Oregon Storage Services Contract - Self-Employed

Description

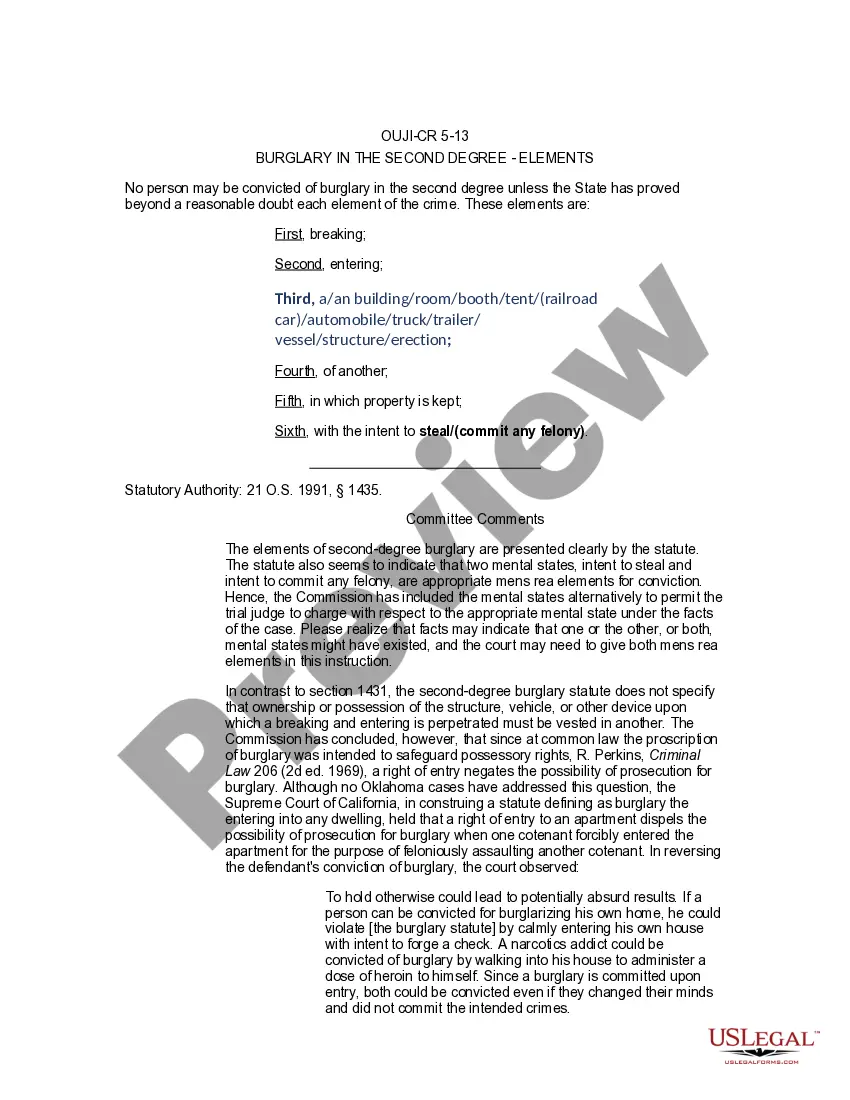

How to fill out Storage Services Contract - Self-Employed?

Selecting the finest legal document template can be a challenge. Of course, there are numerous templates available online, but how do you find the legal form you require? Utilize the US Legal Forms website. This service offers thousands of templates, including the Oregon Storage Services Contract - Self-Employed, which can be utilized for business and personal purposes. All forms are verified by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to access the Oregon Storage Services Contract - Self-Employed. Use your account to browse through the legal forms you have previously purchased. Visit the My documents tab in your account to obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are some simple steps you should follow: First, ensure you have selected the correct form for your city/state. You can review the form using the Review button and examine the form details to confirm it is the right one for you. If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are sure the form is correct, click the Purchase now button to obtain the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and pay for your order using your PayPal account or credit card. Select the document format and download the legal document template to your device. Fill out, edit, print, and sign the acquired Oregon Storage Services Contract - Self-Employed.

Take advantage of this service to ensure you have the necessary legal documentation at your fingertips.

- US Legal Forms is the largest repository of legal forms where you can find a variety of document templates.

- Utilize the service to obtain well-crafted paperwork that adheres to state requirements.

- Ensure accuracy in your selection to avoid any legal issues.

- The platform is user-friendly and designed to assist you in your legal documentation needs.

- Access to a wide range of legal templates can save you time and effort.

- Professional verification guarantees that the forms are compliant with legal standards.

Form popularity

FAQ

To write a storage contract, start by including essential details like the names of both parties, storage unit location, and rental terms. Clearly state the payment amount, due dates, and any additional fees in your Oregon Storage Services Contract - Self-Employed. Incorporate clauses addressing liability, access rights, and termination conditions. Utilizing platforms like uslegalforms can simplify this process by providing templates tailored for your specific needs.

Storage unit contracts outline the terms of rental agreements between the storage facility and the renter. When you sign an Oregon Storage Services Contract - Self-Employed, you agree to specific conditions, such as payment terms, duration of rental, and responsibilities for damages. Understanding these elements helps ensure a smooth rental experience. Always read the contract carefully to avoid any surprises.

Yes, labor laws do apply in various ways to 1099 independent workers in Oregon. While these workers have greater flexibility, they also must adhere to specific regulations regarding wages, workplace safety, and taxation. If you are using an Oregon Storage Services Contract - Self-Employed, it's essential to stay informed about these laws to maintain compliance in your business practices.

While Oregon does not legally require an operating agreement for an LLC, having one is highly beneficial. An operating agreement outlines the structure and management of your business, providing clarity on roles and responsibilities. For those using an Oregon Storage Services Contract - Self-Employed, having this agreement can offer extra protection and ensure smooth operations.

The self-storage law in Oregon governs how storage facilities operate and protect the rights of both owners and renters. It outlines the processes for rental agreements, access to items, and what happens in case of non-payment. If you're working as a self-employed individual utilizing an Oregon Storage Services Contract, understanding these laws can help you navigate your responsibilities effectively.

In Oregon, specific thresholds exist for contractors before requiring a license. Typically, you can perform up to $1,000 worth of work in a year without needing a contractor license. However, if you plan to operate under an Oregon Storage Services Contract - Self-Employed and exceed that threshold, obtaining a license becomes essential to protect your business and comply with state laws.

In Oregon, an independent contractor is someone who provides services under a contract, not classified as an employee. Key qualifications include having control over how the work is performed, offering services to multiple clients, and not being subject to the employer's direction. To benefit fully from an Oregon Storage Services Contract - Self-Employed, one must differentiate themselves as an independent contractor rather than an employee, ensuring compliance with local regulations.

The self-employment tax deduction in Oregon allows self-employed individuals to deduct half of their self-employment taxes from their income when filing. This can significantly lower your overall tax bill and improve your financial standing as an independent contractor. It’s advisable to consult a tax professional to understand how this deduction can benefit you. Always relate this deduction back to your Oregon Storage Services Contract - Self-Employed for comprehensive financial planning.

A storage unit in Oregon is typically considered abandoned after the renter fails to make payments for three months, and the facility has attempted to contact them. After this period, the facility may proceed to auction the contents of the unit. Being aware of this timeline can help you manage your storage contracts effectively. Your Oregon Storage Services Contract - Self-Employed should outline these conditions clearly.

The 3-year rule in Oregon generally refers to the time limit for enforcing certain legal claims, including those related to contracts. If a contract has not been activated within this period, it may become unenforceable. It's important to know this when negotiating your Oregon Storage Services Contract - Self-Employed to safeguard your interests.