A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes using a document designed to falsely imply that it issued from a state or federal source or creates a false impression as to its source, authorization or approval.

Pennsylvania Notice to Debt Collector - Falsely Representing a Document's Authority

Description

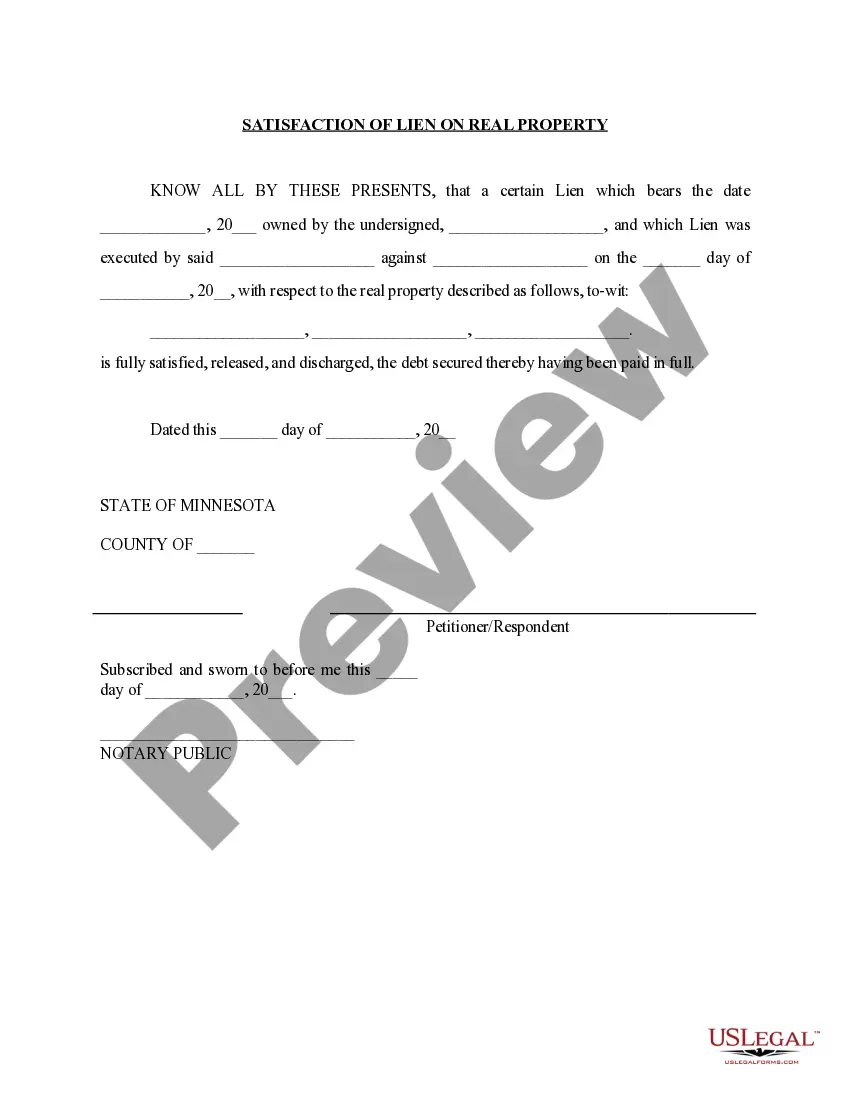

How to fill out Notice To Debt Collector - Falsely Representing A Document's Authority?

If you want to complete, acquire, or print legal document templates, utilize US Legal Forms, the top choice of legal forms, that are accessible online.

Employ the site's simple and user-friendly search to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have located the form you need, click the Buy now button. Select the pricing plan you prefer and enter your details to sign up for an account.

Step 5. Process the transaction. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Use US Legal Forms to discover the Pennsylvania Notice to Debt Collector - Falsely Representing a Document's Authority within just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and then click the Download button to find the Pennsylvania Notice to Debt Collector - Falsely Representing a Document's Authority.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for your specific city/region.

- Step 2. Use the Review feature to check the form's content. Remember to look at the summary.

- Step 3. If you are dissatisfied with the form, use the Search bar at the top of the screen to find additional types in the legal form template.

Form popularity

FAQ

Yes, you may be able to sue a debt collector or a debt collection agency if it engages in abusive, deceptive, or unfair behavior. A debt collector is generally someone who buys a debt from a creditor who, for whatever reason, has been unable to collect from a consumer.

Your dispute should be made in writing to ensure that the debt collector has to send you verification of the debt. If you're having trouble with debt collection, you can submit a complaint with the CFPB online or by calling (855) 411-CFPB (2372).

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

9 Ways to Outsmart Debt CollectorsDon't Get Emotional.Make Sure the Debt Is Really Yours.Ask for Proof.Resist the Scare Tactics.Be Wary of Fees.Negotiate.Call In Backup.Know the Time Limits.More items...?

Write a dispute letter and send it to each credit bureau. Include information about each of the disputed itemsaccount numbers, listed amounts and creditor names. Write a similar letter to each collection agency, asking them to remove the error from your credit reports.

Misrepresentation: Collectors can't try to pretend being someone else. Debtors have reported collectors posing as law enforcement agents, attorneys and credit reporting agency officials. Impersonating a police officer is illegal in many jurisdictions, and it's prohibited everywhere as a debt-collection ploy.

Here are a few suggestions that might work in your favor:Write a letter disputing the debt. You have 30 days after receiving a collection notice to dispute a debt in writing.Dispute the debt on your credit report.Lodge a complaint.Respond to a lawsuit.Hire an attorney.

Pretend to Work for a Government AgencyThe FDCPA prohibits debt collectors from pretending to work for any government agency, including law enforcement. They also cannot claim to be working for a consumer reporting agency.

At a minimum, proper debt validation should include an account balance along with an explanation of how the amount was derived. But most debt collectors respond with an account statement from the original creditor as debt validation and that's generally considered sufficient.

Takeaways on How to Effectively Defend Yourself in a Debt Collection LawsuitMake sure you respond to the Complaint and your response is timely filed.Review potential affirmative defenses that could apply to your case.Make the debt collector prove that they have the legal right to sue you.More items...?