Oregon Assignment of Overriding Royalty Interest (No Proportionate Reduction)

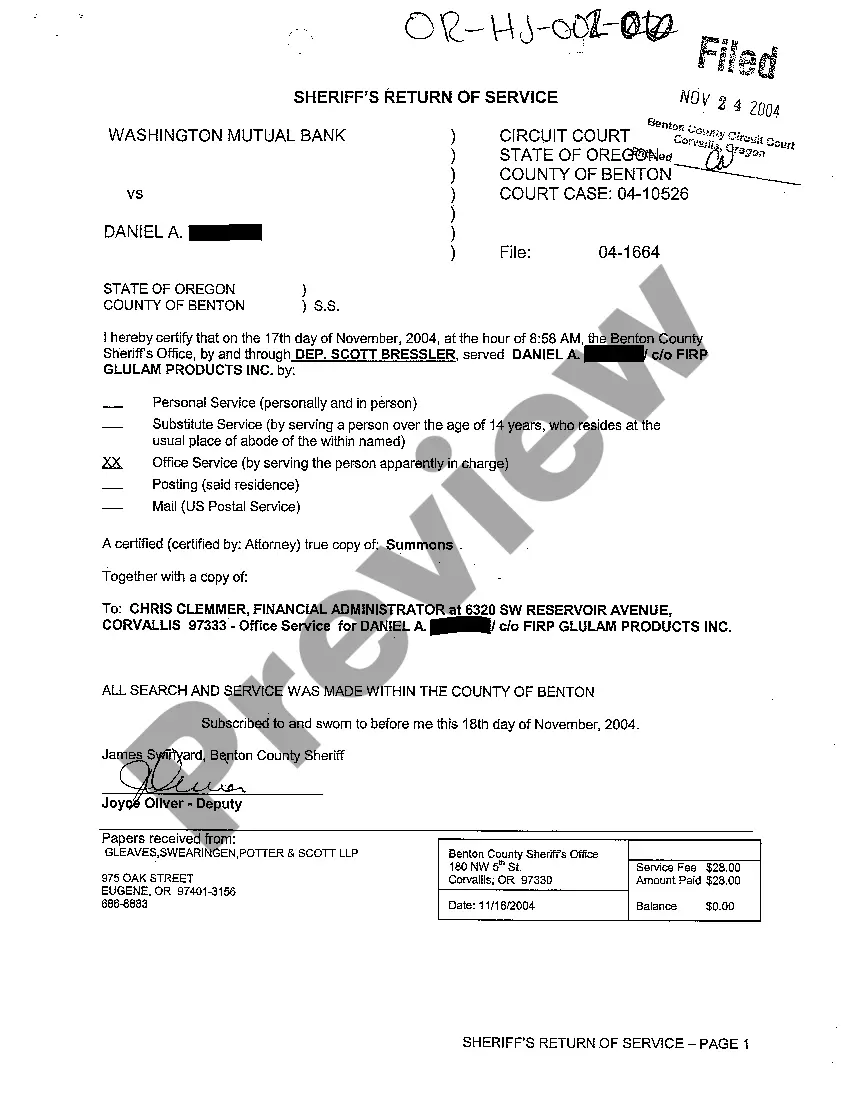

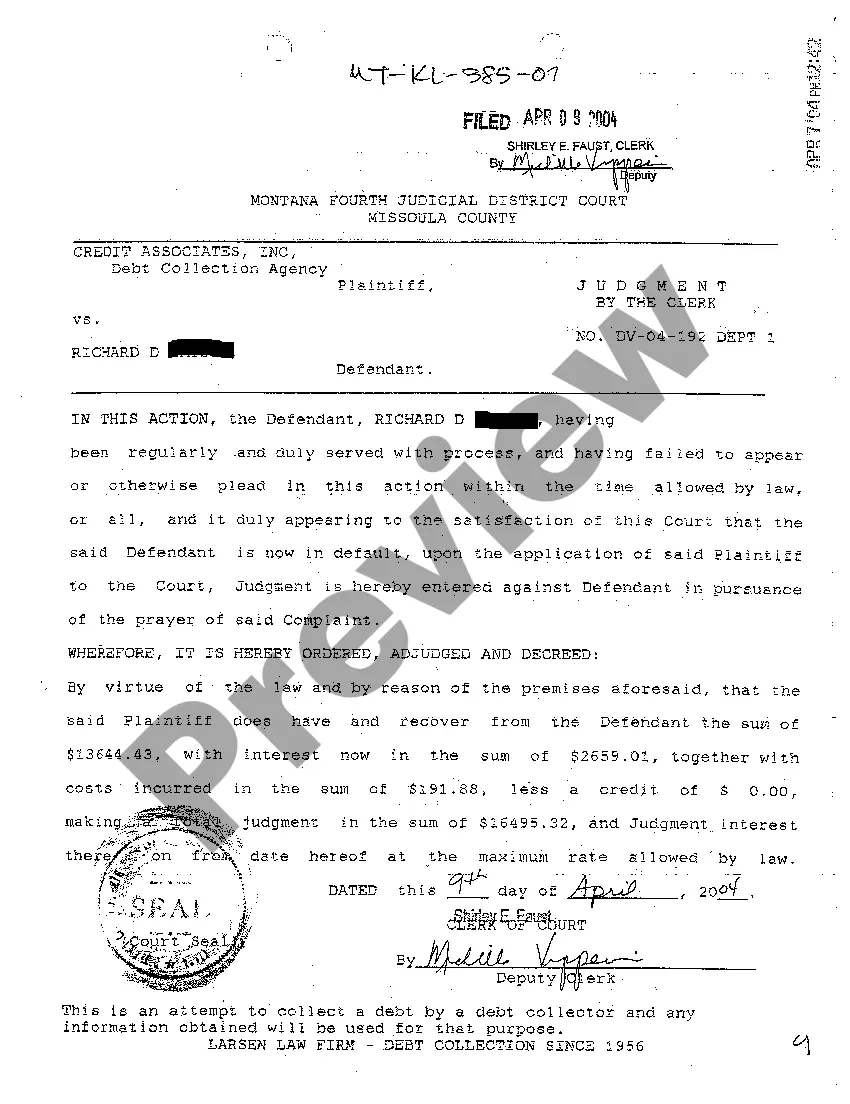

Description

How to fill out Assignment Of Overriding Royalty Interest (No Proportionate Reduction)?

If you wish to total, download, or print out legal record themes, use US Legal Forms, the most important collection of legal kinds, which can be found on the web. Use the site`s simple and practical search to obtain the papers you require. Numerous themes for organization and personal uses are sorted by categories and says, or keywords and phrases. Use US Legal Forms to obtain the Oregon Assignment of Overriding Royalty Interest (No Proportionate Reduction) within a number of click throughs.

In case you are currently a US Legal Forms client, log in in your account and click on the Obtain switch to obtain the Oregon Assignment of Overriding Royalty Interest (No Proportionate Reduction). You can also access kinds you in the past delivered electronically in the My Forms tab of your respective account.

If you are using US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Ensure you have selected the shape for that appropriate city/region.

- Step 2. Take advantage of the Review method to check out the form`s articles. Do not forget about to read the information.

- Step 3. In case you are unhappy with the develop, take advantage of the Search discipline towards the top of the screen to get other variations of the legal develop format.

- Step 4. Upon having located the shape you require, click the Purchase now switch. Select the pricing strategy you prefer and add your credentials to register for the account.

- Step 5. Approach the purchase. You can use your charge card or PayPal account to finish the purchase.

- Step 6. Find the file format of the legal develop and download it on the product.

- Step 7. Total, revise and print out or sign the Oregon Assignment of Overriding Royalty Interest (No Proportionate Reduction).

