Oregon Release of Judgment Lien - Full Release

Description

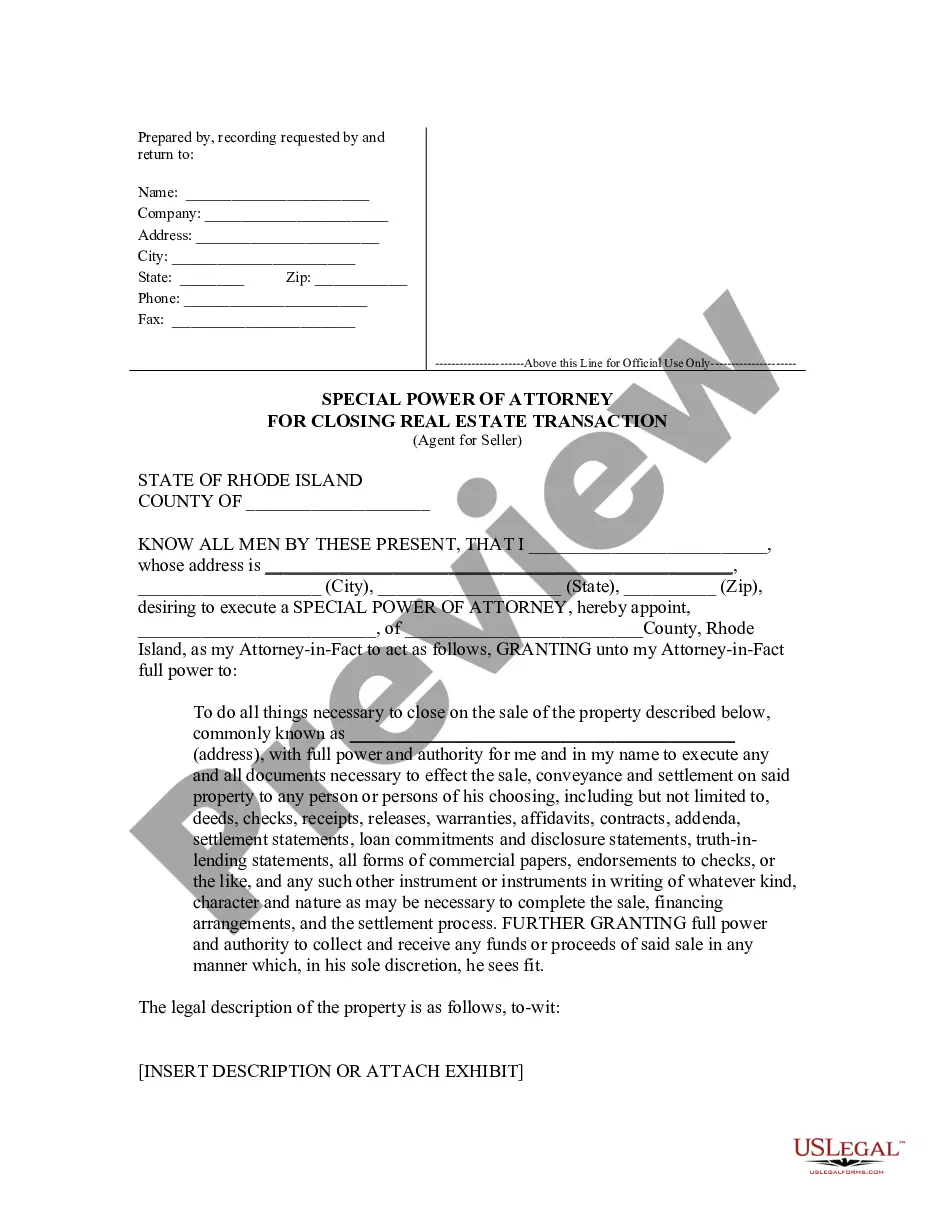

How to fill out Release Of Judgment Lien - Full Release?

