Pennsylvania Approval of Incentive Stock Option Plan

Description

How to fill out Approval Of Incentive Stock Option Plan?

You may spend several hours on the web trying to find the authorized file web template that meets the federal and state demands you need. US Legal Forms supplies thousands of authorized forms which are analyzed by professionals. It is possible to acquire or print the Pennsylvania Approval of Incentive Stock Option Plan from our assistance.

If you already have a US Legal Forms bank account, you are able to log in and then click the Obtain button. Afterward, you are able to complete, edit, print, or indication the Pennsylvania Approval of Incentive Stock Option Plan. Each and every authorized file web template you get is your own property for a long time. To obtain one more version associated with a bought type, proceed to the My Forms tab and then click the corresponding button.

Should you use the US Legal Forms site initially, keep to the basic recommendations below:

- Initially, make certain you have chosen the best file web template for the county/area of your choice. Look at the type explanation to ensure you have selected the right type. If available, utilize the Preview button to search with the file web template also.

- If you would like get one more variation of your type, utilize the Search area to get the web template that meets your requirements and demands.

- Once you have identified the web template you would like, click on Acquire now to move forward.

- Pick the costs prepare you would like, type in your references, and register for an account on US Legal Forms.

- Full the transaction. You can use your credit card or PayPal bank account to fund the authorized type.

- Pick the format of your file and acquire it to the device.

- Make adjustments to the file if needed. You may complete, edit and indication and print Pennsylvania Approval of Incentive Stock Option Plan.

Obtain and print thousands of file layouts while using US Legal Forms website, which offers the biggest collection of authorized forms. Use expert and state-particular layouts to deal with your small business or specific needs.

Form popularity

FAQ

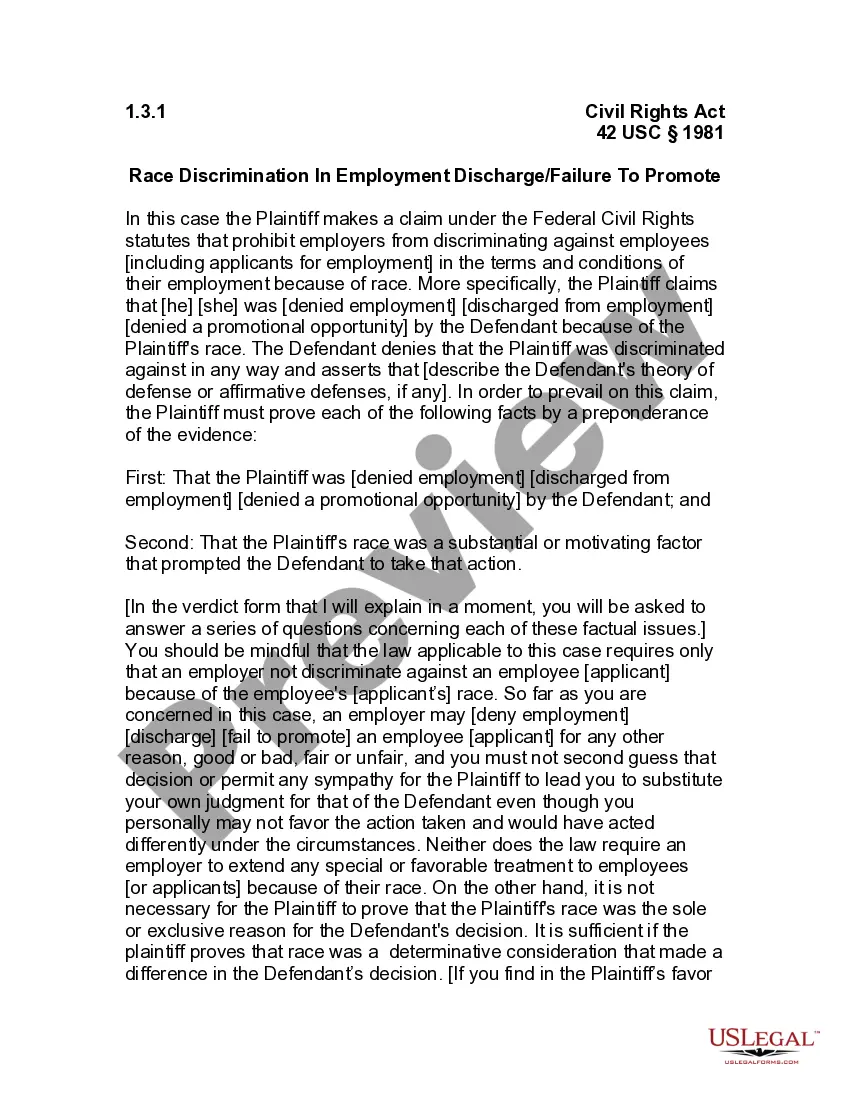

To receive the incentive, you must hold (keep) ISOs for at least one year after exercise and two years after the grant date. If you hold your stock for at least a year after purchase, you will pay the lower capital gains tax rate on the increase in value.

Before options can be written, a stock must be properly registered, have a sufficient number of shares, be held by enough shareholders, have sufficient volume, and be priced high enough.

Incentive stock options, or ISOs, are a type of equity compensation granted only to employees, who can then purchase a set quantity of company shares at a certain price, while receiving favorable tax treatment. ISOs are often awarded as part of an employee's hiring or promotion package.

There are many requirements on using ISOs. First, the employee must not sell the stock until after two years from the date of receiving the options, and they must hold the stock for at least a year after exercising the option like other capital gains. Secondly, the stock option must last ten years.

The ISO $100K limit, also known as the ?ISO limit? or ?$100K rule,? exists to prevent employees from taking too much advantage of the tax benefits associated with ISOs. It states that employees can't receive more than $100,000 worth of exercisable ISOs in a given calendar year.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit. The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income.

Key Characteristics of ISOs Once the options are exercised, the employee has the freedom to either sell the stock immediately or wait for a period of time before doing so. Unlike non-statutory options, the offering period for incentive stock options is always 10 years, after which time the options expire.

Stock options are taxable as compensation on the date they are exercised or when any substantial restrictions lapse. The difference between the fair market value of the stock on the date the option... Should people pay PA personal income tax on their gambling and lottery winnings?