Oregon Clauses Relating to Accounting Matters

Description

How to fill out Clauses Relating To Accounting Matters?

Choosing the right legal papers format could be a struggle. Needless to say, there are plenty of templates available on the Internet, but how would you get the legal kind you will need? Utilize the US Legal Forms internet site. The service gives thousands of templates, for example the Oregon Clauses Relating to Accounting Matters, which can be used for organization and private demands. Each of the kinds are examined by specialists and meet up with federal and state needs.

In case you are previously authorized, log in in your accounts and click on the Download switch to have the Oregon Clauses Relating to Accounting Matters. Make use of accounts to search through the legal kinds you possess ordered earlier. Proceed to the My Forms tab of your respective accounts and acquire another duplicate in the papers you will need.

In case you are a brand new end user of US Legal Forms, listed here are simple guidelines so that you can adhere to:

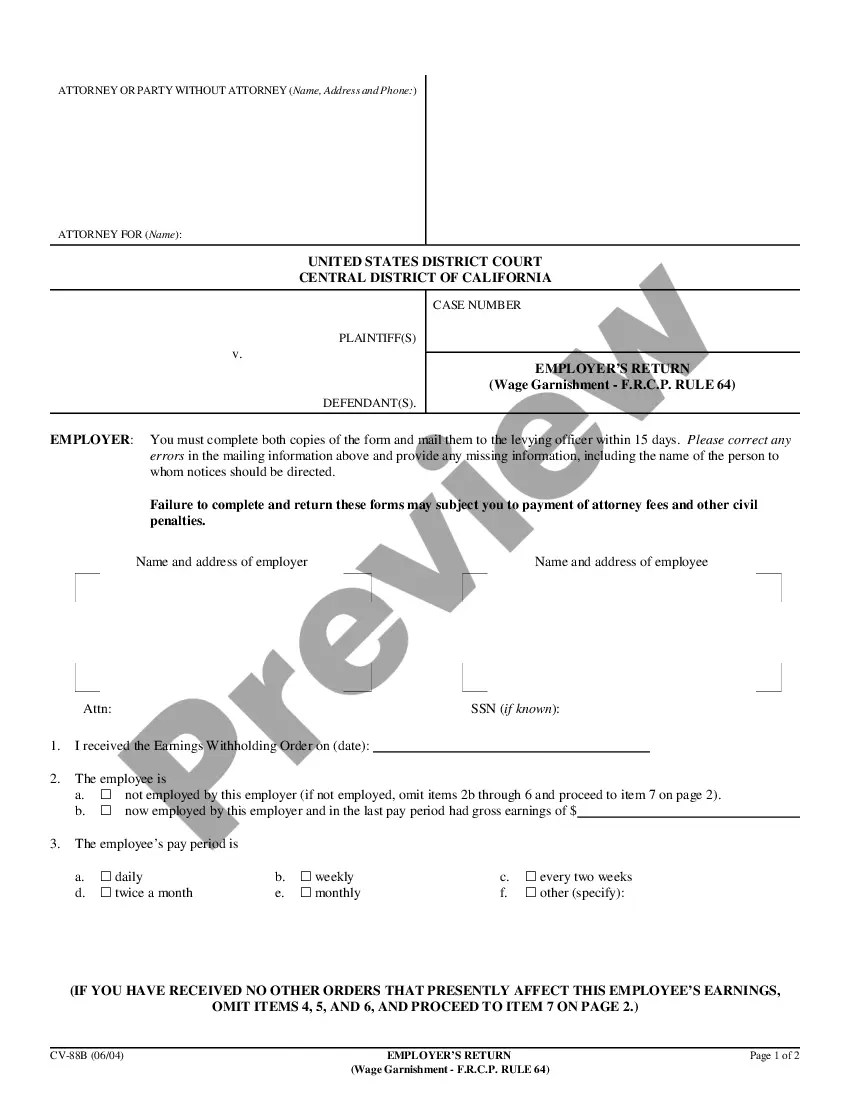

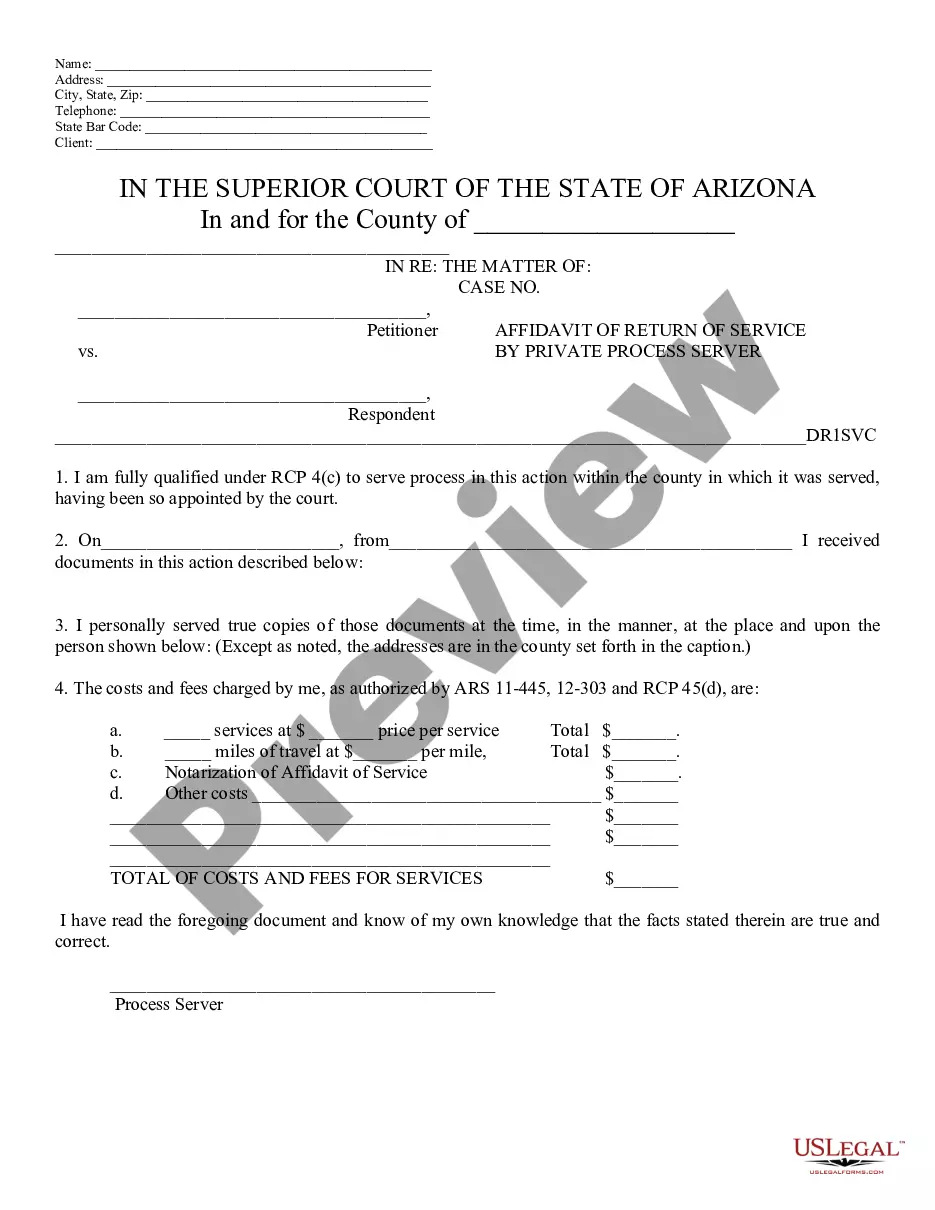

- Initially, make sure you have chosen the right kind for your metropolis/region. You may look through the shape making use of the Preview switch and study the shape explanation to guarantee it will be the best for you.

- In case the kind will not meet up with your requirements, take advantage of the Seach industry to get the appropriate kind.

- Once you are positive that the shape would work, select the Acquire now switch to have the kind.

- Opt for the costs prepare you would like and enter in the necessary information and facts. Build your accounts and buy your order utilizing your PayPal accounts or bank card.

- Choose the document structure and download the legal papers format in your product.

- Full, change and produce and sign the acquired Oregon Clauses Relating to Accounting Matters.

US Legal Forms will be the most significant local library of legal kinds where you will find different papers templates. Utilize the service to download expertly-produced papers that adhere to status needs.

