The decree of the bankruptcy court which terminates the bankruptcy proceedings is generally a discharge that releases the debtor from most debts. A bankruptcy court may refuse to grant a discharge under certain conditions.

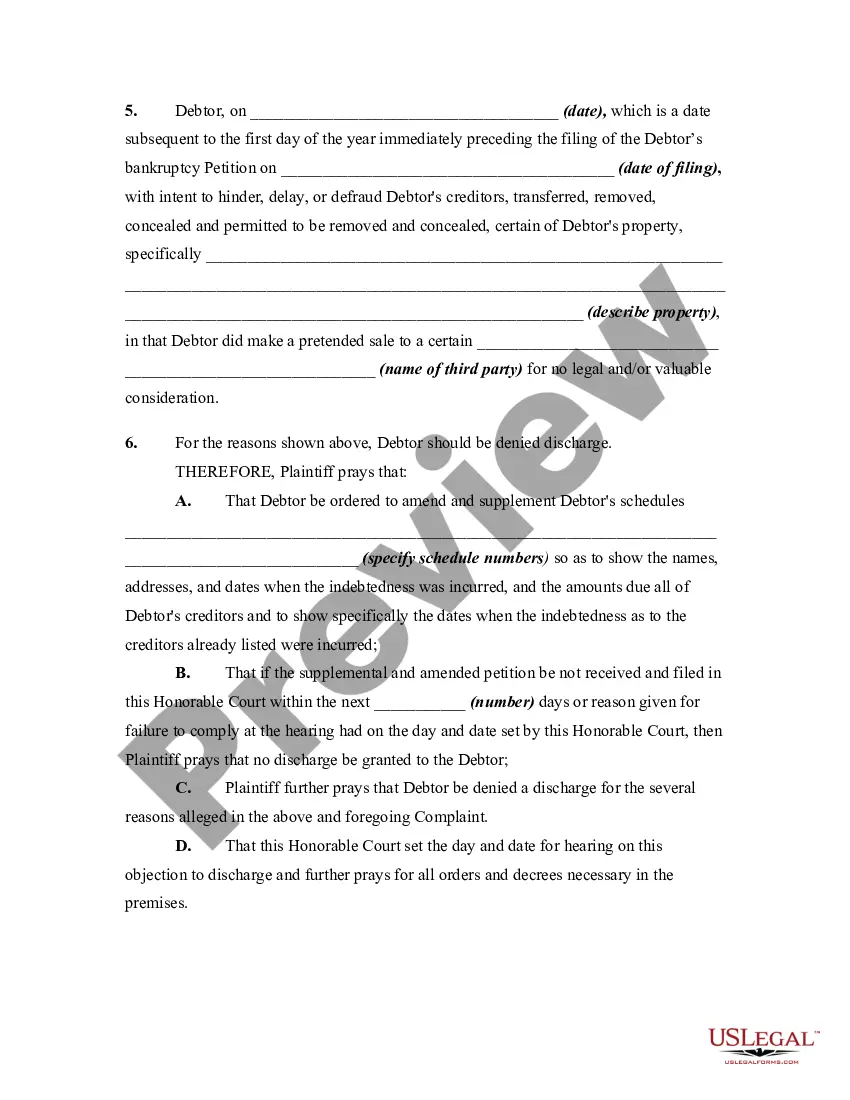

Pennsylvania Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property Within One Year Preceding

Description

How to fill out Complaint Objecting To Discharge In Bankruptcy Proceeding For Transfer, Removal, Destruction, Or Concealment Of Property Within One Year Preceding?

It is possible to invest hrs on the Internet attempting to find the authorized record format that suits the state and federal requirements you want. US Legal Forms gives a large number of authorized forms that are analyzed by specialists. It is possible to down load or printing the Pennsylvania Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property from your assistance.

If you have a US Legal Forms accounts, you may log in and then click the Acquire button. Afterward, you may complete, modify, printing, or sign the Pennsylvania Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property. Each and every authorized record format you buy is the one you have forever. To obtain yet another copy of the obtained type, check out the My Forms tab and then click the corresponding button.

If you are using the US Legal Forms internet site initially, adhere to the easy directions listed below:

- Initial, make sure that you have selected the best record format for the region/area that you pick. Browse the type information to ensure you have chosen the correct type. If offered, make use of the Review button to look with the record format at the same time.

- In order to discover yet another version of your type, make use of the Lookup field to get the format that suits you and requirements.

- After you have found the format you desire, click on Acquire now to move forward.

- Select the costs program you desire, type your credentials, and sign up for an account on US Legal Forms.

- Total the transaction. You should use your credit card or PayPal accounts to purchase the authorized type.

- Select the structure of your record and down load it to your gadget.

- Make alterations to your record if necessary. It is possible to complete, modify and sign and printing Pennsylvania Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property.

Acquire and printing a large number of record layouts making use of the US Legal Forms web site, that offers the largest selection of authorized forms. Use professional and state-specific layouts to tackle your company or specific needs.

Form popularity

FAQ

Debts not discharged include debts for alimony and child support, certain taxes, debts for certain educational benefit overpayments or loans made or guaranteed by a governmental unit, debts for willful and malicious injury by the debtor to another entity or to the property of another entity, debts for death or personal ...

In fact, the federal courts (which handle bankruptcy cases) list 19 different types of debt that are not eligible for discharge. 2 The most common ones are child support, alimony payments, and debts for willful and malicious injuries to a person or property.

5 Reasons Your Bankruptcy Case Could Be Denied The debtor failed to attend credit counseling. Their income, expenses, and debt would allow for a Chapter 13 filing. The debtor attempted to defraud creditors or the bankruptcy court. A previous debt was discharged within the past eight years under Chapter 7.

Among the grounds for denying a discharge to a chapter 7 debtor are that the debtor failed to keep or produce adequate books or financial records; the debtor failed to explain satisfactorily any loss of assets; the debtor committed a bankruptcy crime such as perjury; the debtor failed to obey a lawful order of the ...

If a debt arose from the debtor's intentional wrongdoing, the creditor can object to discharging it. This might involve damages related to a drunk driving accident, for example, or costs caused by intentional damage to an apartment or other property.

An objection to discharge is a notice lodged with the Official Receiver by a trustee to induce a bankrupt to comply with their obligations. An objection will extend the period of bankruptcy so automatic discharge will not occur three years and one day after the bankrupt filed a statement of affairs.