If you wish to full, down load, or printing lawful document themes, use US Legal Forms, the most important selection of lawful forms, that can be found on the web. Take advantage of the site`s simple and practical look for to find the files you will need. Different themes for enterprise and specific uses are categorized by classes and suggests, or search phrases. Use US Legal Forms to find the Oregon Release of Judgment Lien - Full Release in just a number of clicks.

In case you are currently a US Legal Forms customer, log in for your bank account and click on the Acquire key to obtain the Oregon Release of Judgment Lien - Full Release. You can even accessibility forms you previously delivered electronically in the My Forms tab of the bank account.

If you are using US Legal Forms initially, refer to the instructions under:

- Step 1. Be sure you have selected the shape for the appropriate town/country.

- Step 2. Use the Review option to examine the form`s content material. Don`t neglect to learn the information.

- Step 3. In case you are not happy with all the type, make use of the Research field towards the top of the screen to discover other models of the lawful type web template.

- Step 4. Upon having discovered the shape you will need, go through the Get now key. Select the pricing program you favor and include your credentials to register on an bank account.

- Step 5. Procedure the deal. You can utilize your bank card or PayPal bank account to perform the deal.

- Step 6. Choose the file format of the lawful type and down load it in your gadget.

- Step 7. Complete, modify and printing or indication the Oregon Release of Judgment Lien - Full Release.

Every single lawful document web template you buy is yours permanently. You have acces to each type you delivered electronically within your acccount. Click on the My Forms portion and select a type to printing or down load once more.

Be competitive and down load, and printing the Oregon Release of Judgment Lien - Full Release with US Legal Forms. There are many professional and express-certain forms you can utilize for the enterprise or specific demands.

Form popularity

FAQ

Ten years The lien is effective against real property owned or acquired by the defendant for ten years and may be renewed for an additional ten year period. ORS 18.360. -2- (3) and (4) Payment of Judgment. SATISFACTION OF JUDGMENTS - Oregon Secretary of State Oregon.gov ? oard ? displayDivisionR... Oregon.gov ? oard ? displayDivisionR...

To garnish the wages of a debtor: Complete and file a ?Praecipe? form with the court. This form is available from the Trial Court Administrator's office. 2. Obtain the writ of garnishment forms and complete the necessary information.

If you have received a judgment and the defendant refuses to pay it, you may be able to have his or her wages or bank account garnished. The court does not provide garnishment forms. The forms may be purchased at a store that sells legal forms.

You must hire a levying officer (a registered process server or a sheriff's deputy) to collect your judgment. You cannot serve the Writ yourself. Look at the information you have about your debtor's assets. Then tell the levying officer about the assets and where they are.

Once you have received payment from the customer, you must complete and file an Oregon satisfaction of lien form to release a mechanic's lien in Oregon (also known as a construction lien). Oregon Lien Releases: How to Cancel a Lien in OR northwestlienservice.com ? blog ? oregon-lien-rel... northwestlienservice.com ? blog ? oregon-lien-rel...

The judge's decision is final. Once you receive your notice that the judgment was entered, you must send the defendant a written demand for payment. This letter must be sent by certified mail, return receipt requested. The Oregon Judicial Department does not provide forms for demand letters. SMALL CLAIMS INSTRUCTIONS FOR PLAINTIFFS oregon.gov ? forms ? SC-INSTR-plntf oregon.gov ? forms ? SC-INSTR-plntf

In Oregon, the deadline is six years for a mortgage, medical or credit card debt, auto loans, and other contract debts. Unfortunately, state tax debt doesn't have a statute of limitation. Note that the statute of limitations doesn't start when you were last billed but starts with your last payment on your debt.

ORCP 71B(1) allows the court to relieve a party from a judgment or order for mistake, inadvertence, surprise or excusable neglect; fraud, misrepresentation, or other misconduct of an adverse party when accompanied by a pleading containing an assertion of a defense. Motion and Order to Set Aside Judgment Forms and Instructions oregon.gov ? lane ? Documents ? [P... oregon.gov ? lane ? Documents ? [P...