Pennsylvania Installments Fixed Rate Promissory Note Secured by Personal Property

Overview of this form

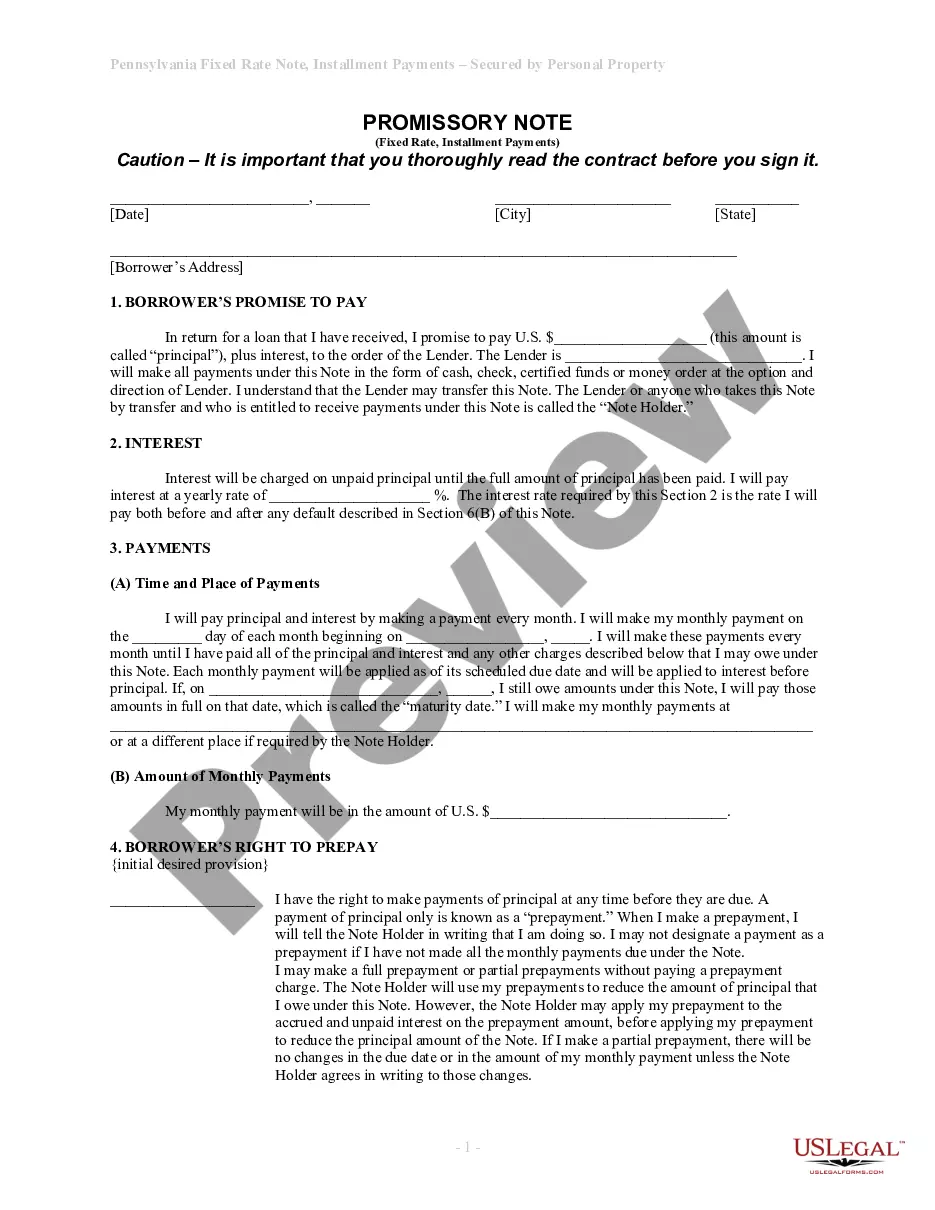

The Pennsylvania Installments Fixed Rate Promissory Note Secured by Personal Property is a legal document that establishes a borrower's promise to repay a loan with fixed interest over time. This form specifically requires a separate security agreement due to the involvement of personal property as collateral. It ensures both the lender's and borrower's rights are clearly defined, distinguishing it from unsecured promissory notes.

What’s included in this form

- Borrower's promise to pay the principal and interest to the lender.

- Specification of the interest rate applicable to the loan.

- Details regarding payment schedule, including frequency and total maturity date.

- Borrower's right to prepay the loan under certain conditions.

