Oregon Certification of Seller

Description

How to fill out Certification Of Seller?

Finding the appropriate legitimate document template can be quite a challenge.

Of course, there are numerous templates accessible online, but how can you obtain the correct type you require.

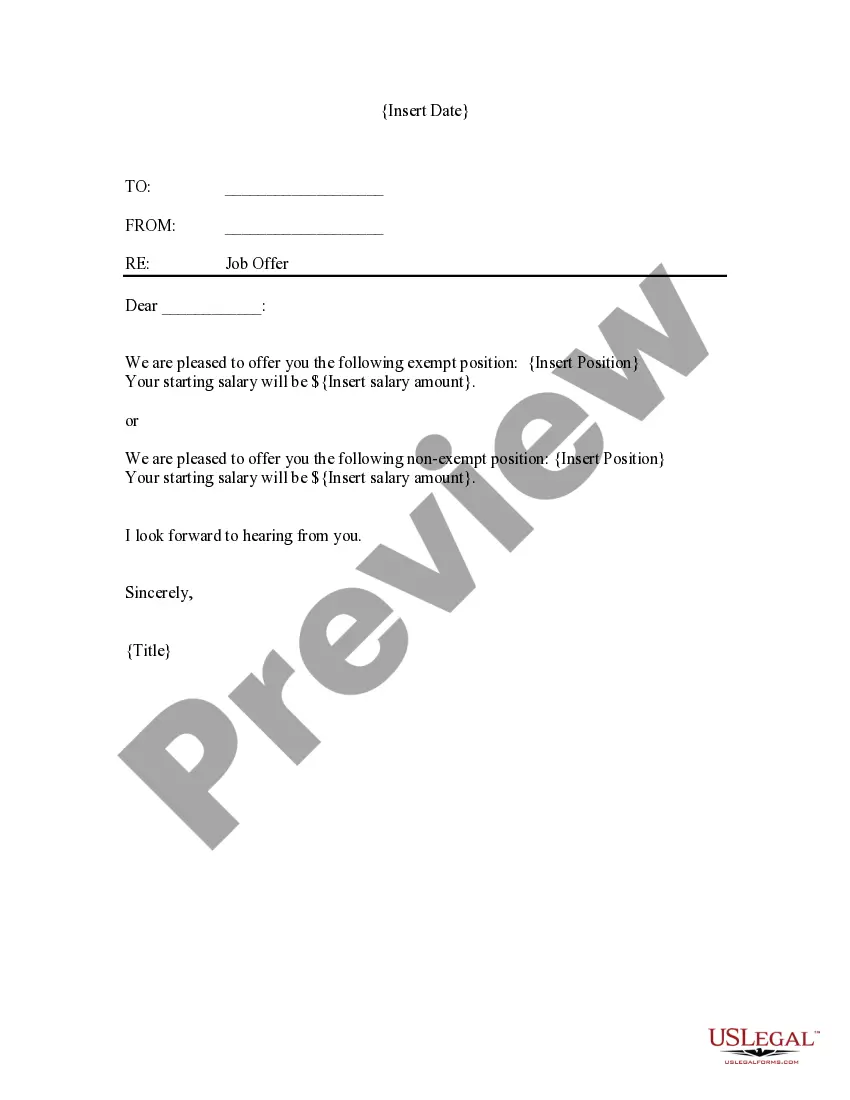

Utilize the US Legal Forms website. The service offers thousands of templates, including the Oregon Certification of Seller, suitable for business and personal requirements.

You may browse the form using the Review button and read the form details to confirm this is indeed the right one for you.

