In a compilation engagement, the accountant presents in the form of financial statements information that is the representation of management (owners) without undertaking to express any assurance on the statements. In other words, using management's records, the accountant creates financial statements without gathering evidence or opining about the validity of those underlying records. Because compiled financial statements provide the reader no assurance regarding the statements, they represent the lowest level of financial statement service accountants can provide to their clients. Accordingly, standards governing compilation engagements require that financial statements presented by the accountant to the client or third parties must at least be compiled.

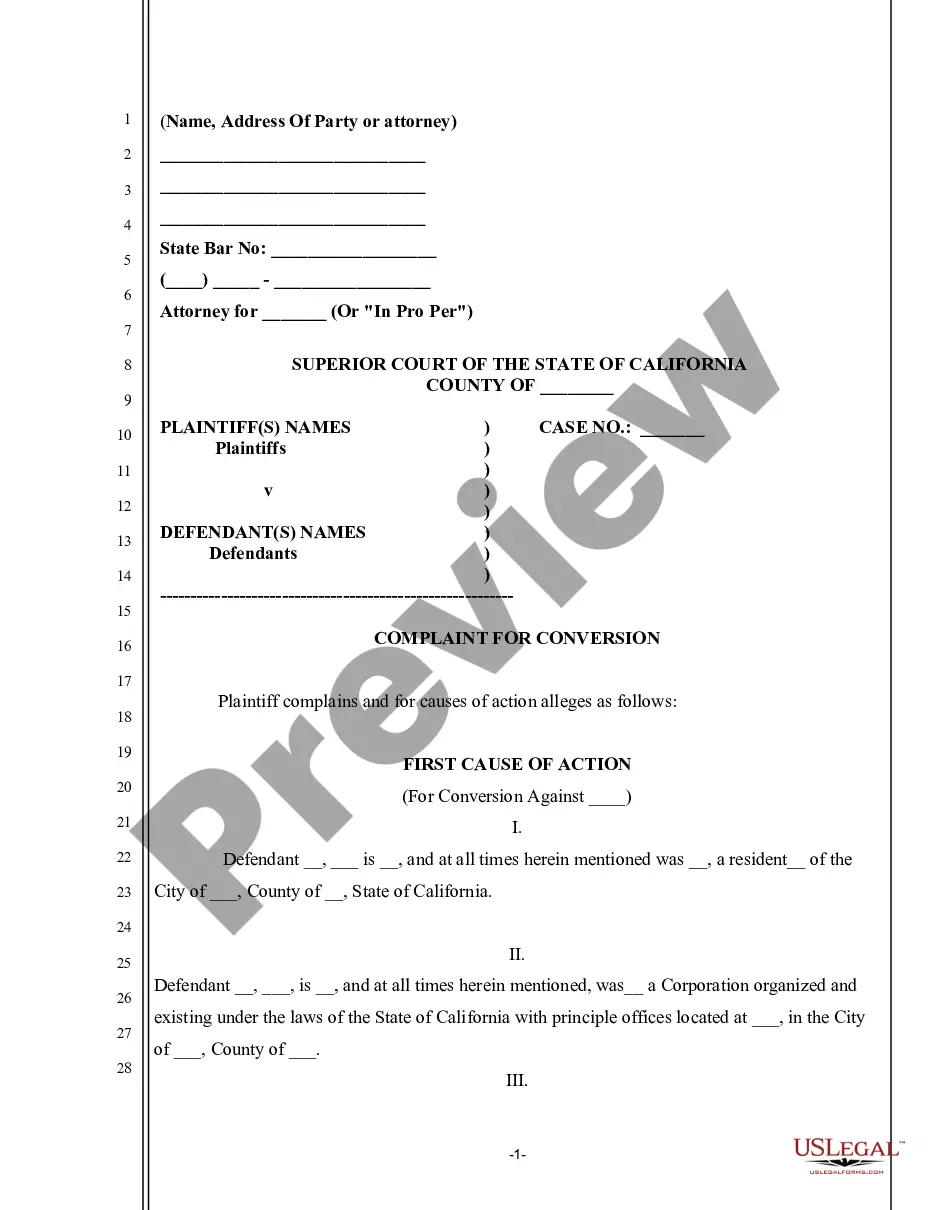

Pennsylvania Report from Review of Financial Statements and Compilation by Accounting Firm

Description

How to fill out Report From Review Of Financial Statements And Compilation By Accounting Firm?

