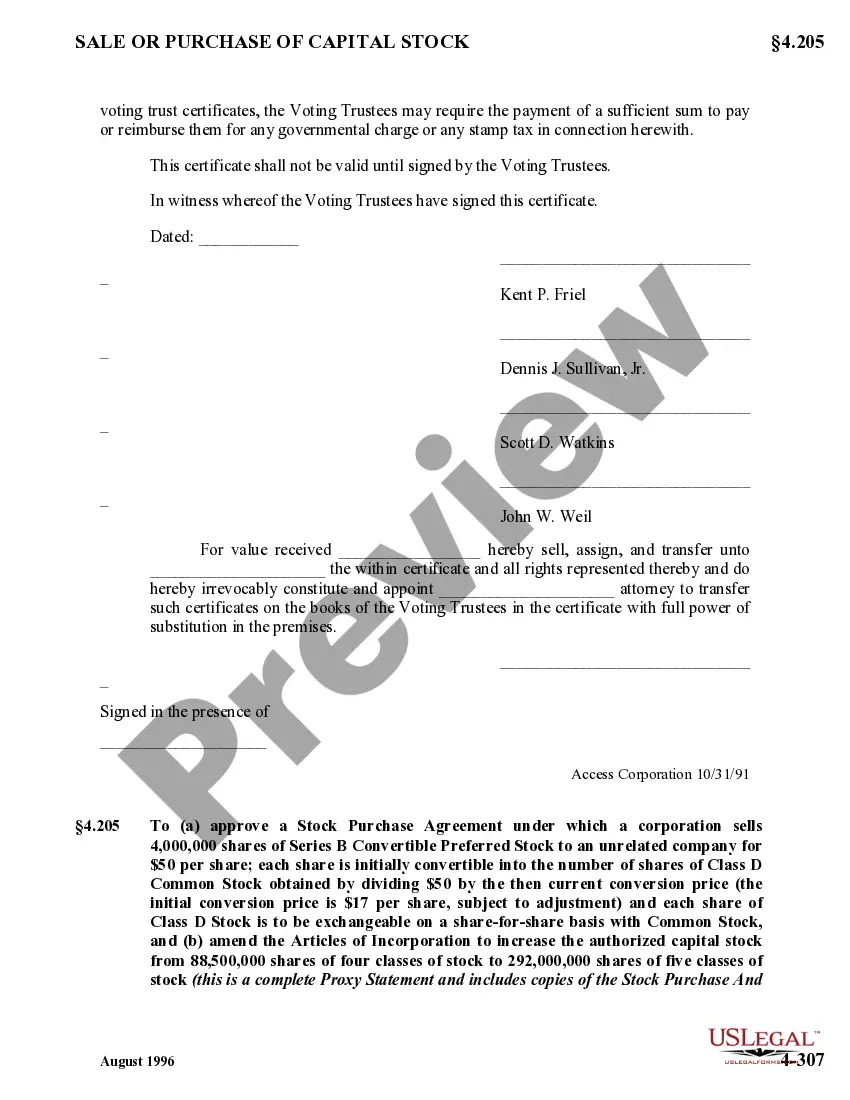

Pennsylvania Voting Trust Certificate

Description

How to fill out Voting Trust Certificate?

If you need to total, obtain, or produce legal file web templates, use US Legal Forms, the greatest assortment of legal kinds, that can be found on the web. Use the site`s basic and convenient research to obtain the documents you need. Different web templates for company and individual reasons are categorized by classes and says, or search phrases. Use US Legal Forms to obtain the Pennsylvania Voting Trust Certificate in just a number of clicks.

If you are already a US Legal Forms client, log in for your bank account and click on the Acquire button to find the Pennsylvania Voting Trust Certificate. You can also gain access to kinds you in the past saved from the My Forms tab of the bank account.

If you are using US Legal Forms initially, refer to the instructions under:

- Step 1. Be sure you have selected the form for the correct area/region.

- Step 2. Take advantage of the Preview choice to examine the form`s articles. Don`t forget to read the outline.

- Step 3. If you are unhappy with all the kind, take advantage of the Search discipline on top of the display screen to get other versions from the legal kind format.

- Step 4. After you have located the form you need, click the Get now button. Choose the pricing program you choose and add your references to sign up for the bank account.

- Step 5. Process the financial transaction. You can use your bank card or PayPal bank account to finish the financial transaction.

- Step 6. Pick the file format from the legal kind and obtain it in your gadget.

- Step 7. Complete, change and produce or sign the Pennsylvania Voting Trust Certificate.

Each legal file format you acquire is yours for a long time. You have acces to each kind you saved in your acccount. Select the My Forms portion and choose a kind to produce or obtain once again.

Contend and obtain, and produce the Pennsylvania Voting Trust Certificate with US Legal Forms. There are millions of skilled and state-specific kinds you may use for your personal company or individual requires.

Form popularity

FAQ

A voting trust can be revocable or irrevocable; typically they are irrevocable for a period of years, or for life of the key person, or until the company is sold. But any other arrangement that suits the objectives and is within the law can be made as well.

While the proxy may be a temporary or one-time arrangement, often created for a specific vote, the voting trust is usually more permanent, intended to give a bloc of voters increased power as a group?or indeed, control of the company, which is not necessarily the case with proxy voting.

While the proxy may be a temporary or one-time arrangement, often created for a specific vote, the voting trust is usually more permanent, intended to give a bloc of voters increased power as a group?or indeed, control of the company, which is not necessarily the case with proxy voting.

A voting trust agreement also goes under the name, pooling agreement. Two or more shareholders transfer their shares to a trustee under a voting arrangement. The trustee will then vote for those shares as a group following the agreement's terms or the majority's will.

Voting trusts are often formed by company directors, but sometimes a group of shareholders will form one to exercise some control over the corporation. It can also be used to resolve conflicts of interest, increase shareholders' voting power, or ward off a hostile takeover.

Voting trust certificates are "securities" as that term is defined by Section 2(1) of the Securities Act of 1933,37 and by many similar provisions under the various state securities laws.

The trustee model of representation is a model of a representative democracy, frequently contrasted with the delegate model of representation. In this model, constituents elect their representatives as 'trustees' for their constituency.

A voting trust certificate is a document used to give temporary voting control over a corporation to one or several individuals. It is issued to a shareholder and represents the normal rights of any other stockholder, such as receiving quarterly dividends in exchange for their common shares.

A voting trust is a contract between shareholders in which their shares and voting rights are temporarily transferred to a trustee. A voting agreement is a contract in which shareholders agree to vote a certain way on specific issues without giving up their shares or voting rights.