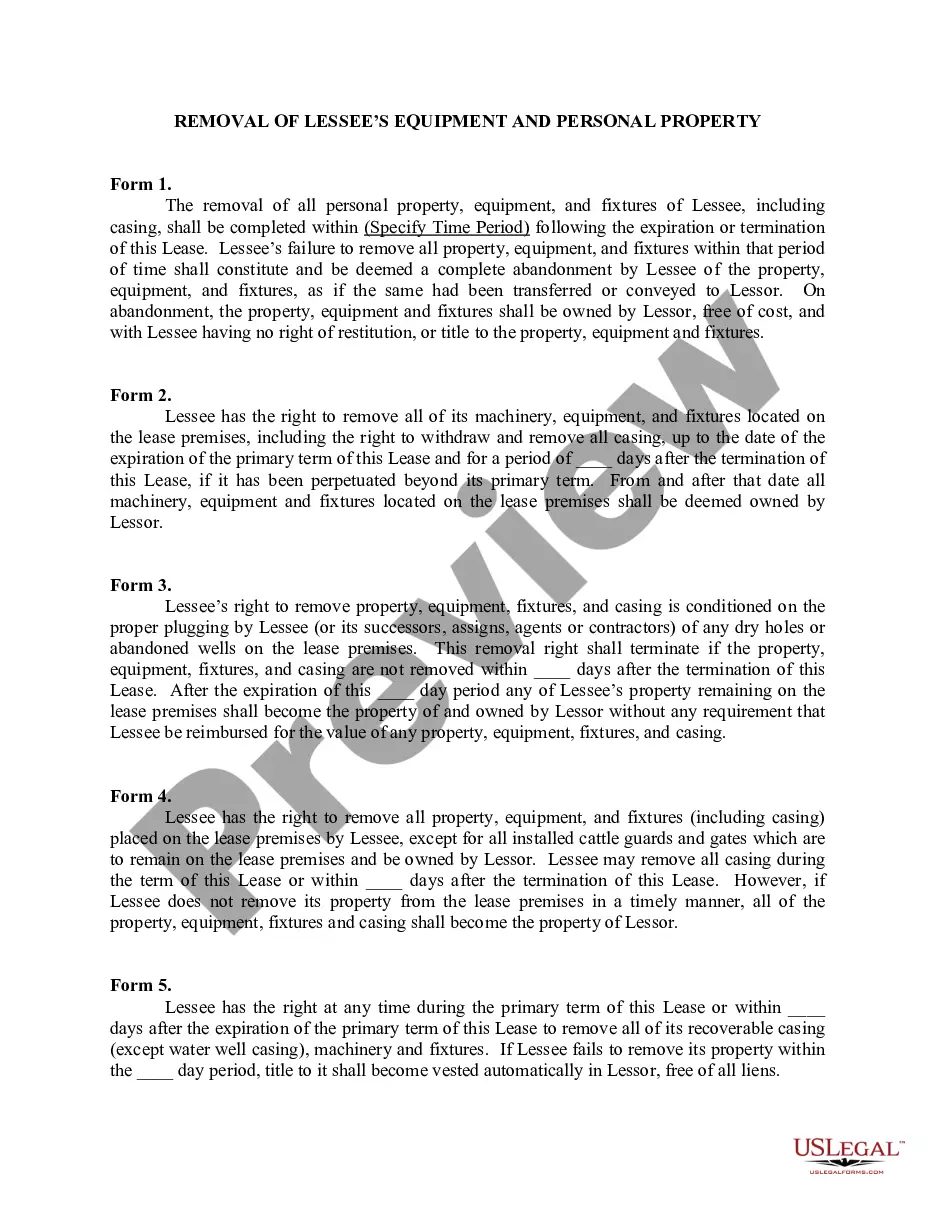

- All of the forms are assessed by experts and comply with state and federal regulations.