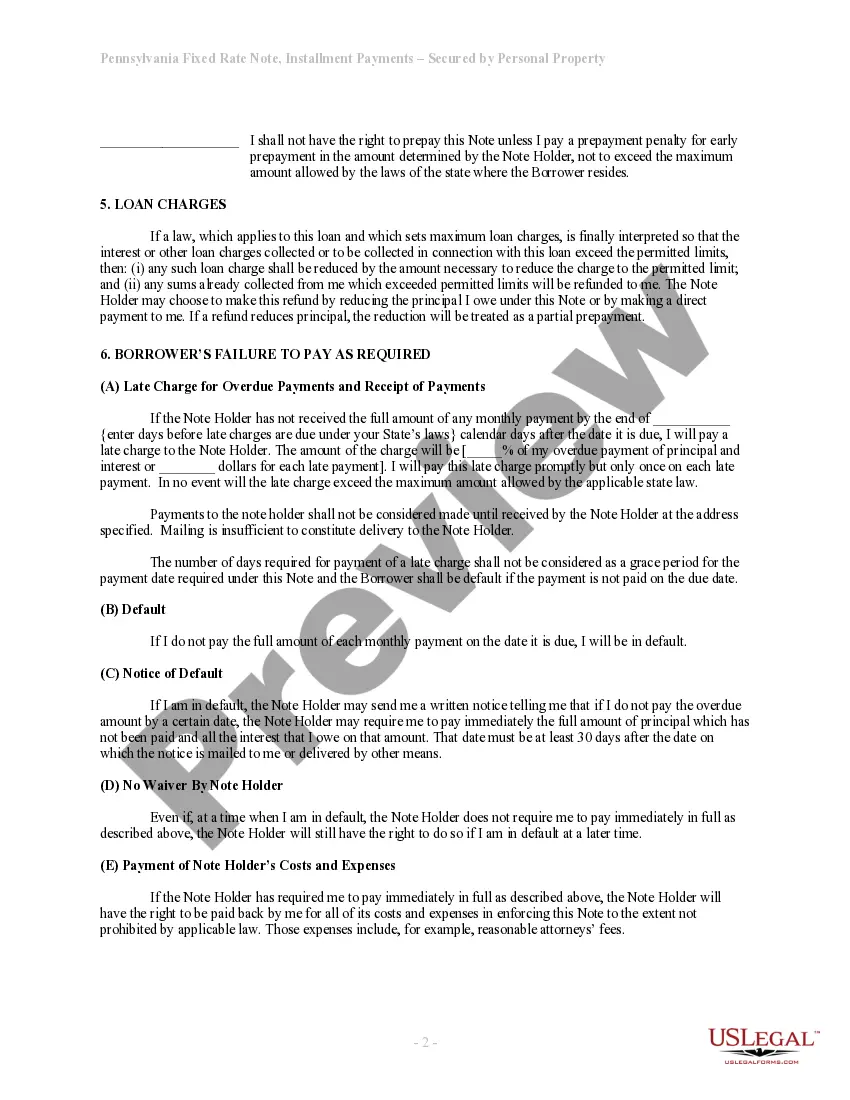

- Clauses regarding late charges and default notifications.

- Provision for the secured lien on personal property through a separate security agreement.

Situations where this form applies

This form is typically used when an individual or entity borrows money and provides personal property as collateral for the loan. It's suitable for various scenarios, including personal loans, business loans, or any situation where a lender prefers a secured loan arrangement to protect their investment.

Who can use this document

- Individuals borrowing money who want to secure the loan with personal property.

- Lenders who require written documentation of the repayment terms.

- Business owners seeking loans that require collateral to mitigate lender risk.

- Anyone needing clear terms regarding loan defaults and prepayment rights.

How to prepare this document

- Identify the parties involved by entering the names and addresses of the borrower and lender.

- Specify the principal amount being borrowed and the applicable interest rate.

- Enter the payment schedule, including the start date and the total duration of the loan.

- Describe the personal property being used as collateral in the separate security agreement.

- Review and sign the form, ensuring all parties are informed of their obligations.

Does this form need to be notarized?

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to include a separate security agreement when personal property is used as collateral.

- Not clearly stating the interest rate or payment schedule.

- Leaving key fields blank, such as the names of the parties or the loan amount.

- Ignoring to update the lender on any changes to the borrowerâs address.

- Not reviewing the prepayment conditions thoroughly.

Benefits of completing this form online

- Convenience: Easily download and fill out the form at your own pace.

- Editability: Make adjustments before printing and signing.

- Reliability: Documents are prepared by licensed attorneys to ensure legal compliance.

- Time-saving: Access and complete the form without visiting a lawyer's office.

Looking for another form?

Form popularity

FAQ

"A promissory note is enforceable through an ordinary breach of contract claim." In other words, it's not required that the loan be secured; an unsecured loan is still enforceable as long as the promissory note is fully completed. Lender and borrower information.

Unlike a mortgage or deed of trust, the promissory note isn't recorded in the county land records. The lender holds the promissory note while the loan is outstanding. When the loan is paid off, the note is marked as "paid in full" and returned to the borrower.

Although a promissory note is usually written on a computer and printed out or a pre-made form is filled out, a handwritten promissory note signed by both parties is legal and will stand up in court.

Types of Property that can be used as collateral. Speak to them in person. Draft a Demand / Notice Letter. Write and send a Follow Up Letter. Enlisting a Professional Collection Agency. Filing a petition or complaint in court. Selling the Promissory Note. Final Tips.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Promissory notes are ideal for individuals who do not qualify for traditional mortgages because they allow them to purchase a home by using the seller as the source of the loan and the purchased home as the source of the collateral.

Secured or unsecured? Generally, promissory notes are unsecured which means it is more like a formal IOU. However, lenders can request some security for the loan. For personal secured promissory notes, a house or car is often used as collateral.

To secure a promissory note means that you identify some specific property and attach it to the note. Then, if the borrower defaults on the loan, you will be able to repossess the collateral as compensation for the loan.

Examples of tangible personal property are your household goods and motor vehicles.Examples of intangible personal property are stocks, bonds, mutual funds, and securities. In addition, if a person owes you money, you may have a promissory note which describes the loan and amount of money the individual owes you.