Pennsylvania Agreement to Incorporate by Partners Incorporating Existing Partnership

Description

How to fill out Agreement To Incorporate By Partners Incorporating Existing Partnership?

You can dedicate hours online looking for the legal document template that aligns with the federal and state requirements you desire.

US Legal Forms provides thousands of legal documents that are assessed by experts.

You can conveniently access or create the Pennsylvania Agreement to Incorporate by Partners Incorporating Existing Partnership from our service.

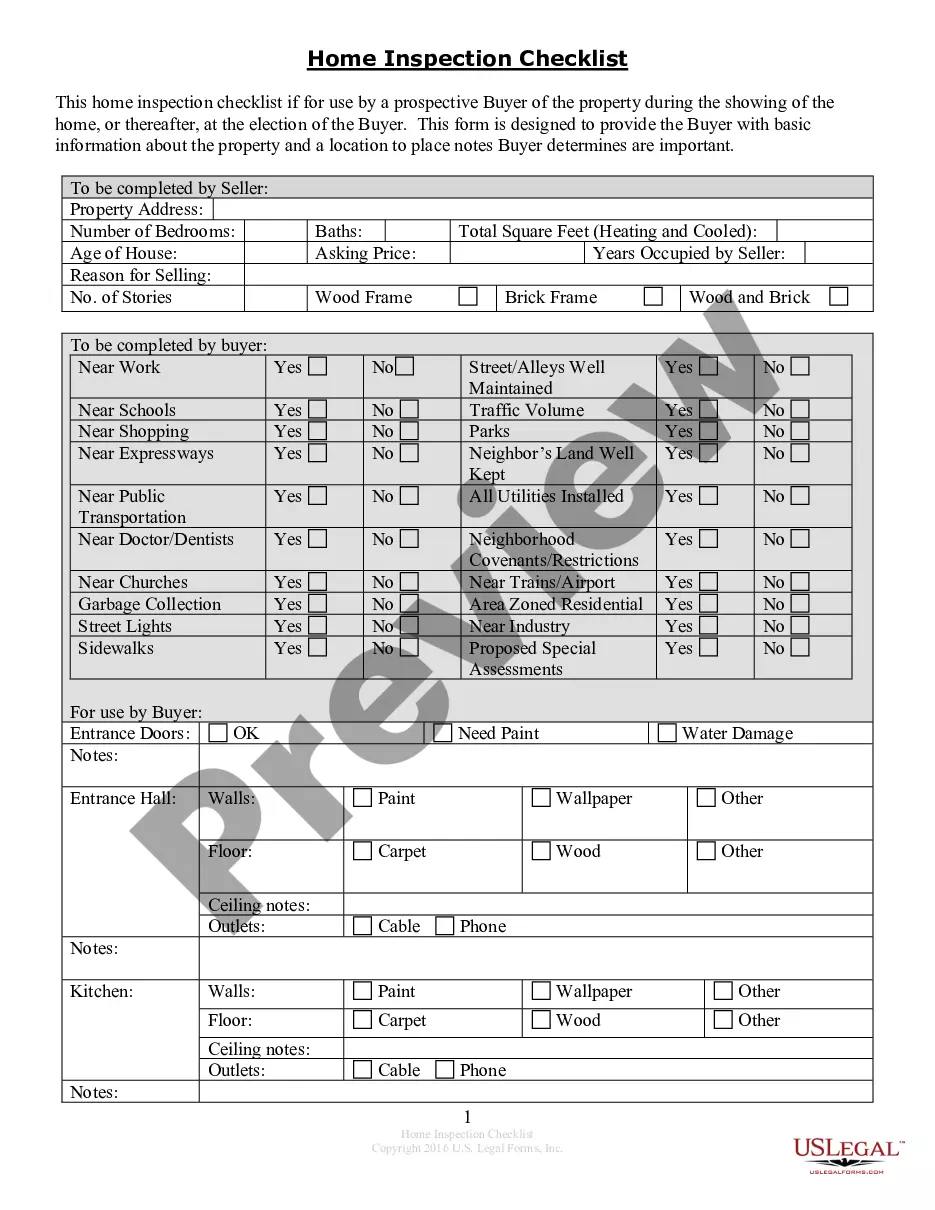

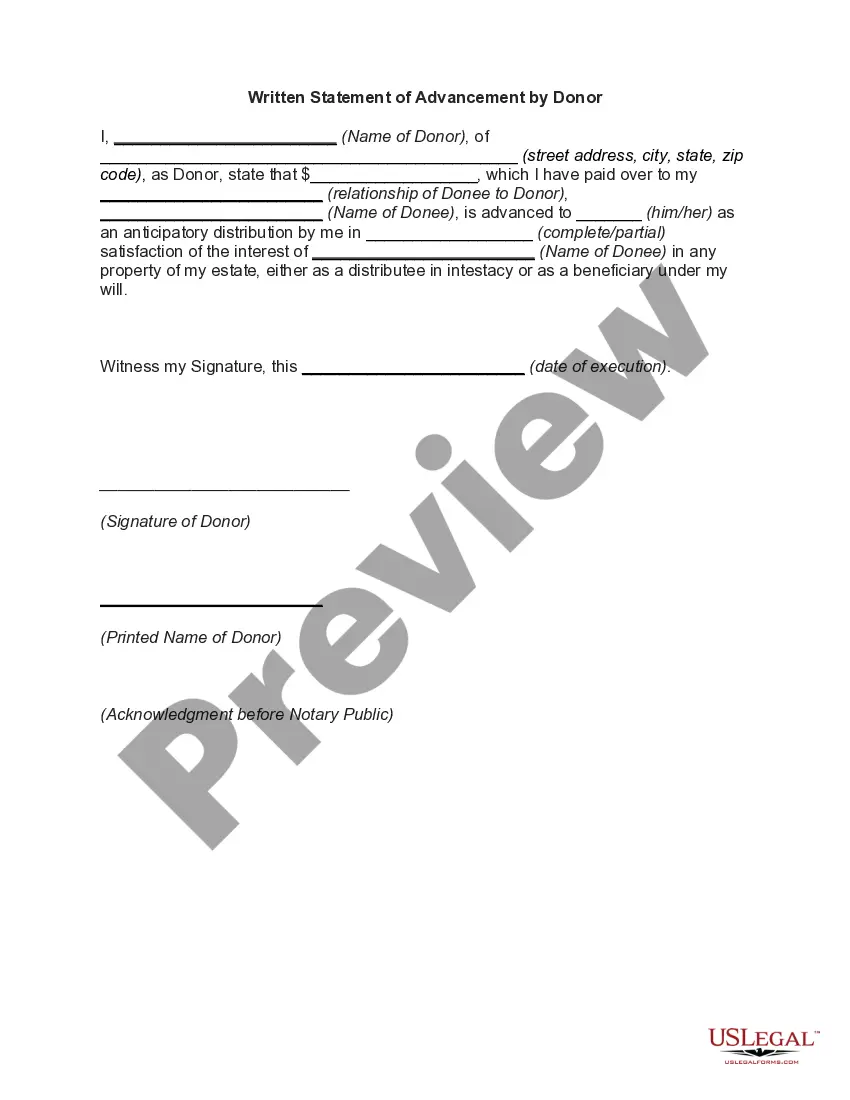

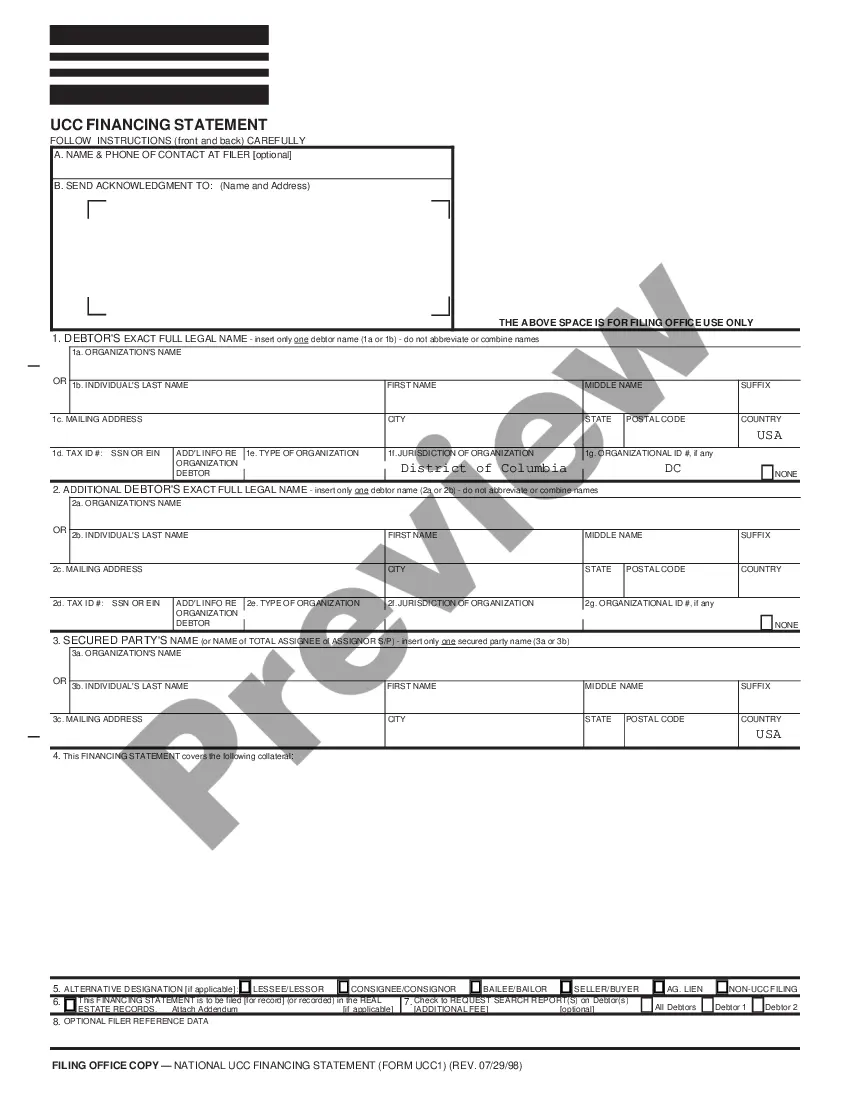

If available, use the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and press the Download button.

- Then, you can complete, modify, create, or sign the Pennsylvania Agreement to Incorporate by Partners Incorporating Existing Partnership.

- Each legal document template you acquire is yours permanently.

- To obtain another copy of the purchased form, visit the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document template for the county/town of your choice.

- Review the form description to ensure you have selected the correct template.

Form popularity

FAQ

Certainly, a partnership can choose to incorporate and become a corporation. This transition through a Pennsylvania Agreement to Incorporate by Partners Incorporating Existing Partnership offers numerous advantages, such as limited liability and potential tax benefits. It serves as a strategic move to enhance the business structure and protect individual partners.

