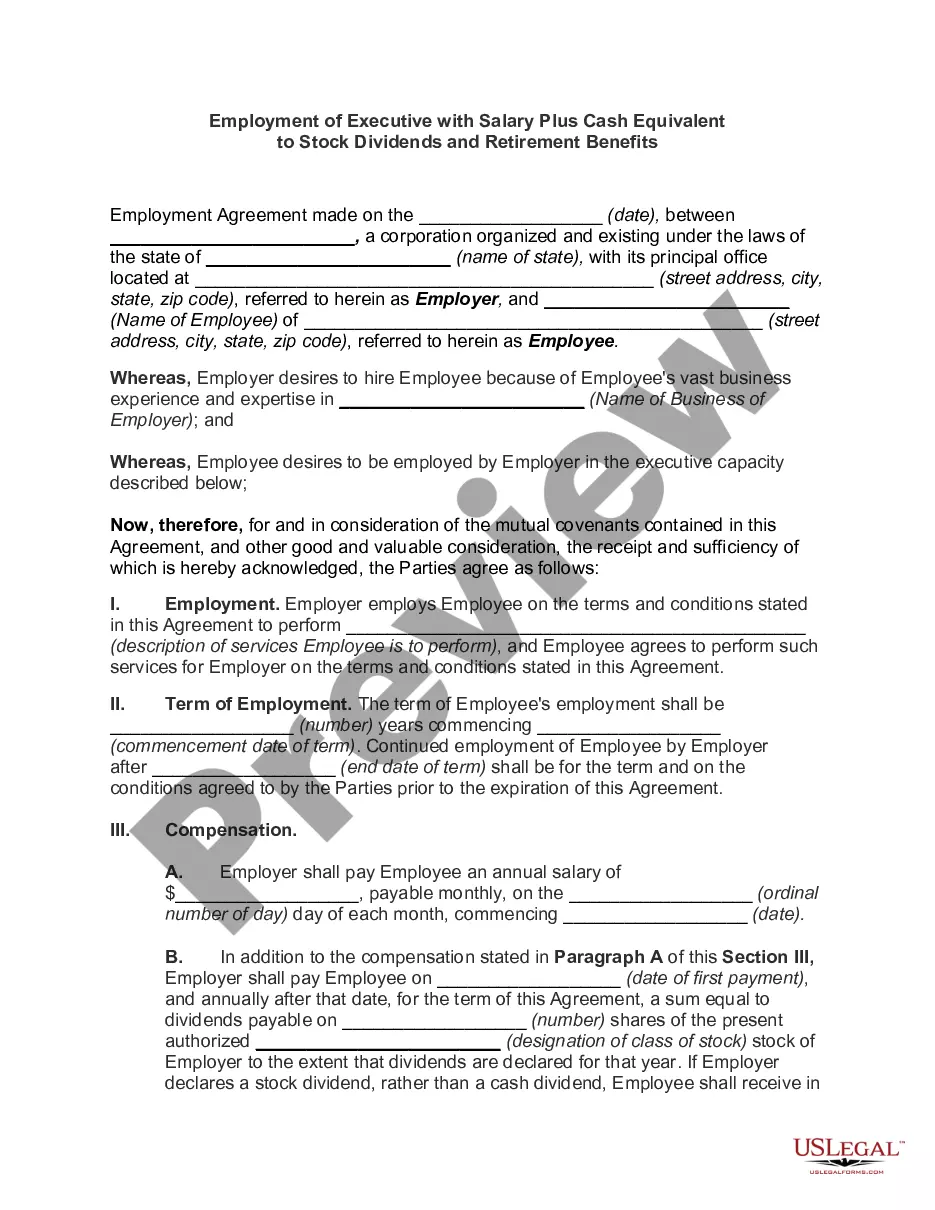

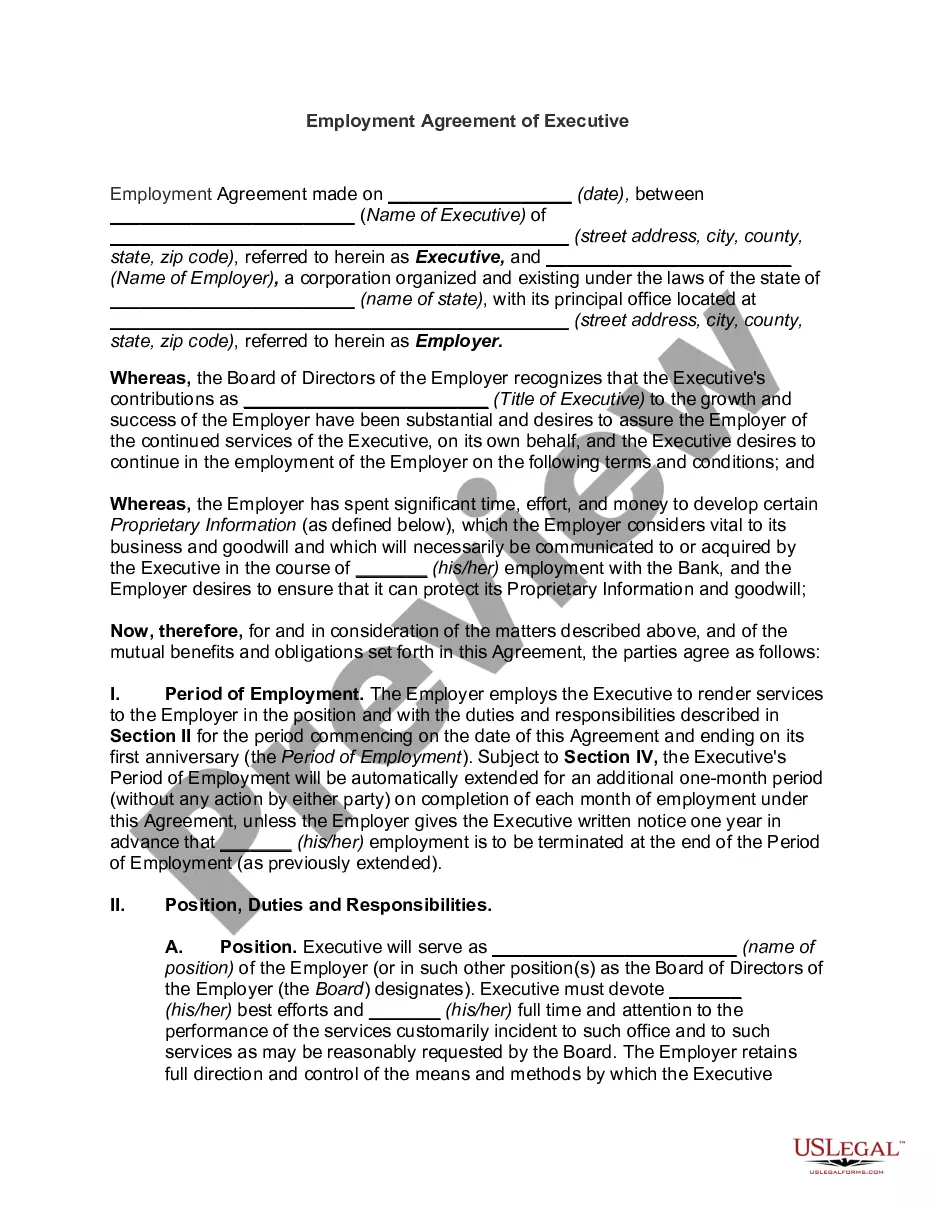

