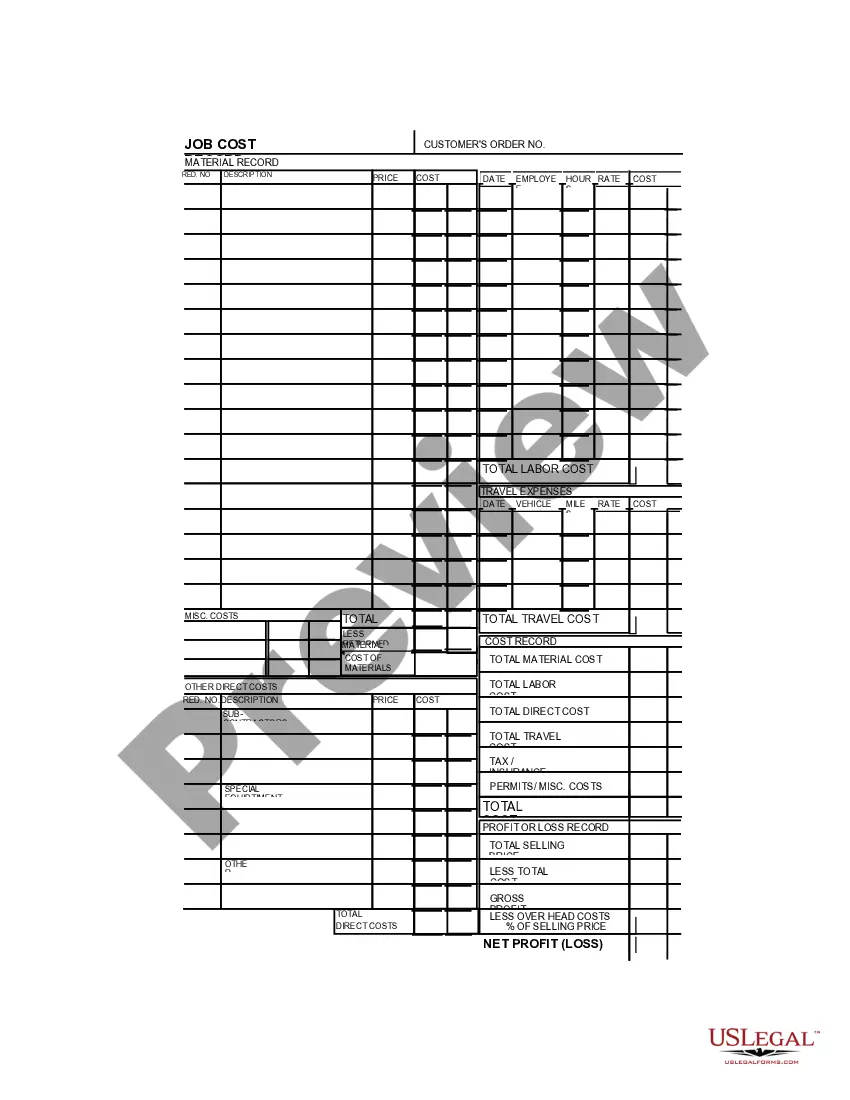

Oregon Job Invoice - Long

Description

How to fill out Job Invoice - Long?

If you wish to finalize, procure, or create legal document templates, utilize US Legal Forms, the largest assembly of legal forms available online.

Employ the site’s straightforward and user-friendly search feature to locate the documents you require.

Numerous templates for business and personal purposes are organized by category and state, or keywords.

Step 4. Once you have found the form you wish to use, click the Buy now button. Select your desired pricing plan and enter your information to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the payment.

- Use US Legal Forms to acquire the Oregon Job Invoice - Long in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Purchase button to obtain the Oregon Job Invoice - Long.

- You also have access to forms you previously downloaded in the My documents tab of your account.

- If you are utilizing US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the form’s content. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the page to find alternative versions in the legal form template.

Form popularity

FAQ

It might surprise many companies that unpaid invoices, under a simple contract, can be legitimately chased for up to 6 years. Legal proceedings would need to be issued within 6 years of the date of the invoice to prevent any claim from being statute barred.

How long does a company have to invoice you for services? Invoices should be issued within a duration of 30 days after a company uses your services. Ideally, invoices must be issued as soon as the product is delivered, or the service is completed.

If no agreed-upon payment date has been established, a customer must pay a company within 30 days of receiving an invoice or the goods or service. A company can use a statutory demand to formally request payment for due payments.

Unless you agree a payment date, the customer must pay you within 30 days of getting your invoice or the goods or service.

The general rule is 30 days from the invoice date. However, you can discuss this with your customer and either make it shorter or longer than 30 days. Regardless of what you agree upon, the payment terms and the due date should be clearly stated on the invoice.

6 Years. This is the statute of limitation for invoices. The time frames will vary as per where you reside, but basically, it's usually six years. After six years, and you have not made any payment on the invoice at this time, then you are not obligated to pay the invoice.

Many businesses provide 30-day payment terms (also referred to as net 30), but there are other payment terms you can use if preferred, including 7-day, 14-day, 45-day, 60-day, or 90-day terms.

Usually, it is between three and six years, but it can be as high as 10 or 15 years in some states. Before you respond to a debt collection, find out the debt statute of limitations for your state. If the statute of limitations has passed, there may be less incentive for you to pay the debt.

The specific time limit to send an invoice depends on your jurisdiction and the terms of the deal. In the UK, for instance, you can pursue debt within six years after it has occurred. In the US, the statute of limitation sets a two years time period for oral contracts and four years for written ones.

How long should you wait for an invoice to be paid? As a business owner, you can set your payment terms, and the most common are either 30 days, 60 days, or 90 days.