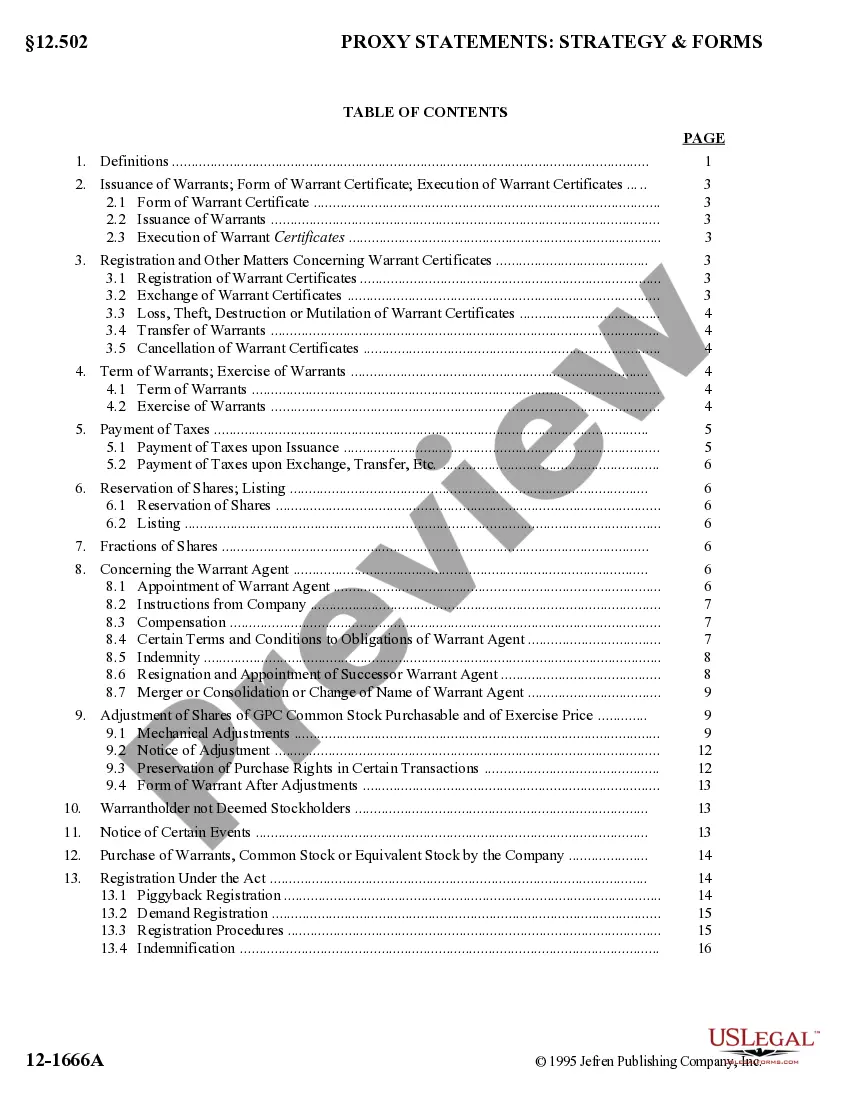

Pennsylvania Second Warrant Agreement by General Physics Corp.

Description

How to fill out Second Warrant Agreement By General Physics Corp.?

US Legal Forms - one of several biggest libraries of authorized forms in the States - provides a wide range of authorized papers layouts you may acquire or produce. While using site, you will get thousands of forms for company and person reasons, categorized by classes, states, or search phrases.You will discover the newest variations of forms just like the Pennsylvania Second Warrant Agreement by General Physics Corp. in seconds.

If you have a membership, log in and acquire Pennsylvania Second Warrant Agreement by General Physics Corp. through the US Legal Forms catalogue. The Down load option will show up on each develop you view. You have accessibility to all earlier saved forms inside the My Forms tab of your respective account.

If you would like use US Legal Forms the first time, listed here are easy guidelines to obtain started out:

- Be sure you have selected the correct develop to your metropolis/area. Go through the Review option to check the form`s articles. Look at the develop information to ensure that you have selected the correct develop.

- In the event the develop does not satisfy your specifications, use the Lookup discipline at the top of the display screen to get the one which does.

- If you are satisfied with the form, confirm your decision by clicking the Buy now option. Then, opt for the pricing prepare you favor and supply your accreditations to register for an account.

- Method the transaction. Use your Visa or Mastercard or PayPal account to complete the transaction.

