Oregon Resolution of Meeting of LLC Members to Borrow Capital from Member

Description

How to fill out Resolution Of Meeting Of LLC Members To Borrow Capital From Member?

Are you currently in a role where you require documents for both professional or personal purposes almost every day.

There are numerous authentic document templates available online, but finding reliable ones can be challenging.

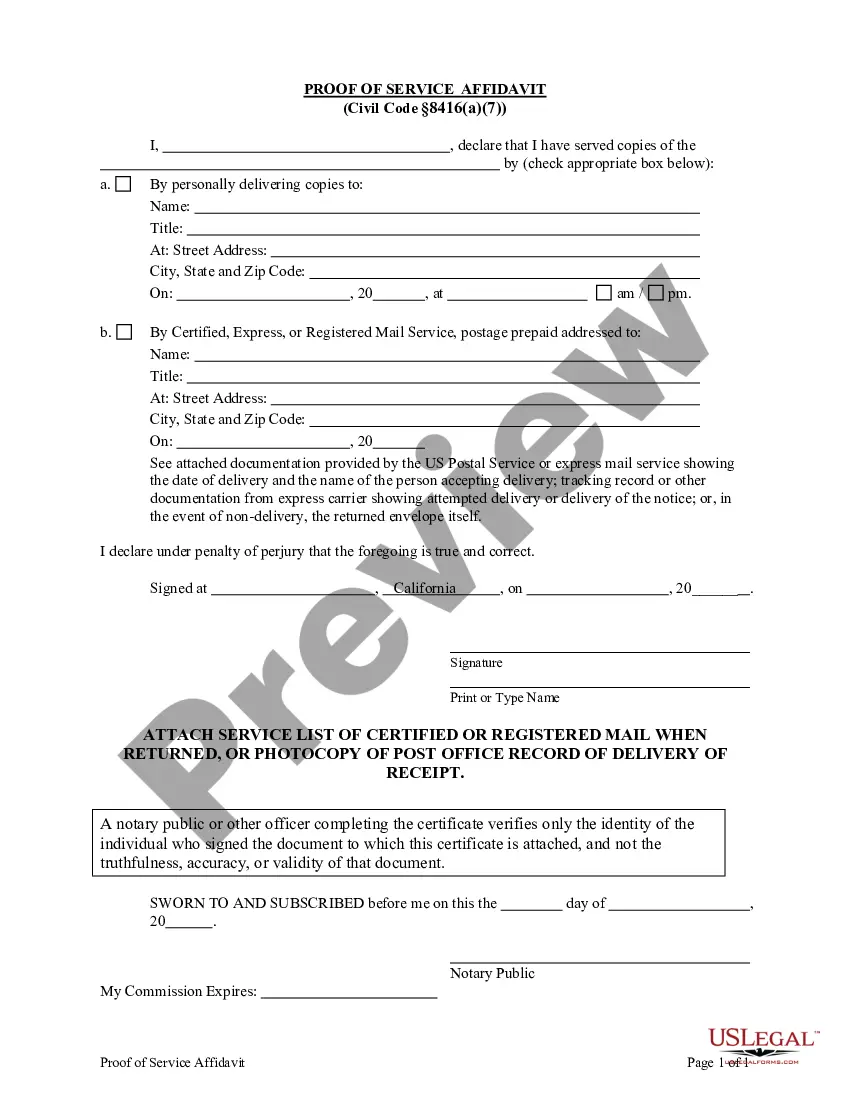

US Legal Forms offers a vast collection of form templates, such as the Oregon Resolution of Meeting of LLC Members to Borrow Capital from Member, which are designed to comply with federal and state requirements.

Once you find the right form, click on Purchase now.

Select the pricing plan you prefer, complete the necessary details to create your account, and pay for the transaction using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Oregon Resolution of Meeting of LLC Members to Borrow Capital from Member template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/county.

- Use the Preview button to review the document.

- Check the information to confirm that you have selected the appropriate form.

- If the form isn’t what you are looking for, use the Search box to find the form that fits your requirements.

Form popularity

FAQ

An LLC resolution is a document describing an action taken by the managers or owners of a company, with a statement regarding the issue that needs to be voted on. This does not need to be a complicated document, and need only include necessary information.

You can't simply gift an interest in profits. If the LLC were to distribute its assets, the LLC operating agreement must provide for the donee to receive a share of the assets on dissolution or if the donee withdraws from the LLC. If the donor provides services to the LLC, she must be reasonably compensated.

LLCs do not have shareholders. They have members who share in the profits of the business. The members' share of the profits is taxable as income. The company itself has no tax liability.

LLC authorization to sign is generally assigned to a managing member who has the authority to sign binding documents on behalf of the LLC. When signing, the managing member must clarify if the signature is as an individual or in their capacity to sign as the representative of the LLC.

An LLC resolution is a written record of important decisions made by members that describes an action taken by the company and confirms that members were informed about it and agreed to it.

Documents Of Resolution (DOR) Documents of Resolution (DORs) are the first tools that establish action plans and time frames, developed by the examiner, to induce and monitor compliance by the credit union officials. They are a step beyond remedial recommendations in the Findings section of an examination report.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

The articles of organization is an operating agreement stating the procedure for voting on an LLC's resolutions. Usually, a majority vote is required for passing a resolution. However, it is permissible to have other voting percentages.

An LLC member resolution is the written record of a member vote authorizing a specific business action. Formal resolutions aren't necessary for small, everyday decisions. However, they're useful for granting authority to members to transact significant business actions, such as taking out a loan on behalf of the LLC.

Such processes can be laid out in a corporate resolution form, usually known as the operating agreement. The agreement can also specify whether or not the decision-making is to be agreed upon by all members or a majority of members.