Oregon Metal Works Services Contract - Self-Employed

Description

How to fill out Metal Works Services Contract - Self-Employed?

US Legal Forms - one of the most important collections of legal documents in the United States - provides a range of legal form templates that you can download or print. By using the site, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the most recent versions of forms such as the Oregon Metal Works Services Contract - Self-Employed in just a few minutes. If you already have a subscription, Log In and download the Oregon Metal Works Services Contract - Self-Employed from the US Legal Forms library. The Download option will appear on every form you view. You can access all previously saved forms in the My documents section of your account.

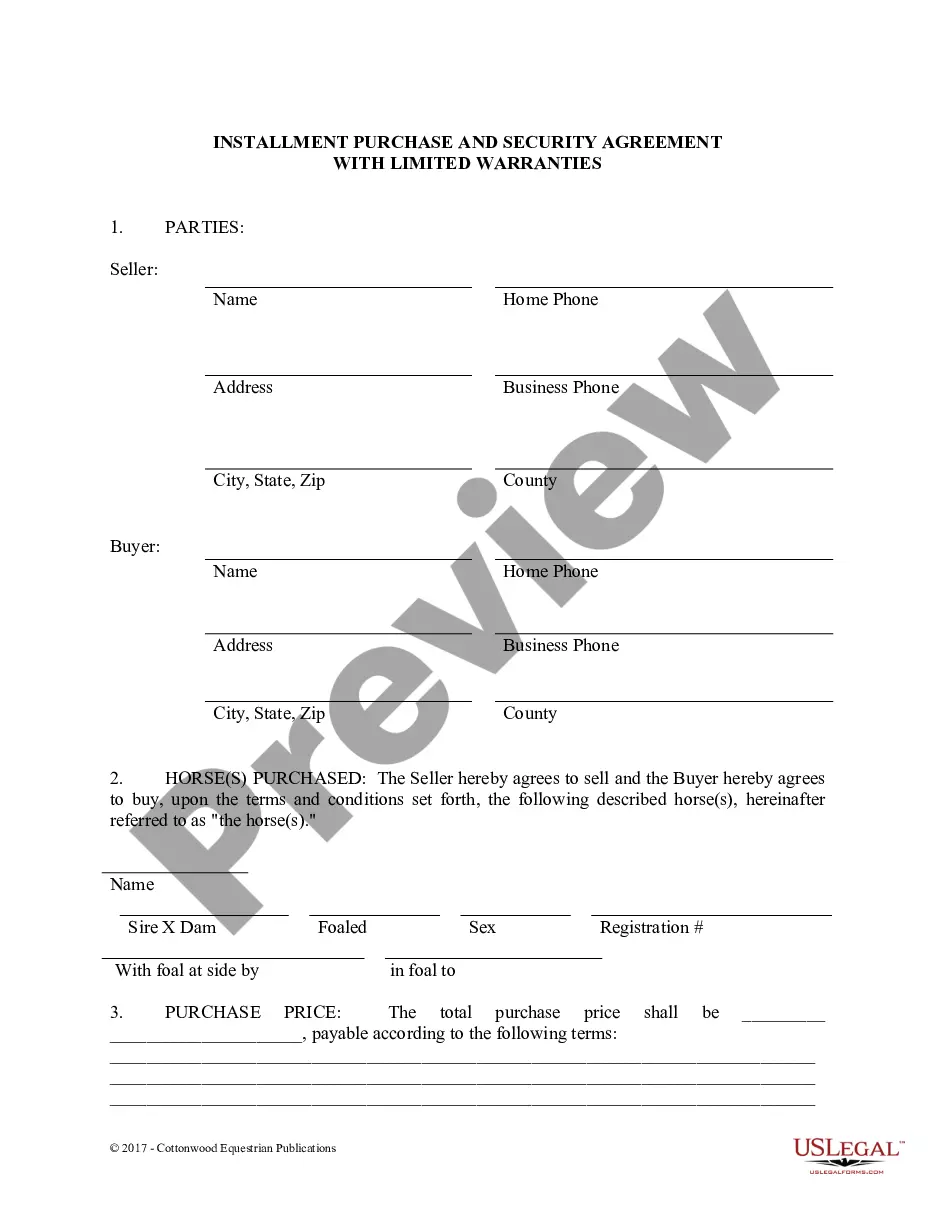

If you are using US Legal Forms for the first time, here are simple steps to get started: Ensure you have selected the correct form for your region/county. Click on the Preview button to review the form's details. Check the form description to confirm that you have picked the right form. If the form doesn’t meet your needs, use the Search box at the top of the screen to find one that does. Once you are satisfied with the form, confirm your choice by clicking on the Buy now button. Then, select the pricing plan you prefer and provide your credentials to register for the account. Process the payment. Use your credit card or PayPal account to complete the transaction. Choose the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the saved Oregon Metal Works Services Contract - Self-Employed. Every template you added to your account does not have an expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents area and click on the form you want.

- Access the Oregon Metal Works Services Contract - Self-Employed with US Legal Forms, the largest collection of legal document templates.

- Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements.

Form popularity

FAQ

To set yourself up as an independent contractor, start by clearly defining your services and target audience. Next, create a business plan that outlines your goals and financial projections. It's important to formalize your client relationships with written agreements, such as an Oregon Metal Works Services Contract - Self-Employed, to protect both parties’ interests. Finally, ensure you comply with local regulations and tax requirements to operate smoothly.

Setting yourself up as a contractor involves several key steps. First, register your business name and obtain an EIN from the IRS for tax purposes. Then, you should open a separate bank account for your business transactions to keep your finances organized. Utilizing an Oregon Metal Works Services Contract - Self-Employed can also ensure your agreements with clients are formal and legally binding.

To be an independent contractor, you need to comply with specific legal requirements. First, you should establish your business structure, which could be a sole proprietorship or an LLC. Next, you need to obtain any necessary permits or licenses relevant to your work. Finally, you must have a clear understanding of how to draft and use an Oregon Metal Works Services Contract - Self-Employed, which outlines the terms of your services.

