Oregon Real Property - Schedule A - Form 6A - Post 2005

Description

How to fill out Real Property - Schedule A - Form 6A - Post 2005?

Discovering the right legitimate document template might be a struggle. Of course, there are plenty of web templates available on the Internet, but how would you find the legitimate kind you need? Take advantage of the US Legal Forms web site. The support provides thousands of web templates, like the Oregon Real Property - Schedule A - Form 6A - Post 2005, that can be used for business and private needs. All the varieties are checked by pros and meet up with federal and state specifications.

Should you be presently listed, log in for your accounts and click the Download switch to find the Oregon Real Property - Schedule A - Form 6A - Post 2005. Make use of accounts to look from the legitimate varieties you have acquired earlier. Check out the My Forms tab of your own accounts and obtain one more duplicate in the document you need.

Should you be a fresh end user of US Legal Forms, listed here are basic directions that you can comply with:

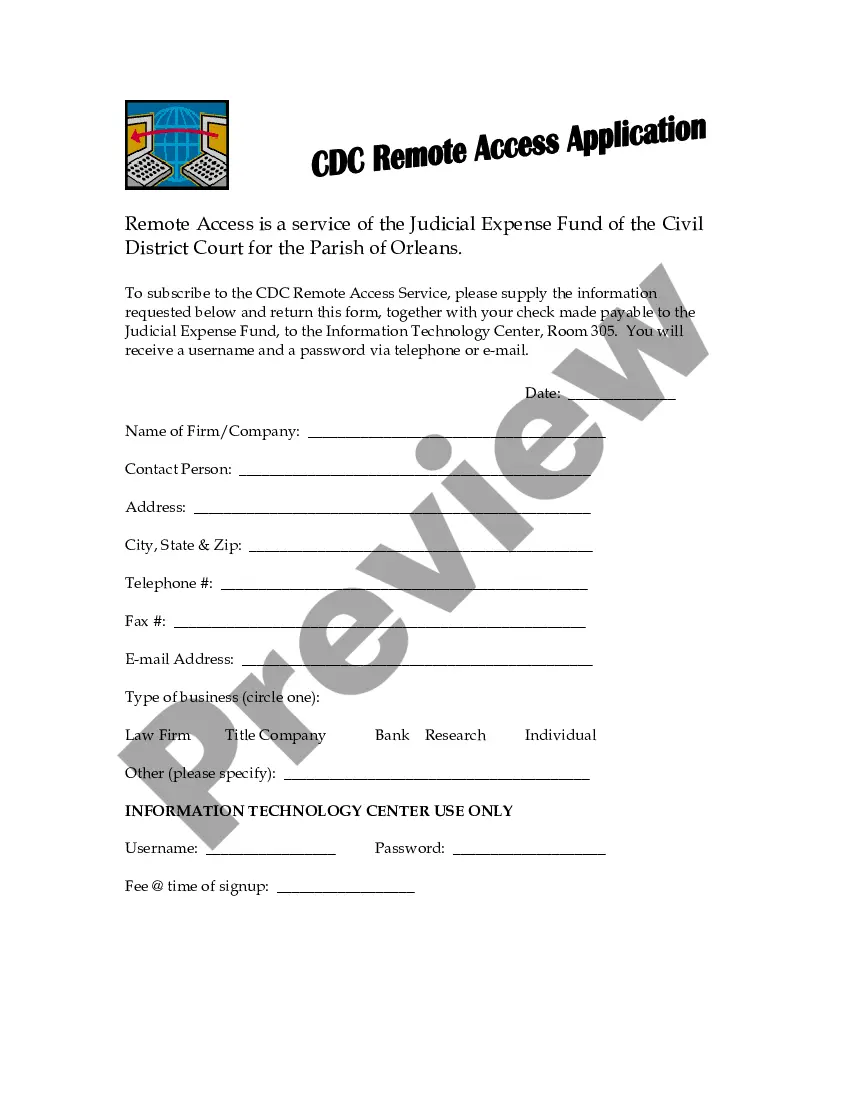

- First, make sure you have selected the right kind for your personal city/region. You are able to examine the shape utilizing the Preview switch and read the shape outline to make certain this is basically the best for you.

- When the kind does not meet up with your expectations, make use of the Seach field to find the appropriate kind.

- When you are certain the shape is suitable, go through the Buy now switch to find the kind.

- Opt for the prices prepare you would like and type in the needed details. Make your accounts and buy the transaction utilizing your PayPal accounts or charge card.

- Opt for the document format and obtain the legitimate document template for your system.

- Total, edit and print and sign the acquired Oregon Real Property - Schedule A - Form 6A - Post 2005.

US Legal Forms will be the largest collection of legitimate varieties for which you can discover numerous document web templates. Take advantage of the service to obtain professionally-made documents that comply with condition specifications.

Form popularity

FAQ

The Oregon basis for depreciation is generally the lower of the federal unadjusted basis or the fair market value. The federal unadjusted basis is the original cost before any adjustments. Adjustments include: reductions for investment tax credits, depletion, amortization, or amounts expensed under IRC Section 179.

Does Oregon require an addback of federal bonus depreciationdeductions? No, Oregon does not require an addback of federal bonus depreciation deductions. Oregon adopts Internal Revenue Code (IRC) Sec. 168(k) by reference without modification for corporate excise (income) tax purposes.

The Oregon basis for depreciation is generally the lower of the federal unadjusted basis or the fair market value. The federal unadjusted basis is the original cost before any adjustments. Adjustments include: reductions for investment tax credits, depletion, amortization, or amounts expensed under IRC Section 179.