Pennsylvania Direct Deposit Form for Payroll

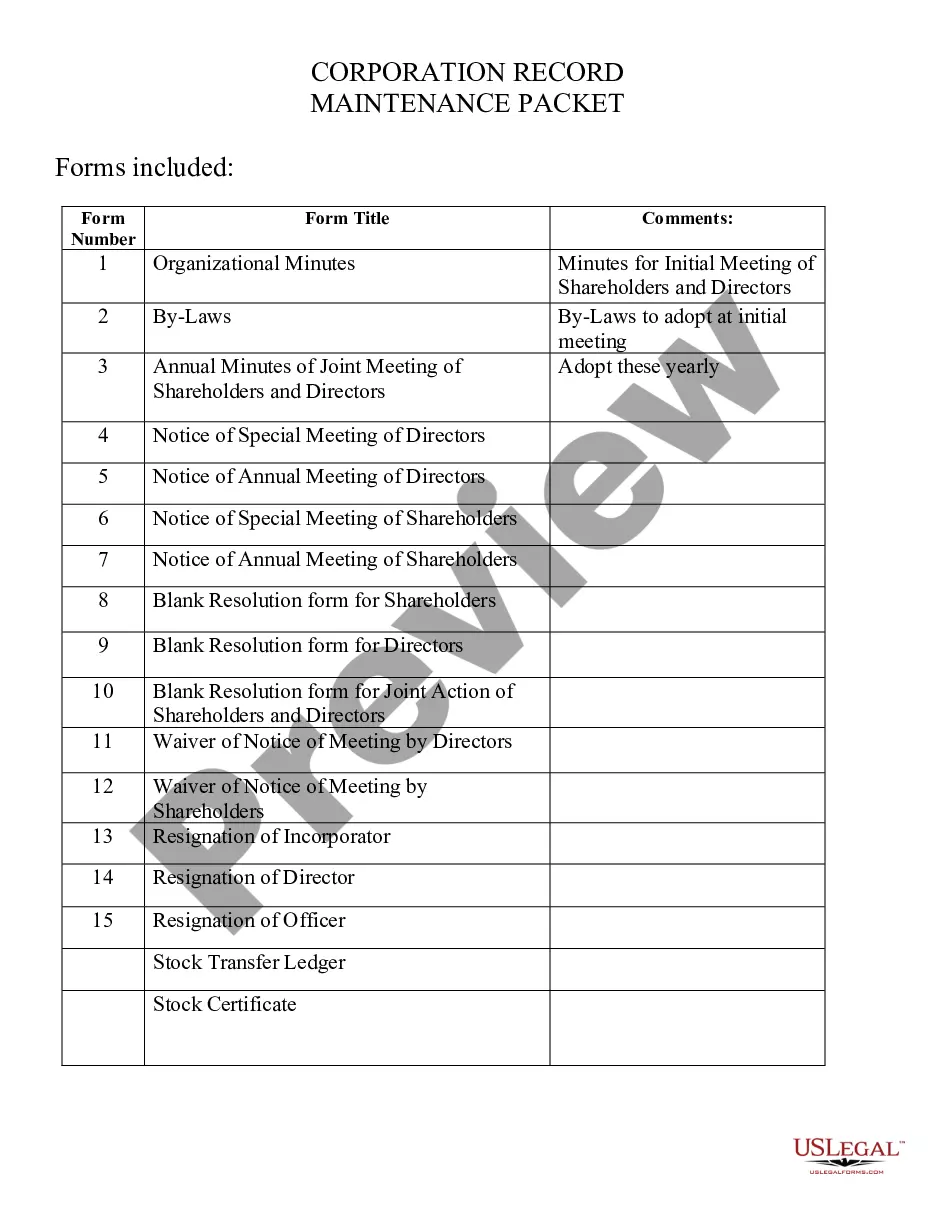

Description

How to fill out Direct Deposit Form For Payroll?

It is feasible to allocate time on the internet seeking the legal document template that aligns with the state and federal requirements you desire.

US Legal Forms offers a wide array of legal documents that are scrutinized by professionals.

You can effortlessly download or print the Pennsylvania Direct Deposit Form for Payroll from my services.

If available, utilize the Review button to examine the document template as well.

- If you already possess a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can complete, modify, print, or sign the Pennsylvania Direct Deposit Form for Payroll.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of any purchased form, visit the My documents tab and then click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow these straightforward instructions.

- First, ensure that you have selected the correct document template for the area/city of your choice.

- Review the form description to ensure you have chosen the right template.

Form popularity

FAQ

To obtain a direct deposit form from a US bank, you can either visit a local branch or access your online banking account. Look for the forms section in your account settings, where you can download and fill out the Pennsylvania Direct Deposit Form for Payroll. If needed, contact customer support for assistance in accessing the necessary documentation.

You can get your direct deposit form by speaking with your employer or checking their employee portal. Many companies provide these forms digitally for employee convenience. Additionally, US Legal Forms offers various templates, including the Pennsylvania Direct Deposit Form for Payroll, allowing you to fill it out correctly from the comfort of your home.

To obtain a Pennsylvania Direct Deposit Form for Payroll, you can visit your employer's human resources department. They typically provide this form for employees to authorize direct deposits. Additionally, you can find a template online through platforms like US Legal Forms, where you can easily customize and download the form you need.

An ACH form and a direct deposit form are often similar, as both facilitate the automatic transfer of funds between bank accounts. However, the Pennsylvania Direct Deposit Form for Payroll specifically allows you to set up direct deposits from your employer’s payroll directly into your bank account. Always check with your employer to confirm which form they need for setup.

Yes, an employer can require direct deposit in Pennsylvania, but they must inform you of this policy beforehand. If your employer opts for this method, they usually provide the Pennsylvania Direct Deposit Form for Payroll to complete. Remember, it’s important to understand your rights and ensure that you have access to your funds promptly.

To get a voided check for direct deposit, simply take a blank check from your checking account and write 'VOID' across the front. This process ensures that the check cannot be used for any other purpose. Include this voided check along with your Pennsylvania Direct Deposit Form for Payroll to provide your banking details for deposits.

Your employer will require the Pennsylvania Direct Deposit Form for Payroll filled out by you. This form collects information like your bank account details to facilitate the direct deposit process. Ensure you provide accurate information so your payments are deposited correctly.

To obtain a direct deposit form for work, you should contact your employer's Human Resources department. They will provide you with the Pennsylvania Direct Deposit Form for Payroll, which you can fill out and submit. Alternatively, you might find this form on your employer’s internal portal or website.

To set up direct deposit, you typically do not need a specific tax form. However, you should complete the Pennsylvania Direct Deposit Form for Payroll provided by your employer. This form helps ensure that your earnings go directly to your bank account, simplifying your payroll process and making it more efficient.

You can easily obtain a Pennsylvania Direct Deposit Form for Payroll without visiting the bank by downloading it from your employer's website or a secure payroll platform like US Legal Forms. This platform offers a variety of customizable forms that you can fill out from home. After completing the form, submit it as directed by your employer’s guidelines.