Oregon Domestic Partnership Dependent Certification Form

Description

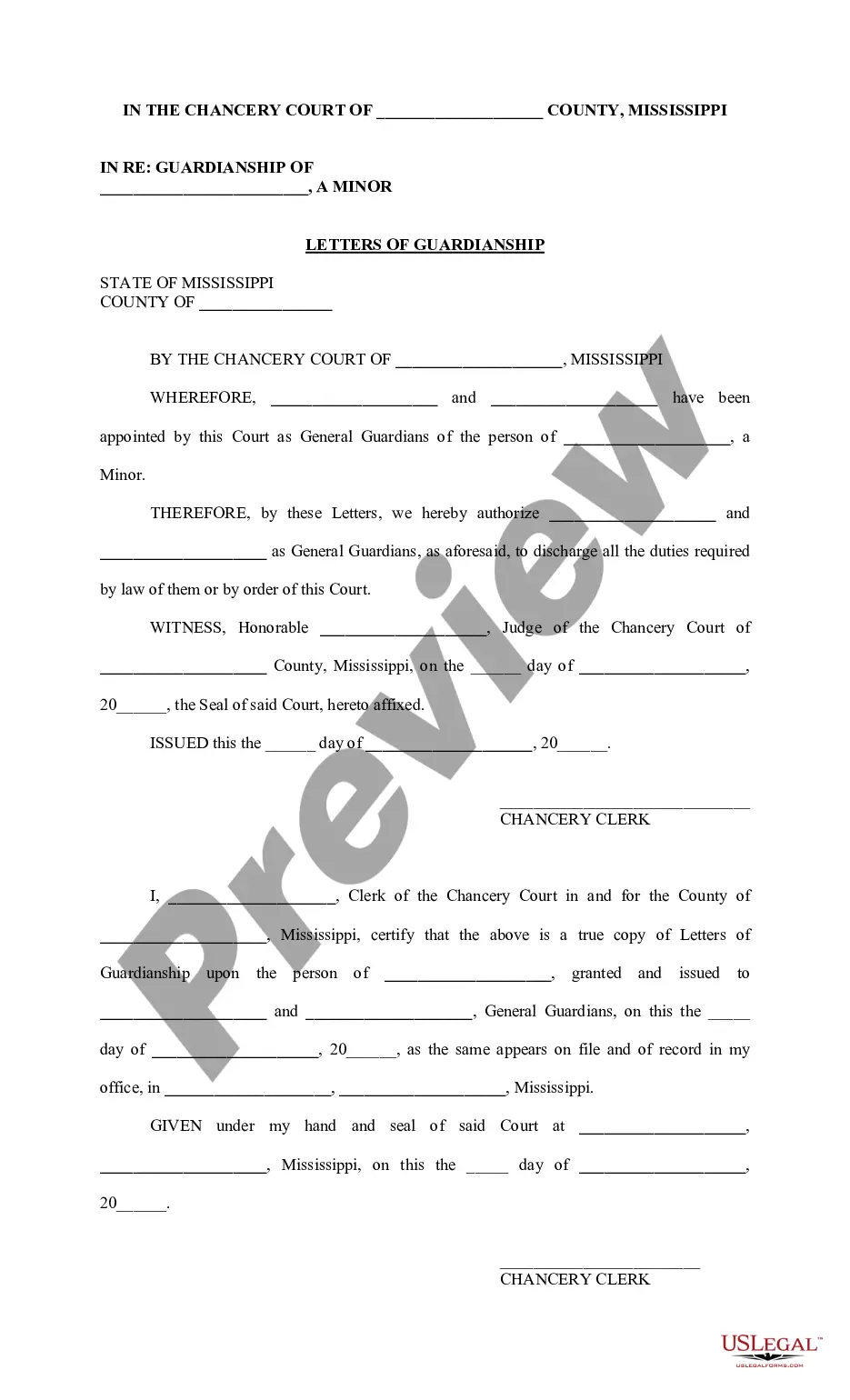

How to fill out Domestic Partnership Dependent Certification Form?

You might spend hours online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers a vast array of legal forms that are reviewed by professionals.

You can download or print the Oregon Domestic Partnership Dependent Certification Form from our service.

If available, utilize the Review button to look through the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Oregon Domestic Partnership Dependent Certification Form.

- Every legal document template you obtain is yours permanently.

- To retrieve another copy of an acquired form, navigate to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your chosen area/town.

- Read the form description to confirm you have chosen the right form.

Form popularity

FAQ

You must meet these requirements to register your domestic partnership with the State of Oregon: Are a same-sex couple. At least 18 years of age. One of the parties must be a resident of Oregon.

To cover a domestic partner, members pay the same premium share for core benefits and the same premiums for optional benefits as they would in covering a spouse. This is also true of coverage for a domestic partner's eligible children.

Can my domestic partner claim me as a dependent? Yes, your domestic partner can claim you as a dependent on their tax return under qualifying relative rules for determining dependency status. Dependents don't necessarily need to be related to be claimed on tax returns.

Requirements and Conditions One registrant must be an Oregon resident. There is no waiting period. The Domestic Partnership form must be signed by both parties, and must have signatures notarized. Please be advised that there is no notary available in the County Clerk's office.

The state of Oregon recognizes unregistered domestic partnerships of heterosexual or homosexual couples. This is when the partnership includes shared assets, income, or debts during the relationship. Registered domestic partnerships also exist in Oregon.

A registered domestic partnership is "a civil contract entered into between two individuals of the same sex who are at least 18 years of age, who are otherwise capable and at least one of whom is a resident of Oregon." Oregon doesn't recognize civil unions or domestic partnerships certified in other states.

A straight couple cannot get a registered domestic partnership as defined by Oregon law. Under state law, a domestic partnership is a civil contract between individuals of the same sex who are at least eighteen years old and capable of contract.

You must meet these requirements to register your domestic partnership with the State of Oregon:Are a same-sex couple.At least 18 years of age.One of the parties must be a resident of Oregon.Are not married or registered as the domestic partner of another person in any jurisdiction.More items...

A registered domestic partnership is "a civil contract entered into between two individuals of the same sex who are at least 18 years of age, who are otherwise capable and at least one of whom is a resident of Oregon." Oregon doesn't recognize civil unions or domestic partnerships certified in other states.