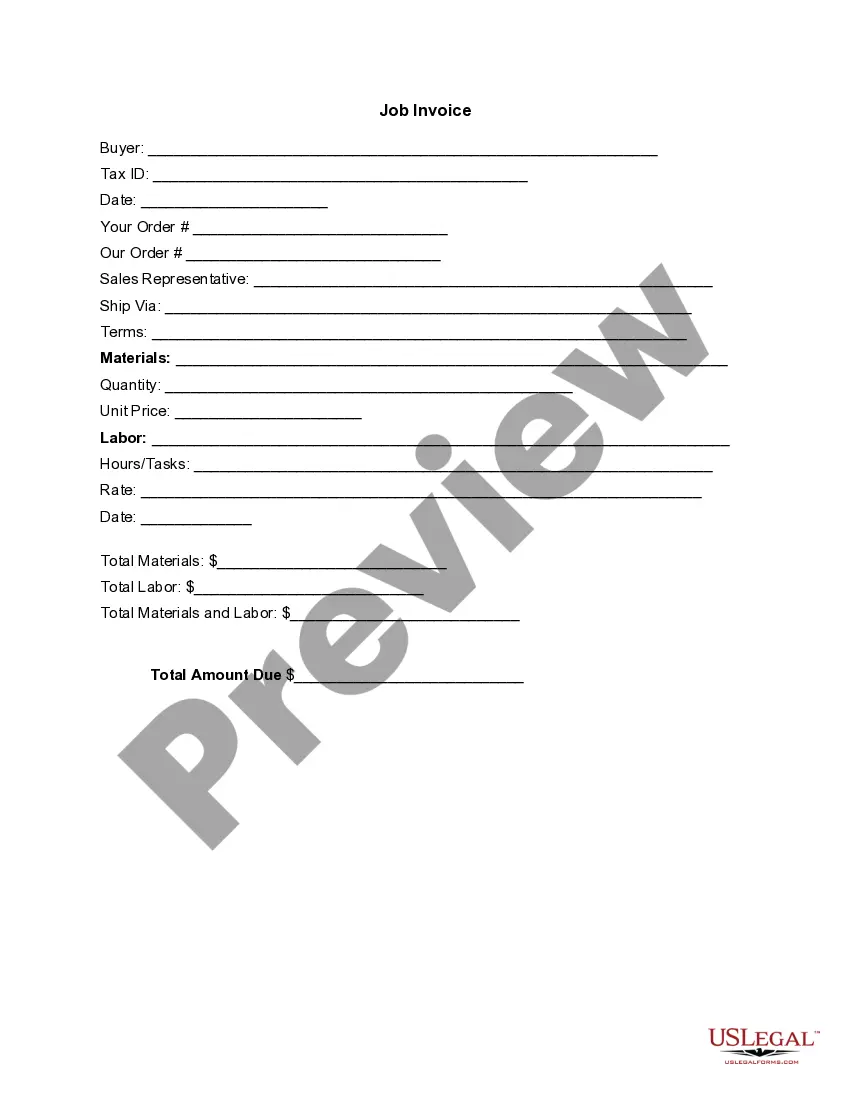

- If you are currently registered, Log In to your account and click the Acquire button to locate the Oregon Certification of Seller.

- Use your account to browse the legal forms you have previously purchased.

- Visit the My documents tab of your account and retrieve another copy of the document you need.

- If you are a new client of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the appropriate form for the city/area.

Form popularity

FAQ

How Much Is A Sellers Permit In Oregon? If you would like to file the form online, you can do so on the Oregon Secretary of State's website or you can mail it to the Corporation Division of the State. Fees for filing are $50 per person.

Oregon uses the Oregon Business Registry Resale Certificate for Oregon buyers who buy goods outside of the state and then resell them in Oregon.

State of Oregon Business Licensing Oregon does not have a standard state business license, and because there is no state sales tax, there is also no Oregon seller's permit. Businesses in certain professions may be required to have specific licenses or permits.

Most businesses operating in or selling in the state of Oregon are required to purchase a resale certificate annually. Even online based businesses shipping products to Oregon residents must collect sales tax. Obtaining your sales tax certificate allows you to do so.

An Oregon buyer who purchases goods outside Oregon for resale in the ordinary course of business may provide this certificate to an out-of-state seller of property as evidence that the buyer is registered to do business in Oregon.

An Oregon Sellers Permit can only be obtained through an authorized government agency. Depending on the type of business, where you're doing business and other specific regulations that may apply, there may be multiple government agencies that you must contact in order to get an Oregon Sellers Permit.

You can apply for a resale certificate through your state's tax department. Be sure to apply to the state tax department in the state you physically have an addressnot the state in which you are incorporated, if it's different.

Sales/use taxes Oregon doesn't have sales or use taxes and doesn't issue exemption certificates. If you need an exemption from paying sales tax in another state, contact the Secretary of State's Corporation Division.