You can spend numerous hours online trying to locate the legal form template that meets the federal and state requirements you need.

US Legal Forms provides a vast array of legal templates that can be reviewed by experts.

You can download or print the Pennsylvania Report from Review of Financial Statements and Compilation by Accounting Firm from their services.

First, ensure that you have chosen the correct form template for the county/city of your choice. Review the form summary to confirm you have chosen the right document. If available, use the Review option to inspect the form template as well.

- If you already have a US Legal Forms account, you can Log In and select the Download option.

- Then, you can fill out, modify, print, or sign the Pennsylvania Report from Review of Financial Statements and Compilation by Accounting Firm.

- Every legal template you purchase belongs to you indefinitely.

- To get an extra copy of a purchased form, visit the My documents tab and click on the relevant option.

- If you're using the US Legal Forms website for the first time, follow the simple steps below.

Form popularity

FAQ

Writing a financial review report involves collecting and analyzing financial statements to provide stakeholders with insights. Begin by compiling necessary financial information, followed by conducting analytical procedures. Summarize your findings and present them concisely, emphasizing critical insights into the financial performance. This process ultimately aids in producing a Pennsylvania Report from Review of Financial Statements and Compilation by Accounting Firm.

Writing a financial review involves analyzing the financial data provided. Begin with a thorough examination of the data and perform necessary analytical procedures. Next, summarize your findings clearly, making sure to explain any significant variances or trends. This approach will help you craft a reliable Pennsylvania Report from Review of Financial Statements and Compilation by Accounting Firm that stakeholders can trust.

When writing a financial reporting report, start by gathering all relevant financial data. Organize the information in a clear, logical format that showcases your analysis. It's vital to highlight key metrics and trends that reflect the organization's performance, giving stakeholders valuable insights. This aligns well with creating a Pennsylvania Report from Review of Financial Statements and Compilation by Accounting Firm.

The main difference between a financial review and a compilation is the level of assurance provided. A financial review involves limited analysis and provides some assurance about the reliability of the financial statements, while a compilation presents information without any assurance. Knowing this distinction can enhance the understanding of a Pennsylvania Report from Review of Financial Statements and Compilation by Accounting Firm.

A financial review report provides an overview of a company's financial health based on limited procedures. This report typically involves inquiries and analytical procedures, rather than a full audit. The primary goal is to provide a level of assurance to stakeholders regarding the reliability of financial statements. Understanding this helps in creating a Pennsylvania Report from Review of Financial Statements and Compilation by Accounting Firm that meets necessary standards.

To write a compilation report, start by gathering the financial statements you need to compile. Next, apply the necessary accounting principles to ensure accuracy. It’s essential to include a clear explanation of the purpose of the report and the limitations of your work. Finally, present the compilation report in a structured manner, which will serve as a Pennsylvania Report from Review of Financial Statements and Compilation by Accounting Firm.

A CPA must possess the requisite skills, knowledge, and experience to perform a review of an entity's financial statements. They should be familiar with the applicable accounting standards and professional ethics relating to the Pennsylvania Report from Review of Financial Statements and Compilation by Accounting Firm. By engaging a skilled CPA, organizations can ensure the reliability of their financial reporting.

When financial statements are reviewed, it means that a CPA has conducted limited procedures to provide a moderate level of assurance that there are no material misstatements. This process typically involves inquiries and analytical procedures, creating a Pennsylvania Report from Review of Financial Statements and Compilation by Accounting Firm. Such reviews are beneficial for businesses seeking to enhance credibility without the rigor of an audit.

When planning a financial statement audit, a CPA must understand the entity's environment, including its internal controls and financial reporting practices. This knowledge is critical in the context of preparing a Pennsylvania Report from Review of Financial Statements and Compilation by Accounting Firm. It enables the CPA to identify risks and tailor the audit approach for effective and efficient results.

Yes, a non-CPA can perform a financial review; however, the results may not carry the same weight or credibility as those conducted by a CPA. In the context of a Pennsylvania Report from Review of Financial Statements and Compilation by Accounting Firm, a CPA's involvement assures compliance with professional standards and enhances trust among stakeholders. Relying on a qualified CPA can provide more accurate insights for decision-making.