The new federal rule regarding independent contractors focuses on clarifying their classification and rights. This impacts workers under the Oregon Metal Works Services Contract - Self-Employed by setting specific criteria for determining if a worker is an independent contractor or an employee. Knowing these guidelines protects you and helps ensure proper classification in your contracts. USLegalForms provides resources that can keep you informed about these changes and support your independent contractor journey.

Yes, labor laws do apply to 1099 independent workers in Oregon, but it varies by the nature of the work and the contractual agreement. Under the Oregon Metal Works Services Contract - Self-Employed, you might not have the same protections as employees, but certain health and safety regulations still apply. Understanding these nuances is crucial for maintaining compliance and ensuring fair treatment. Consider exploring USLegalForms for expert guidance on your rights and obligations.

Yes, you can be a self-employed contractor in Oregon under the Oregon Metal Works Services Contract - Self-Employed. This arrangement allows you to operate your own business while providing services to clients. As a self-employed contractor, you establish your own rates, choose your projects, and maintain control over your work schedule. It is essential to understand the responsibilities you assume, including managing taxes and adhering to any licensing requirements.

Whether you need a business license as an independent contractor in Oregon depends on your specific services. For an Oregon Metal Works Services Contract - Self-Employed, it is usually wise to acquire a license to comply with local laws and enhance credibility. Some trades require licensing, while others may not. Consult local authorities for detailed guidance based on your business activities.

Setting up as a self-employed contractor involves several steps, starting with choosing a business structure and registering it if necessary. For an Oregon Metal Works Services Contract - Self-Employed, ensure you have the right permits and licenses. Create a detailed business plan, establish a dedicated workspace, and choose reliable accounting methods. Platforms like US Legal Forms can help simplify the process with necessary legal documents.

To qualify as an independent contractor in Oregon, you must adhere to specific criteria set by the IRS and state laws. This includes having control over how and when you complete your work. For an Oregon Metal Works Services Contract - Self-Employed, focus on showcasing your expertise, tools, and ability to manage your projects independently. Maintaining clear documentation of your work helps cement your status.

While not always mandatory, registering your business as an independent contractor can offer significant advantages. An Oregon Metal Works Services Contract - Self-Employed typically benefits from having a registered business for liability protection. Additionally, registration can enhance trust with clients and provide access to better business resources. It's a good step to establish yourself professionally.