Pennsylvania Receipt Template for Small Business

Description

How to fill out Receipt Template For Small Business?

Locating the appropriate legal document template can be challenging. Clearly, there are numerous themes available online, but how can you discover the legal form you require.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Pennsylvania Receipt Template for Small Business, that can be utilized for both business and personal needs. All the forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Acquire button to obtain the Pennsylvania Receipt Template for Small Business. Use your account to review the legal forms you have previously ordered. Navigate to the My documents tab in your account to obtain another copy of the document you need.

Select the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Pennsylvania Receipt Template for Small Business. US Legal Forms is indeed the largest library of legal forms where you can find numerous document templates. Take advantage of the service to download professionally crafted documents that adhere to state regulations.

- First, ensure you have selected the correct form for your city/state.

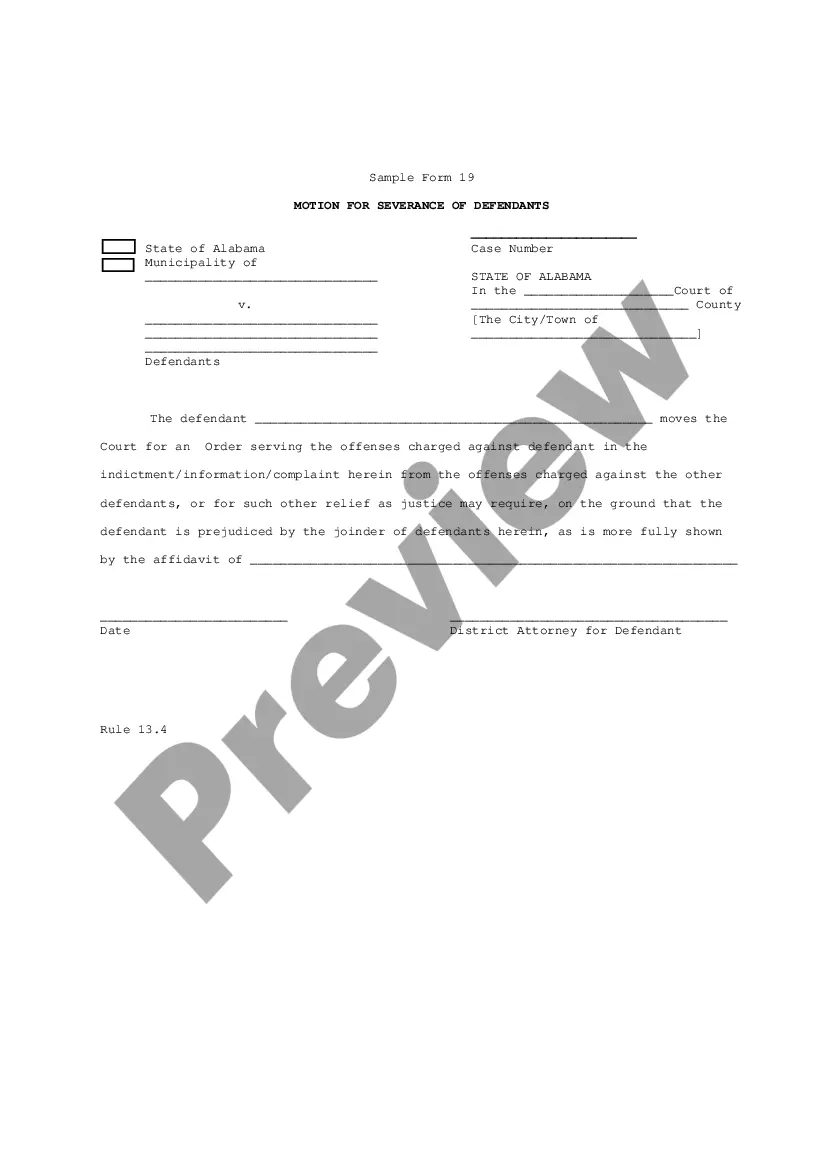

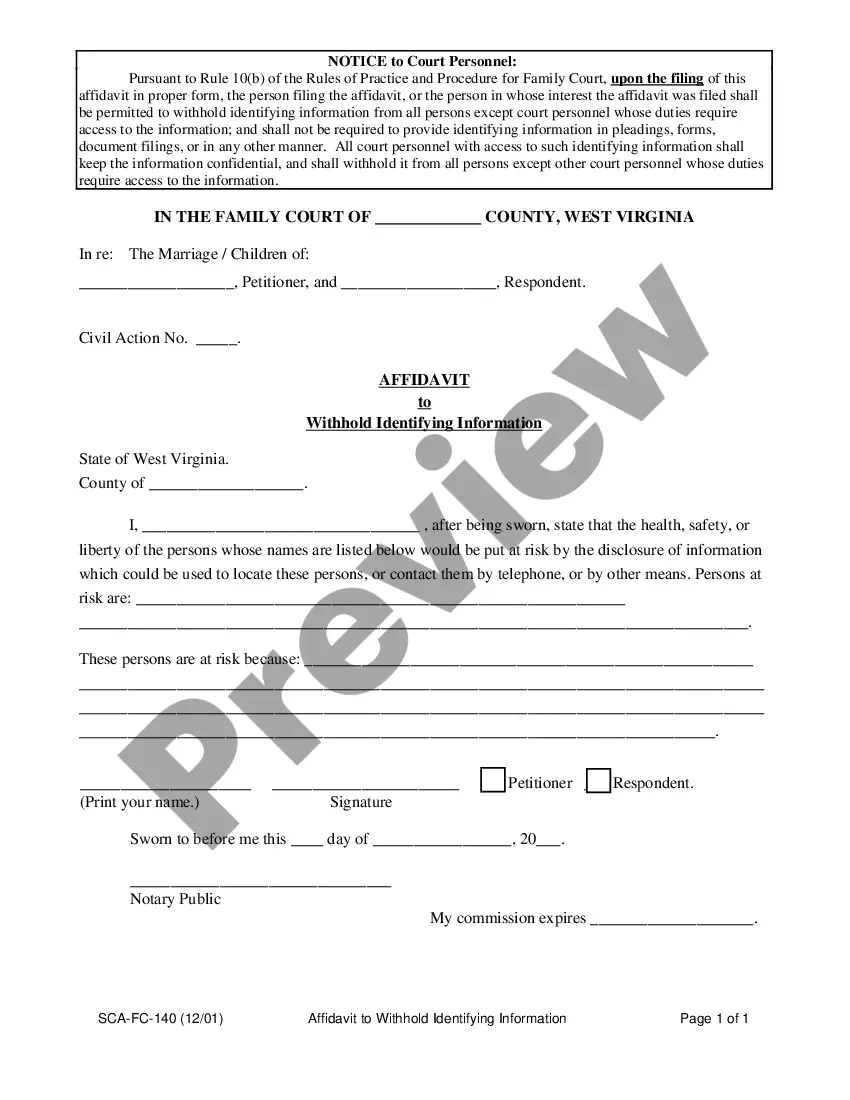

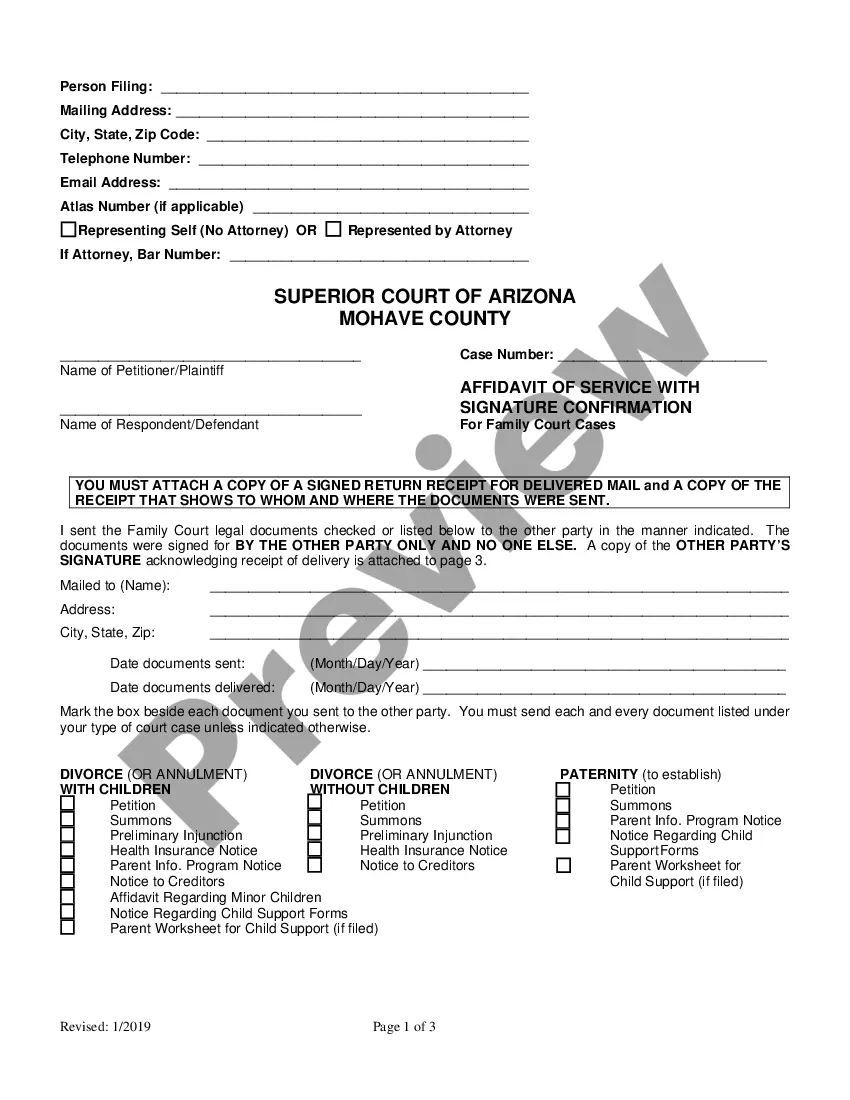

- You can preview the form using the Review button and read the form details to ensure it is suitable for you.

- If the form does not meet your needs, utilize the Search area to find the correct form.

- Once you are confident the form will work, click the Acquire now button to obtain the form.

- Choose the pricing plan you prefer and enter the required information.

- Create your account and pay for the transaction using your PayPal account or Visa or Mastercard.

Form popularity

FAQ