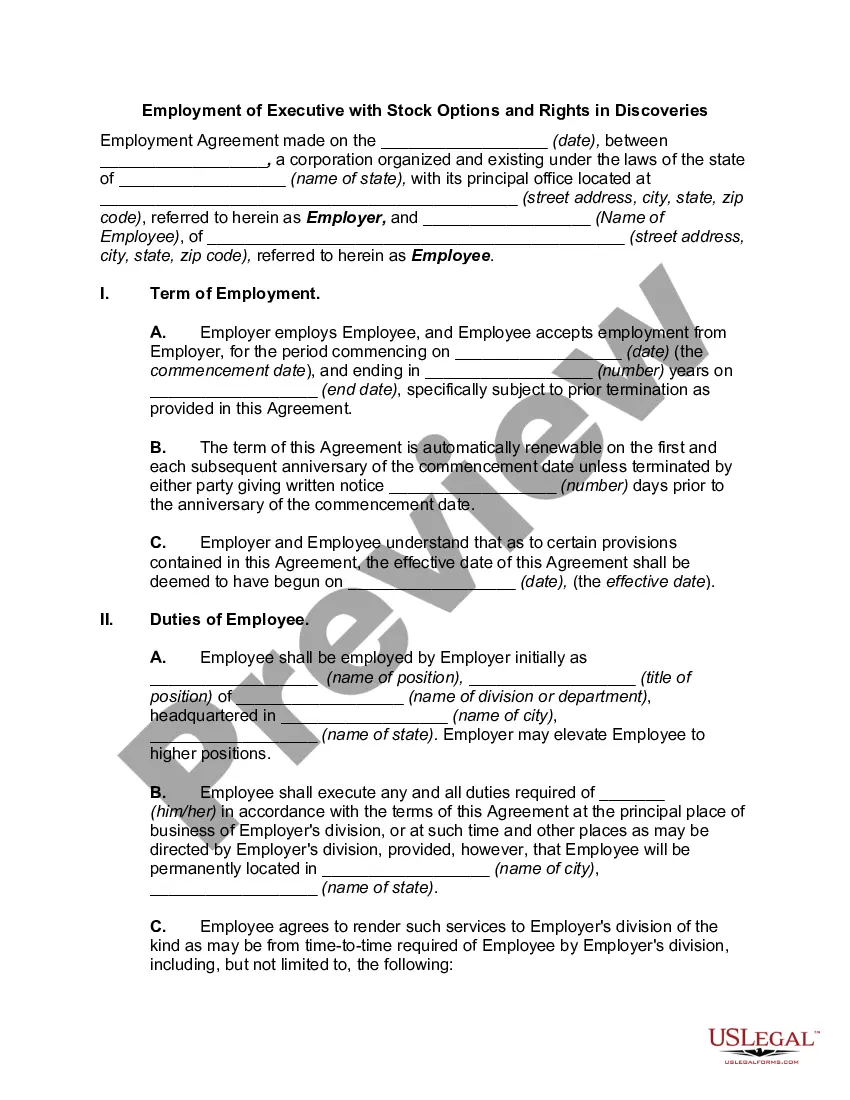

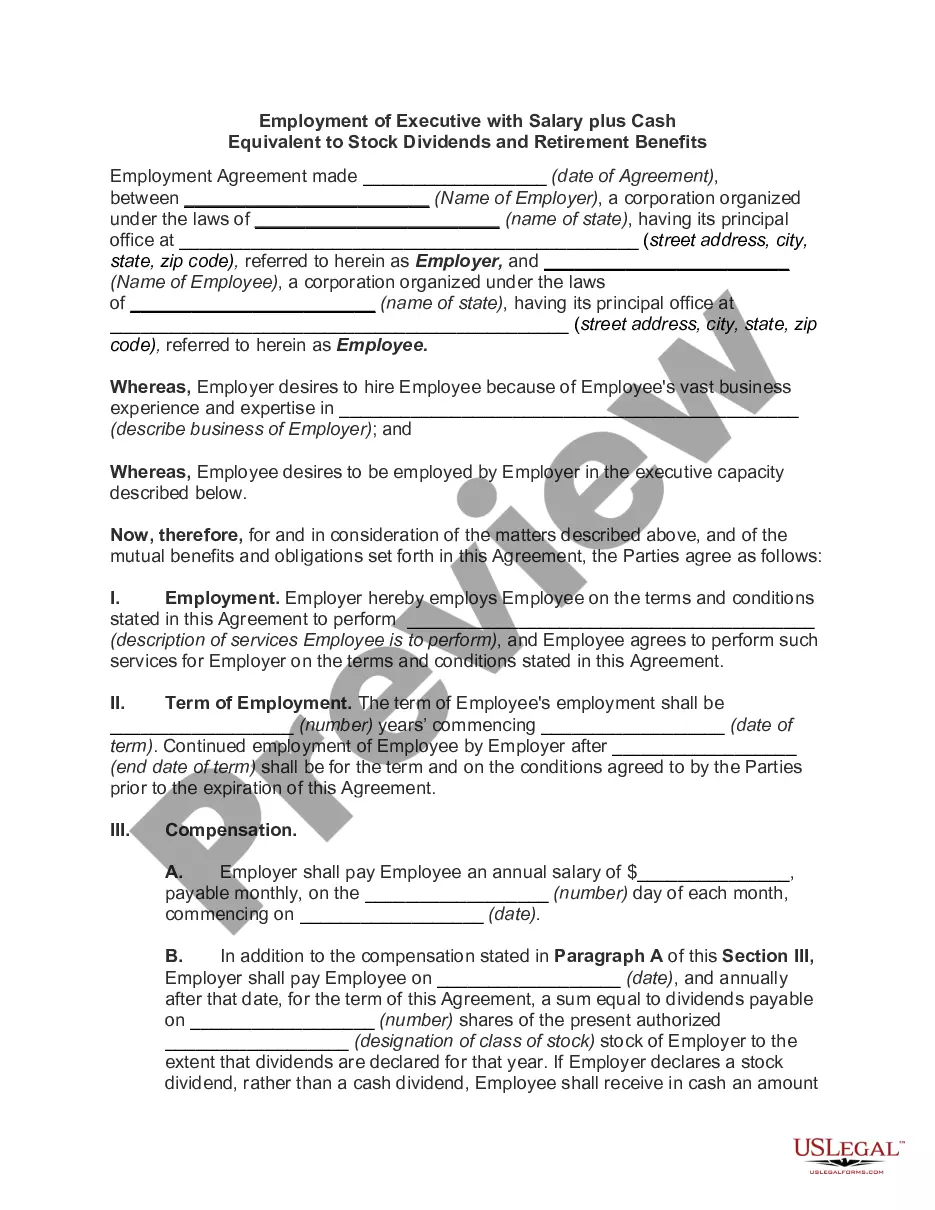

Pennsylvania Employment of Executive with Salary Plus Cash Equivalent to Stock Dividends and Retirement Benefits