- Pick the file format and acquire the form in your system.

- Make alterations. Fill up, change and produce and indicator the saved Pennsylvania Second Warrant Agreement by General Physics Corp..

Every design you put into your money does not have an expiry time and is yours forever. So, if you wish to acquire or produce one more version, just go to the My Forms area and then click in the develop you need.

Gain access to the Pennsylvania Second Warrant Agreement by General Physics Corp. with US Legal Forms, by far the most considerable catalogue of authorized papers layouts. Use thousands of specialist and status-distinct layouts that meet your organization or person needs and specifications.

Form popularity

FAQ

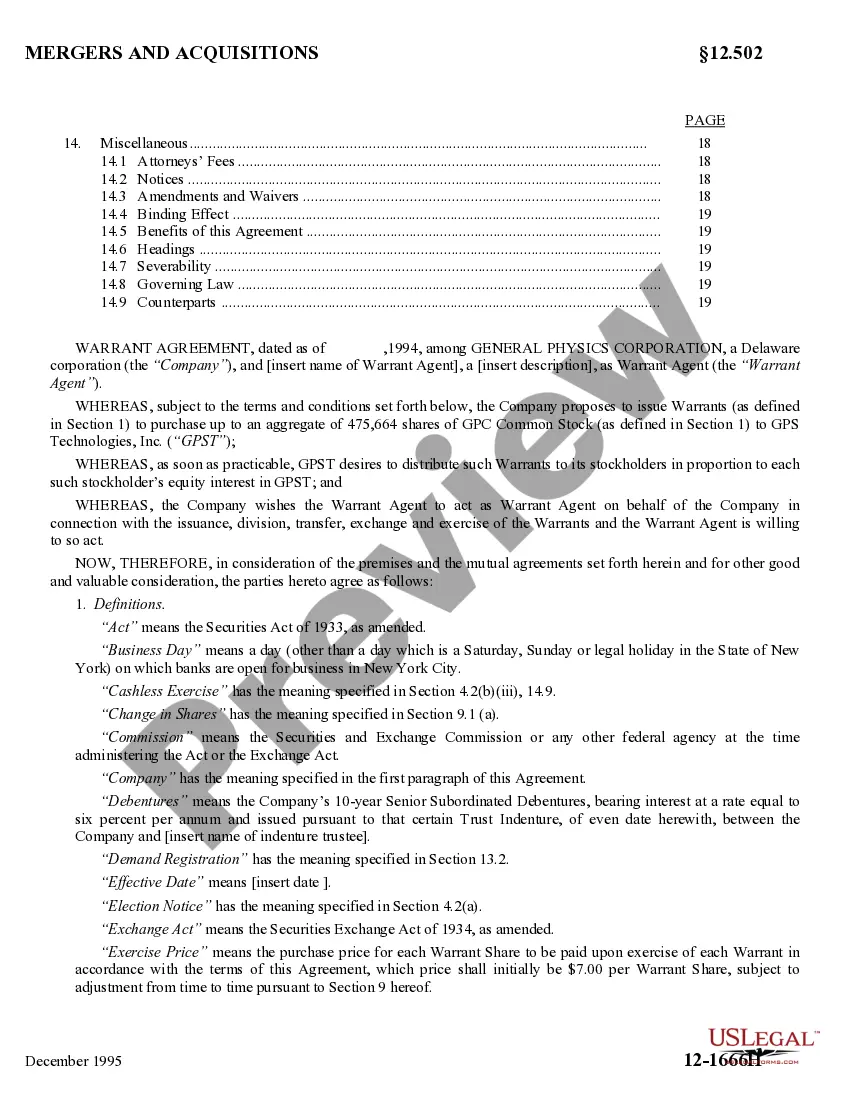

What is a Warrant? A warrant is an agreement between two parties ? the ?issuer? (i.e., a company) and the ?holder? of the warrant ? that entitles the holder to purchase the issuer's stock at a specified price within a certain time frame.

Companies often issue stock warrants by attaching the warrant to a bond or other security that they use to raise capital. The warrant helps attract investors and also represents potential future capital for the issuing company.

A warrant agreement is an agreement to purchase stock, also called a stock warrant. The agreement provides one party the right to purchase a company's stock at a specific price and at a specific date.

What Is Warrant Coverage? Warrant coverage is an agreement between a company and one or more shareholders where the company issues a warrant equal to some percentage of the dollar amount of an investment. Warrants, similar to options, allow investors to acquire shares at a designated price.