Yes, Microsoft Word offers various receipt templates that you can customize. However, using a Pennsylvania Receipt Template for Small Business typically provides more specific features tailored to your business needs. By utilizing a dedicated template, you ensure that all essential information is included and properly formatted.

Creating a receipt for your small business is straightforward with a Pennsylvania Receipt Template for Small Business. Enter your business details, transaction information, and payment method on the template. This process not only helps you maintain accurate records but also builds trust with your customers through professional documentation.

To make a PDF receipt, begin with a Pennsylvania Receipt Template for Small Business. After entering all necessary information, you can save your document as a PDF file. This ensures easy sharing via email or printing, allowing your customers to receive a polished digital copy.

Yes, you can make a receipt yourself using a Pennsylvania Receipt Template for Small Business. Simply customize the template by adding your business logo, contact information, and relevant transaction details. This approach allows you to create a tailored receipt that reflects your brand and serves your specific business purposes.

To generate a receipt, you can use a Pennsylvania Receipt Template for Small Business. Start by entering your business name, the date of the transaction, and the details of the goods or services provided. Once you fill in these details, you will create a professional-looking receipt that meets your small business needs.

The current sales tax rate in Pennsylvania is six percent, although some local jurisdictions may impose additional taxes. It’s crucial to apply this rate to your transactions and note it on each receipt. A Pennsylvania Receipt Template for Small Business can help you manage this calculation with ease, ensuring compliance with state laws. Always check for any updates to the tax rates to remain informed and accurate in your transactions.

To set up sales tax for your business, start by determining whether your products or services are taxable in your state. Register with the appropriate state tax authority and obtain a sales tax permit. Utilizing a Pennsylvania Receipt Template for Small Business will assist you in recording sales tax accurately for each transaction. This organized approach can save you time during tax filing and provide clarity in your financial records.

Setting up sales tax in Pennsylvania involves registering your business with the state and obtaining a sales tax license. With a Pennsylvania Receipt Template for Small Business, you can effectively track sales tax collected on your sales. This template can help you keep consistent records, simplifying your tax reporting responsibilities. Make sure to stay updated on any changes in tax rates and regulations to remain compliant.

Yes, you need receipts for small business expenses to maintain clear records and prepare for tax season. A Pennsylvania Receipt Template for Small Business can simplify this process, ensuring you capture all necessary details. Proper documentation helps validate your expenses, making it easier to claim deductions. Overall, receipts are essential for staying organized and complying with tax regulations.

Filling up a receipt form entails entering all required details such as your business name, transaction date, product descriptions, and payment amounts. Ensure accuracy and clarity for easy reference. You can save time and maintain professionalism by using a Pennsylvania Receipt Template for Small Business, which guides you through all necessary fields effortlessly.