Are you currently in a position that you require papers for either business or person uses virtually every day time? There are tons of lawful record layouts available on the net, but locating types you can trust is not effortless. US Legal Forms delivers 1000s of form layouts, like the Pennsylvania Compromise of Creditor's Claim against Estate by Payment of Cash and Conveying of Real Property, that happen to be written in order to meet state and federal demands.

In case you are already acquainted with US Legal Forms site and also have a free account, merely log in. Following that, you may obtain the Pennsylvania Compromise of Creditor's Claim against Estate by Payment of Cash and Conveying of Real Property design.

Unless you offer an accounts and want to begin to use US Legal Forms, adopt these measures:

- Discover the form you require and ensure it is to the appropriate area/area.

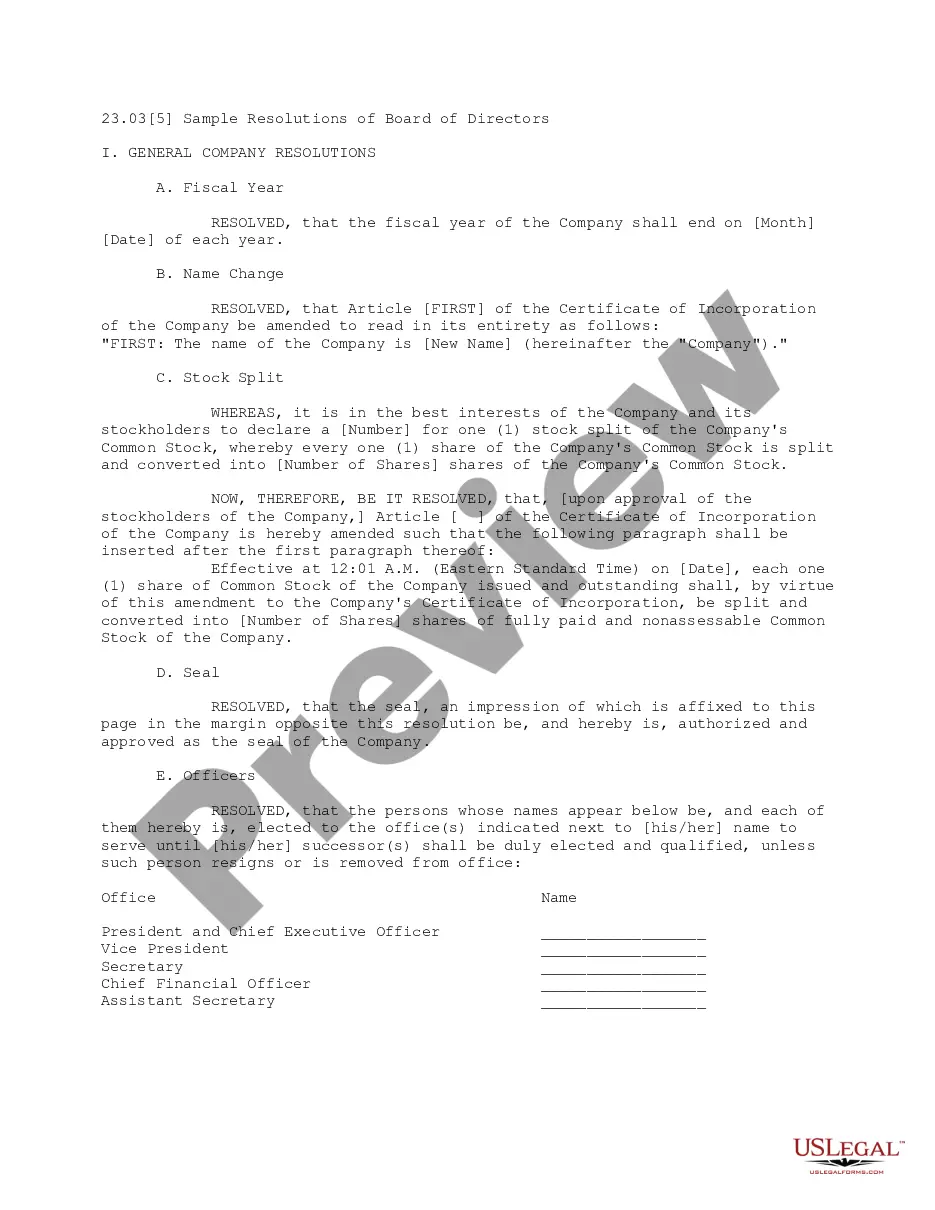

- Make use of the Preview key to analyze the form.

- See the description to ensure that you have selected the right form.

- If the form is not what you`re looking for, use the Lookup industry to discover the form that suits you and demands.

- Once you discover the appropriate form, click on Purchase now.

- Pick the prices prepare you need, fill in the necessary details to create your bank account, and buy an order making use of your PayPal or Visa or Mastercard.

- Pick a hassle-free data file format and obtain your copy.

Find every one of the record layouts you possess bought in the My Forms food list. You can obtain a more copy of Pennsylvania Compromise of Creditor's Claim against Estate by Payment of Cash and Conveying of Real Property anytime, if possible. Just click on the essential form to obtain or print the record design.

Use US Legal Forms, the most substantial assortment of lawful forms, to save lots of time as well as avoid blunders. The support delivers skillfully made lawful record layouts which can be used for a range of uses. Produce a free account on US Legal Forms and begin creating your way of life easier.