pennsylvania Termination of Operating Agreement

Description

How to fill out Termination Of Operating Agreement?

If you want to total, acquire, or print legitimate papers web templates, use US Legal Forms, the greatest variety of legitimate varieties, that can be found on the web. Take advantage of the site`s basic and practical search to obtain the files you will need. Numerous web templates for company and specific uses are categorized by types and suggests, or search phrases. Use US Legal Forms to obtain the Pennsylvania Termination of Operating Agreement in a couple of clicks.

Should you be presently a US Legal Forms consumer, log in in your account and click on the Acquire switch to obtain the Pennsylvania Termination of Operating Agreement. You may also gain access to varieties you previously saved within the My Forms tab of the account.

If you use US Legal Forms the very first time, refer to the instructions below:

- Step 1. Make sure you have selected the shape to the appropriate area/land.

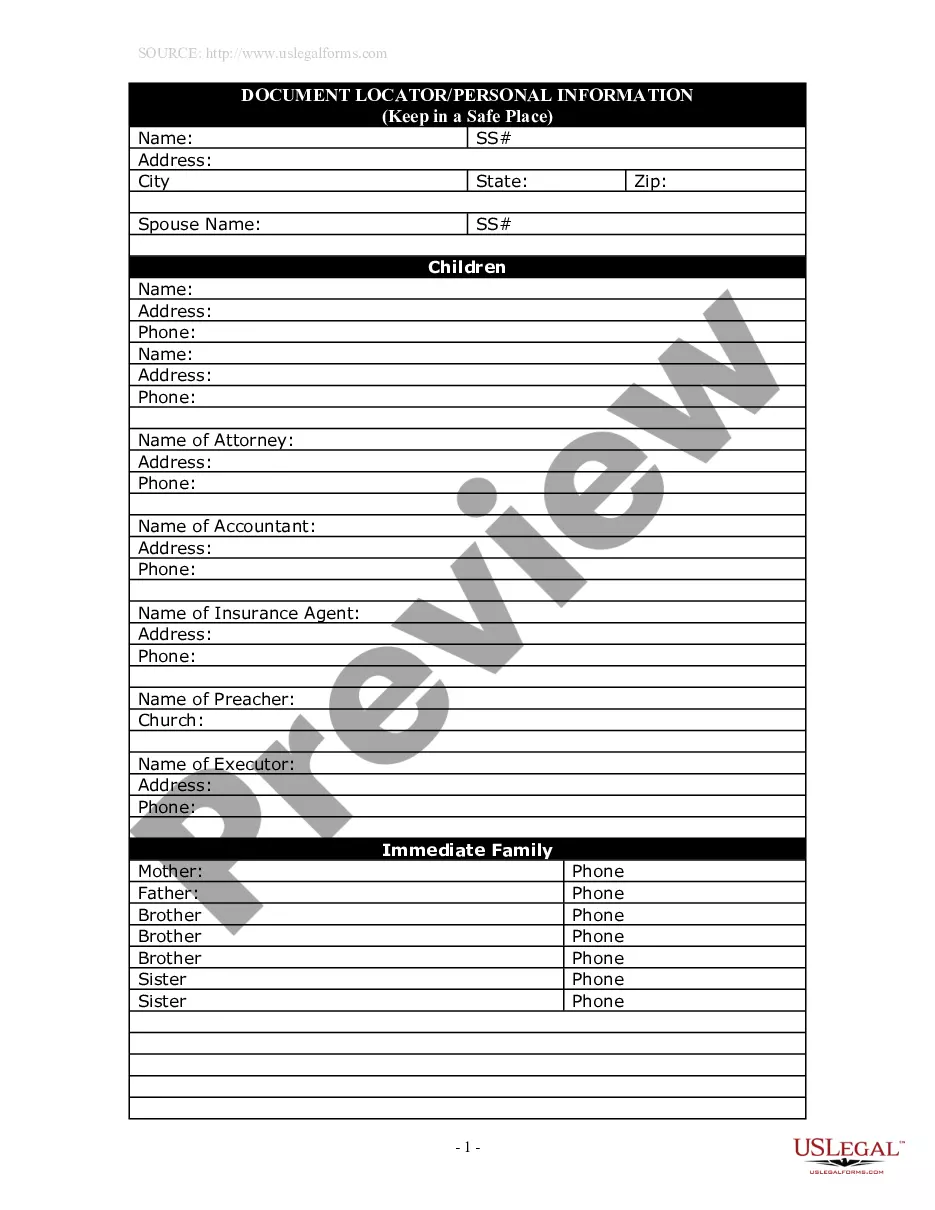

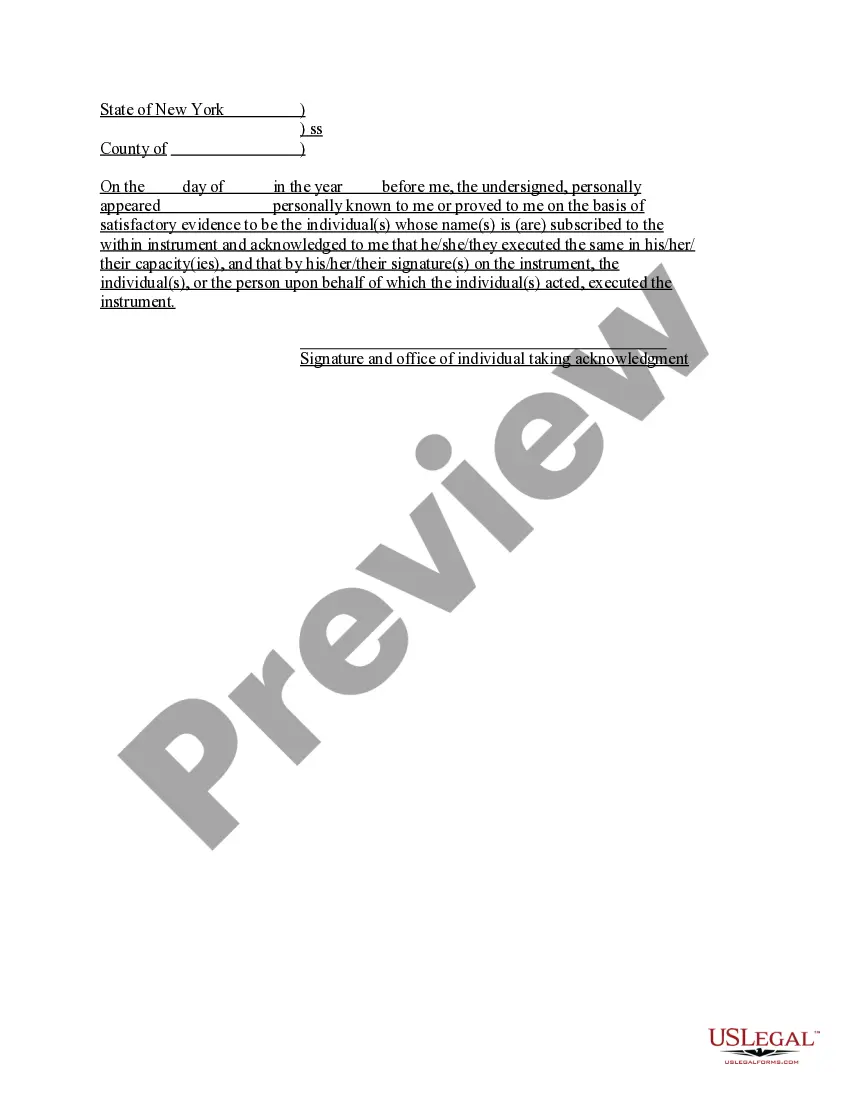

- Step 2. Use the Review solution to look over the form`s articles. Don`t forget to learn the description.

- Step 3. Should you be not satisfied with the kind, utilize the Research area near the top of the screen to find other types from the legitimate kind format.

- Step 4. After you have identified the shape you will need, select the Acquire now switch. Opt for the prices strategy you choose and add your accreditations to register for an account.

- Step 5. Procedure the deal. You can utilize your credit card or PayPal account to accomplish the deal.

- Step 6. Pick the structure from the legitimate kind and acquire it on the device.

- Step 7. Comprehensive, modify and print or indication the Pennsylvania Termination of Operating Agreement.

Every single legitimate papers format you get is yours for a long time. You have acces to every kind you saved within your acccount. Go through the My Forms portion and decide on a kind to print or acquire again.