Every legal record format you acquire is your own property eternally. You have acces to every develop you delivered electronically in your acccount. Go through the My Forms portion and pick a develop to print out or download yet again.

Remain competitive and download, and print out the Oregon Assignment of Overriding Royalty Interest (No Proportionate Reduction) with US Legal Forms. There are millions of skilled and condition-certain kinds you can use for the organization or personal needs.

Form popularity

FAQ

in clause (or shutin royalty clause) traditionally allows the lessee to maintain the lease by making shutin payments on a well capable of producing oil or gas in paying quantities where the oil or gas cannot be marketed, whether due to a lack of pipeline connection or otherwise.

A clause in an oil & gas lease that provides that if the leased land is later owned by separate parties, such as in a sale of part of the property, the lessee can continue to operate, develop, and treat the lease as a whole and pay royalties to each owner based on its percentage of ownership of the entire area.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

The owner of a royalty interest receives a portion of the income generated from oil and gas production. Unlike an ORRI, a royalty-interest owner does not have the right to execute leases or collect bonus payments. The RI owner does not bear any operating costs or expenses related to the well.

A proportionate-reduction clause, also known as a lesser-interest clause in the oil and gas industry, is a provision in a lease agreement that allows the lessee to reduce payments if the lessor owns less than 100% of the mineral interest.

A proportionate-reduction clause, also known as a lesser-interest clause, is a provision in an oil-and-gas lease that allows the lessee to reduce payments proportionately if the lessor owns less than 100% of the mineral interest.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

What is the granting clause? The granting clause is the clause under which the owner of the oil and gas rights leases the oil and gas rights to the oil and gas company along with the right to develop the oil and gas on a specifically described piece of real estate.