Form popularity

FAQ

If the client owns the QuickBook software, then all QuickBooks electronic records belong to the client. This situation may occur when a client pays for software that is maintained in the CPAs office. If the CPA owns the QuickBooks software, then the Board considers the electronic records to be the CPAs working papers.

An accountant is a person whose job involves keeping financial records for a business.

If the client owns the QuickBook software, then all QuickBooks electronic records belong to the client. This situation may occur when a client pays for software that is maintained in the CPAs office. If the CPA owns the QuickBooks software, then the Board considers the electronic records to be the CPAs working papers.

The directors of every company and the members of every LLP are required by law to prepare accounts for each financial year, being full statutory annual accounts, and a company tax return.

If you are having problems with a Licensed Tax Consultant or Tax Preparer, you should contact the Board of Tax Practitioners at (503) 378-4034. Most CPAs and PAs sincerely try to do all they can on behalf of their clients.

However, ?records of the client? do not include any return, claim for refund, schedule, affidavit, appraisal, or any other document prepared by the practitioner or the firm pending the client's fulfillment of a contractual obligation of fee payments.

Italian roots. But the father of modern accounting is Italian Luca Pacioli, who in 1494 first described the system of double-entry bookkeeping used by Venetian merchants in his Summa de Arithmetica, Geometria, Proportioni et Proportionalita.

?A person is deemed to be engaged in the practice of public accounting, if (1) he holds himself out to the public as one skilled in the knowledge, science and practice of accounting and as qualified to render professional services as a certified public accountant; or (2) he offers and/or renders to more than one client ...