Remain competitive and acquire, and print the Pennsylvania Termination of Operating Agreement with US Legal Forms. There are millions of skilled and state-particular varieties you may use to your company or specific needs.

Form popularity

FAQ

Dissolving a Church or Nonprofit in Pennsylvania Take an Official Vote of the Board of Directors/Members. ... Obtain Tax Certificates. ... Obtain Attorney General Approval. ... Obtain Court Approval to Sell Real Estate. ... Ensure that Money Left Over is Transferred to a Similar Nonprofit.

To dissolve your corporation in Pennsylvania, you provide the completed Articles of Dissolution-Domestic (DSCB: 15-1977/5877) form to the Department of State, Corporation Bureau, by mail or in person. You may fax file if you have a customer deposit account with the Bureau.

When all debts, obligations and other liabilities of the limited partnership have been paid and discharged or adequate provision has been made therefor and all of the remaining property and assets of the company have been distributed to the partners, a domestic limited partnership shall execute a Certificate of ...

How do you dissolve a Pennsylvania Limited Liability Company? To dissolve your domestic LLC in Pennsylvania, you must provide the completed Certificate of Dissolution, Domestic Limited Liability Company (DCSB: 15-8975/8978) form to the Department of State by mail, in person, or online.

How do I amend my LLC operating agreement? Hold a meeting of all LLC members. Draft a member resolution (to add or remove a member) Vote on the member resolution. Pass the resolution with majority approval. Save the member resolution with your records.

Pennsylvania doesn't administratively dissolve LLCs. However, if you fail to file your decennial report, your LLC's name will no longer be reserved for your use. To reinstate your LLC's name, you can file your late decennial report.

Do you need an operating agreement in Pennsylvania? No, it's not legally required in Pennsylvania under § 8815. Single-member LLCs need an operating agreement to preserve their corporate veil and to prove ownership.

Filing fee for termination of a Pennsylvania LLC is $70.