Pennsylvania Partial Release of Liens for Notes and Security Agreements

Description

How to fill out Partial Release Of Liens For Notes And Security Agreements?

If you need to total, down load, or print out legitimate file themes, use US Legal Forms, the largest selection of legitimate forms, which can be found online. Utilize the site`s simple and easy hassle-free research to find the papers you will need. Numerous themes for company and personal uses are categorized by classes and suggests, or key phrases. Use US Legal Forms to find the Pennsylvania Partial Release of Liens for Notes and Security Agreements in just a handful of mouse clicks.

If you are currently a US Legal Forms buyer, log in to the accounts and then click the Down load option to obtain the Pennsylvania Partial Release of Liens for Notes and Security Agreements. You can also access forms you previously acquired in the My Forms tab of your accounts.

If you are using US Legal Forms the first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the shape to the proper city/land.

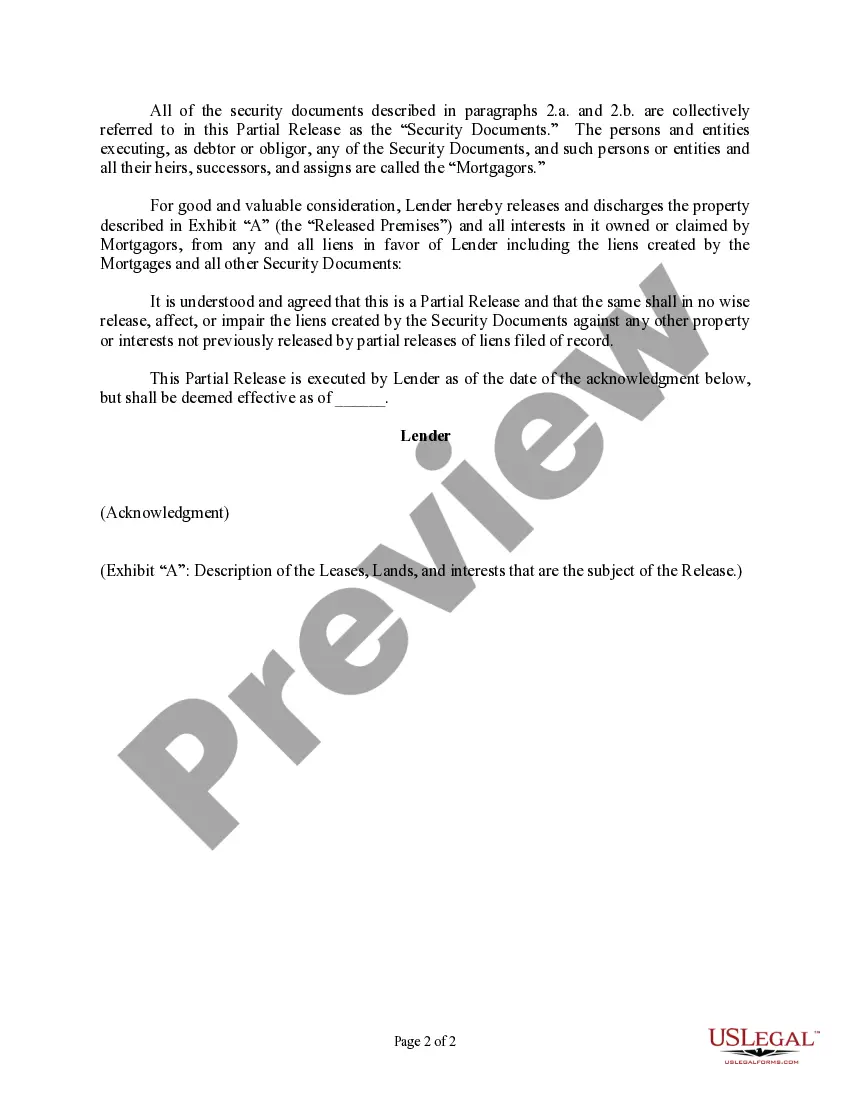

- Step 2. Use the Preview solution to look over the form`s information. Don`t forget about to learn the explanation.

- Step 3. If you are not satisfied together with the develop, utilize the Search area at the top of the screen to locate other models in the legitimate develop web template.

- Step 4. When you have located the shape you will need, go through the Purchase now option. Pick the pricing program you prefer and add your references to sign up for an accounts.

- Step 5. Method the deal. You should use your charge card or PayPal accounts to accomplish the deal.

- Step 6. Choose the format in the legitimate develop and down load it on your gadget.

- Step 7. Full, revise and print out or indicator the Pennsylvania Partial Release of Liens for Notes and Security Agreements.

Every legitimate file web template you buy is your own property forever. You possess acces to each develop you acquired within your acccount. Select the My Forms section and choose a develop to print out or down load once again.

Remain competitive and down load, and print out the Pennsylvania Partial Release of Liens for Notes and Security Agreements with US Legal Forms. There are many specialist and state-certain forms you may use for the company or personal requirements.

Form popularity

FAQ

About Pennsylvania Final Unconditional Lien Waiver Form This pa final unconditional waiver (also called a final unconditional lien release) should be used when the final payment for a project has been made and received by the party that furnished labor or materials.

Lien waivers by a general contractor are made by filing a ?Stipulation Against Liens? (Stipulation), often referred to as a ?Stip,? with the prothonotary's office in the county where the project is located. The Stipulation must be in proper form and must be filed and properly indexed to be valid.

Yes, however, there are exceptions. A direct contractor is allowed to waive lien rights prior to furnishing work own residential projects when the residence is not more than 3 stories tall.

Involuntary Lien: A lien imposed against property without consent of the owner. Taxes, special assessments, federal income tax liens, and State tax liens are examples of involuntary liens.

The lien will stay in effect for five years, but can be renewed, if the debtor does not sell the property within that time period.

This pa partial conditional waiver (also called a partial conditional lien release) should be used when a progress payment on the project is expected. There may be future expected payments on the project, but this waiver applies only to a specific, expected progress or partial payment.

TIMING OF THE MECHANICS' LIEN A mechanics' lien must be filed within six (6) months after completion of the work.

(a) Residential Property. A contractor or subcontractor may waive his right to file a claim against residential property by a written instrument signed by him or by any conduct which operates equitably to estop such contractor from filing a claim.