Description

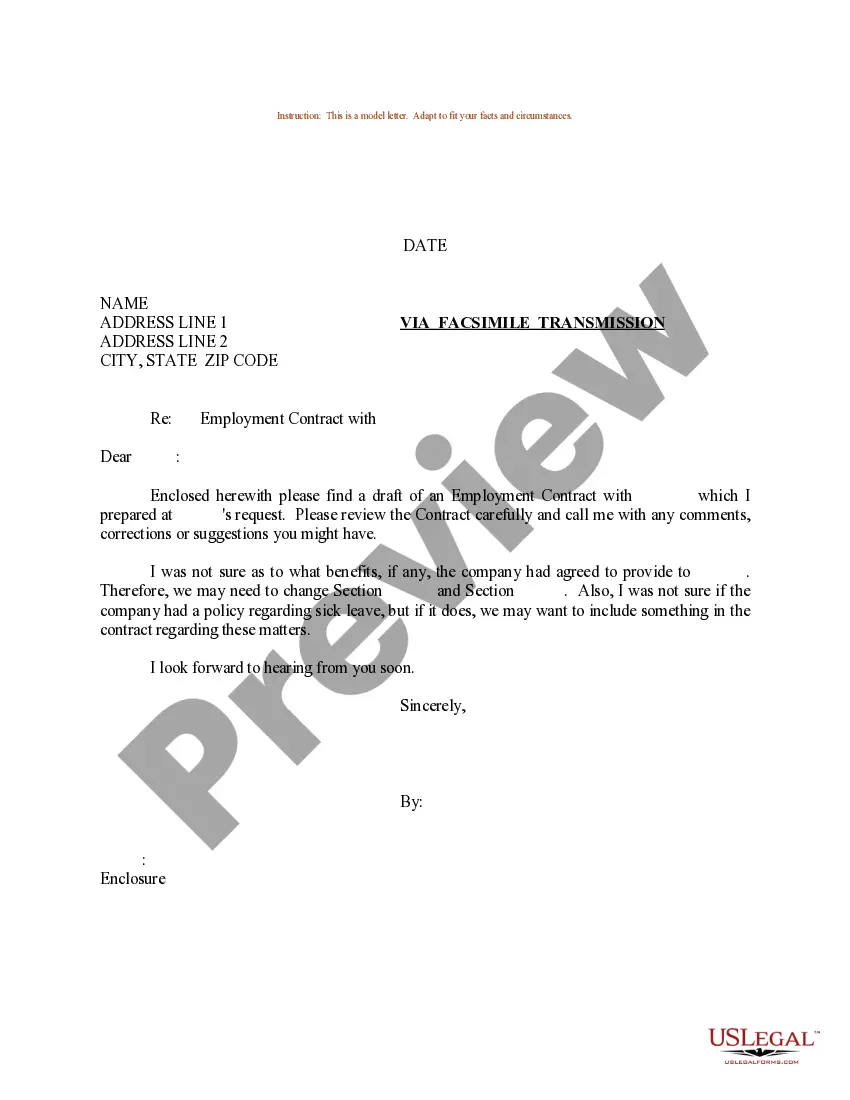

How to fill out Employment Of Executive With Salary Plus Cash Equivalent To Stock Dividends And Retirement Benefits?

If you have to comprehensive, obtain, or print out legitimate file web templates, use US Legal Forms, the largest variety of legitimate kinds, which can be found on the web. Use the site`s basic and practical lookup to find the papers you will need. Different web templates for business and individual uses are sorted by classes and suggests, or keywords and phrases. Use US Legal Forms to find the Pennsylvania Employment of Executive with Salary Plus Cash Equivalent to Stock Dividends and Retirement Benefits in just a few mouse clicks.

When you are currently a US Legal Forms client, log in to the profile and then click the Download option to have the Pennsylvania Employment of Executive with Salary Plus Cash Equivalent to Stock Dividends and Retirement Benefits. You may also accessibility kinds you earlier acquired within the My Forms tab of your own profile.

If you are using US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the form for the right metropolis/country.

- Step 2. Take advantage of the Review choice to check out the form`s information. Do not overlook to learn the explanation.

- Step 3. When you are not happy together with the type, use the Search field at the top of the monitor to get other types of the legitimate type web template.

- Step 4. When you have located the form you will need, go through the Acquire now option. Choose the pricing program you like and put your references to register for an profile.

- Step 5. Procedure the financial transaction. You can utilize your charge card or PayPal profile to accomplish the financial transaction.

- Step 6. Find the structure of the legitimate type and obtain it on your own gadget.

- Step 7. Full, modify and print out or sign the Pennsylvania Employment of Executive with Salary Plus Cash Equivalent to Stock Dividends and Retirement Benefits.

Each and every legitimate file web template you purchase is the one you have eternally. You might have acces to each type you acquired within your acccount. Click on the My Forms section and decide on a type to print out or obtain once again.