Yes, Pennsylvania does permit the Pass-Through Entity Tax (PTET), which is beneficial for many partnerships and LLCs. This state-level tax allows eligible entities to reduce their tax burden while simplifying their filing process. Ensure your partnership understands the qualifications by consulting relevant legal resources or platforms like uslegalforms.

Typically, a partnership firm is not incorporated unless it takes formal steps to do so. The primary action involves creating a Pennsylvania Agreement to Incorporate by Partners Incorporating Existing Partnership, which grants the firm corporate status. This incorporation process not only provides legal recognition but also helps establish liability protections.

To add a partner to an LLC in Pennsylvania, you first need to consult your operating agreement. You may have to draft an amendment to include the new partner formally. Once done, make sure to file any required documents with the state to maintain compliance with Pennsylvania laws and regulations.

Incorporating a partnership means it has filed legal documents to become a corporation. This shift provides the business with distinct legal status, allowing it to own property, enter contracts, and undertake liabilities independently. The Pennsylvania Agreement to Incorporate by Partners Incorporating Existing Partnership outlines this transformation.

When a partnership incorporates, it transforms into a legal entity separate from its partners. This means the business now has its own rights and responsibilities under the law. Additionally, the partnership may benefit from limited liability, protecting personal assets from business debts and liabilities.

Yes, a partnership can incorporate to become a corporation. This process involves filing a Pennsylvania Agreement to Incorporate by Partners Incorporating Existing Partnership. By doing so, the partnership gains the benefits of limited liability and formal management structures that a corporation provides.

To form a partnership with an existing business, you should first discuss and agree on the terms with the current owners. Next, drafting a Pennsylvania Agreement to Incorporate by Partners Incorporating Existing Partnership is crucial for aligning expectations and outlining roles. This approach will provide a solid foundation for a successful partnership.

A partnership agreement is essential because it outlines each partner's responsibilities, rights, and contributions. Additionally, creating a Pennsylvania Agreement to Incorporate by Partners Incorporating Existing Partnership can provide clarity on how to transition to a corporation. Such an agreement can mitigate disputes and ensure smooth operations.

Partnerships can indeed turn into corporations by following the appropriate legal procedures. The Pennsylvania Agreement to Incorporate by Partners Incorporating Existing Partnership is a vital tool for this transformation. It details how to transition from a partnership to a corporation, ensuring that all partners agree on the new terms.