Pennsylvania Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor

Description

How to fill out Irrevocable Trust For Lifetime Benefit Of Trustor With Power Of Invasion In Trustor?

Selecting the optimal legal document format can be challenging.

Naturally, there are numerous templates available online, but how do you acquire the legal form you desire.

Utilize the US Legal Forms website. The service provides thousands of templates, including the Pennsylvania Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor, suitable for business and personal needs.

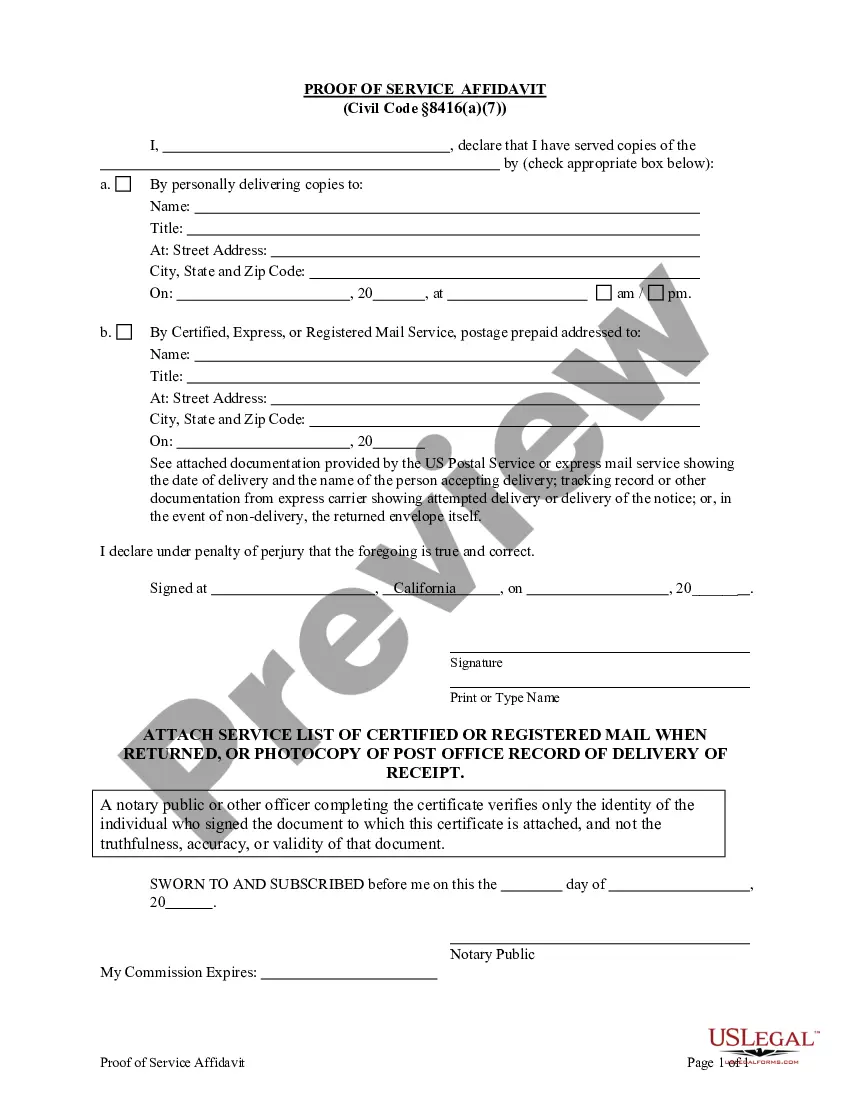

First, ensure you have selected the correct form for your region/county. You can review the form using the Preview button and read the form description to confirm it is suitable for you.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Obtain button to retrieve the Pennsylvania Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor.

- Use your account to search through the legal forms you have previously purchased.

- Navigate to the My documents tab of your account and obtain another copy of the document you need.

- If you are a first-time user of US Legal Forms, here are some simple guidelines for you to follow.

Form popularity

FAQ

With an Irrevocable Trust, once you have transferred the ownership of the house to the trust, it's irrevocable, meaning you are never supposed to be able to take it back. The trust will own that house for the rest of your life.

Can a Beneficiary be removed from an Irrevocable Trust. A beneficiary can renounce their interest from the trust and, upon the consent of other beneficiaries, be allowed to exit. A trustee cannot remove a beneficiary from an irrevocable trust.

The only three times you might want to consider creating an irrevocable trust is when you want to (1) minimize estate taxes, (2) become eligible for government programs, or (3) protect your assets from your creditors.

Irrevocable trusts can help you lower your tax liability, protect you from lawsuits and keep beneficiaries from mishandling assets. But you also have to accept the downsides of loss of control and an inflexible structure too.

An irrevocable trust cannot be modified or terminated without permission of the beneficiary. "Once the grantor transfers the assets into the irrevocable trust, he or she removes all rights of ownership to the trust and assets," Orman explained.

Irrevocable trusts are an important tool in many people's estate plan. They can be used to lock-in your estate tax exemption before it drops, keep appreciation on assets from inflating your taxable estate, protect assets from creditors, and even make you eligible for benefit programs like Medicaid.

With an irrevocable trust, you must get written consent from all involved parties to switch the trustee. That means having the trustmaker (the person who created the trust), the current trustee and all listed beneficiaries sign an amendment to remove the trustee and replace him or her with a new one.

Removing a Trustee But if the trustor is no longer alive or has an irrevocable trust, anyone wishing to remove a trustee will have to go to court. Any party with a reasonable interest in the trustsuch as co-trustee or a beneficiarymust file a petition with the probate court requesting that it remove the trustee.

Although one person can be both trustor and trustee, or both trustee and beneficiary, the roles of the trustor, trustee, and beneficiary are distinctly different.

But assets in an irrevocable trust generally don't get a step up in basis. Instead, the grantor's taxable gains are passed on to heirs when the assets are sold. Revocable trusts, like assets held outside a trust, do get a step up in basis so that any gains are based on the asset's value when the grantor dies.