Remain competitive and obtain, and print out the Pennsylvania Employment of Executive with Salary Plus Cash Equivalent to Stock Dividends and Retirement Benefits with US Legal Forms. There are millions of professional and condition-distinct kinds you can utilize to your business or individual demands.

Form popularity

FAQ

Retirement income is not taxable: Payments from retirement accounts like 401(k)s and IRAs are tax exempt. PA also does not tax income from pensions for residents aged 60 and over. Social Security income is not taxable: Just like with a pension, in Pennsylvania, Social Security is tax exempt.

The State employees' Retirement System, the Pennsylvania School Employees' Retirement System, the Pennsylvania Municipal Employees Retirement System and the U.S. Civil Service Commission Retirement Disability Plan are eligible Pennsylvania retirement plans and all distributions are exempt from Pennsylvania personal ...

Some types of income are exempt from Pennsylvania state income tax, including child support, alimony, unemployment payments, and some capital gains on the sale of a primary residence. Some deductions are allowed for contributions to educational savings accounts and medical or health savings accounts.

The minimum income amount depends on your filing status and age. In 2022, for example, the minimum for single filing status if under age 65 is $12,950. If your income is below that threshold, you generally do not need to file a federal tax return.

Photocopies of your Form(s) W-2 (be sure the information is legible), or your actual Form(s) W-2. Include a statement to list and total your other taxable compensation. You must submit photocopies of your Form(s) 1099-R, 1099-MISC, 1099-NEC and other statements that show other compensation and any PA tax withheld.

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

Do I Have to Pay Income Tax in Pennsylvania? Full-year residents, part-year residents, and nonresidents are all required to file an income tax return in Pennsylvania once they have made over $1 in taxable income, even if no tax is due.

So as long as you earned income, there is no minimum to file taxes in California. It is a good idea to talk with a tax professional to determine your filing status and whether you are required to file or could benefit from doing so anyway.