Oregon Agreement to Dissolve and Wind up Partnership with Sale to Partner along with Warranties and Indemnification

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner Along With Warranties And Indemnification?

Are you currently in the location where you require paperwork for both business or personal purposes nearly every day.

There are numerous legal document templates accessible online, but locating ones you can trust is not easy.

US Legal Forms provides a vast array of form templates, such as the Oregon Agreement to Dissolve and Wind up Partnership with Sale to Partner along with Warranties and Indemnification, designed to comply with federal and state regulations.

Select the pricing plan you prefer, fill in the necessary information to create your account, and complete the purchase using your PayPal or credit card.

Choose a suitable document format and download your copy.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- Then, you can download the Oregon Agreement to Dissolve and Wind up Partnership with Sale to Partner along with Warranties and Indemnification template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your specific area/state.

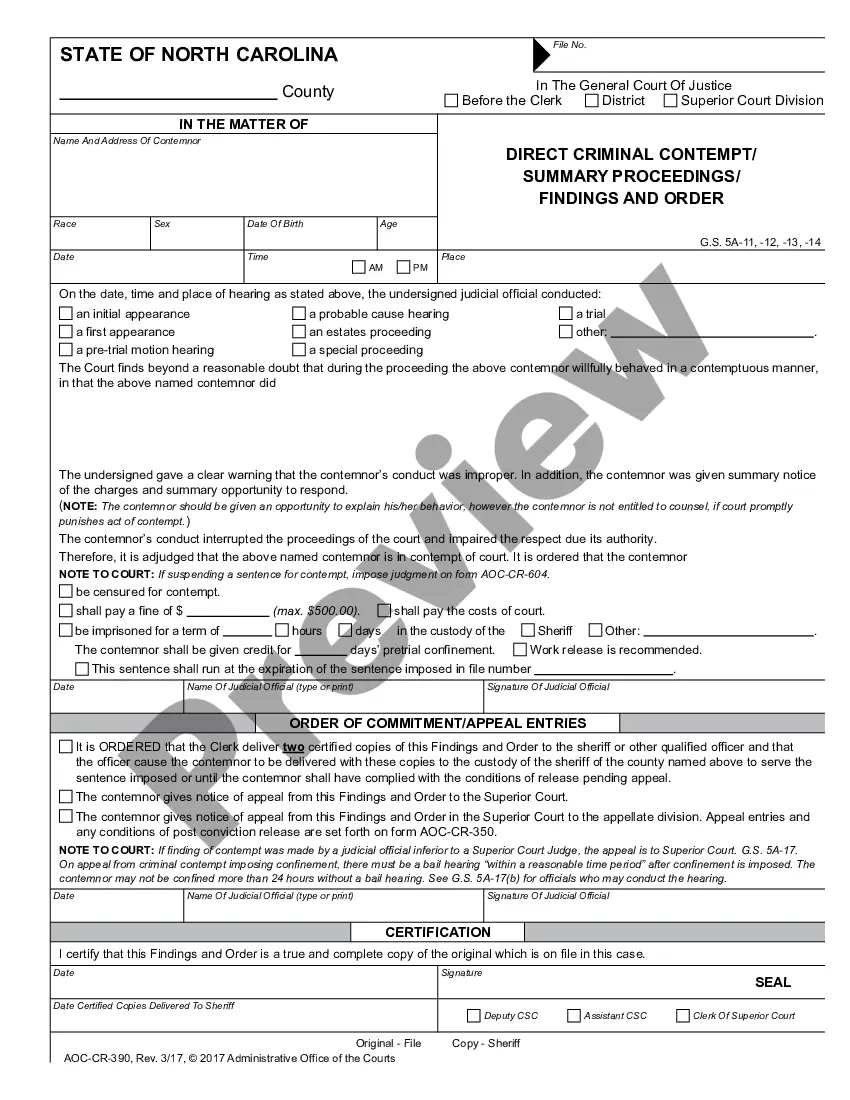

- Use the Review button to evaluate the form.

- Check the summary to ensure you have selected the correct form.

- If the form is not what you are looking for, utilize the Search field to find the form that meets your needs and requirements.

- Once you find the correct form, click Buy now.

Form popularity

FAQ

While a partner might wish to dissolve the partnership at any moment, it is crucial to adhere to the guidelines established in the partnership agreement. The Oregon Agreement to Dissolve and Wind up Partnership with Sale to Partner along with Warranties and Indemnification outlines specific conditions and procedures to follow for dissolution. Acting without understanding these procedures can result in unwanted legal ramifications. It is wise to consult with a legal expert before taking any action.

Winding up a partnership firm requires several important steps to ensure compliance with the law. The process can involve settling debts, liquidating assets, and distributing the remaining assets among partners. The Oregon Agreement to Dissolve and Wind up Partnership with Sale to Partner along with Warranties and Indemnification provides a roadmap for these steps, helping to streamline the winding-up process. Legal resources, such as uslegalforms, can help simplify this complex procedure.

Yes, a partner can initiate the dissolution of a partnership, but it must be done following the stipulations outlined in the partnership agreement. The Oregon Agreement to Dissolve and Wind up Partnership with Sale to Partner along with Warranties and Indemnification serves as a crucial document in this process. It details the requirements for dissolution and conditions for the sale of partnership interests. Proper execution of this process can safeguard the interests of all partners.

If one partner wishes to leave, it is essential to refer to your partnership agreement and the Oregon Agreement to Dissolve and Wind up Partnership with Sale to Partner along with Warranties and Indemnification. This document provides clarity on how to handle the situation, including any financial settlements or buyout procedures. Open communication between partners can facilitate a smoother transition. Seeking legal assistance may also help in navigating the complexities involved.

Walking away from a partnership without proper procedure can lead to significant legal complications. The Oregon Agreement to Dissolve and Wind up Partnership with Sale to Partner along with Warranties and Indemnification outlines the necessary steps to ensure a smooth transition. It is advisable to follow these guidelines to protect yourself legally and financially. Consulting with professionals can provide additional guidance.

To terminate a partnership agreement, partners should refer to the terms outlined in their initial contract. They can then draft the Oregon Agreement to Dissolve and Wind up Partnership with Sale to Partner along with Warranties and Indemnification to formalize the termination. This agreement protects all parties involved by detailing each partner’s responsibilities and any indemnifications necessary. Utilizing platforms like uslegalforms can simplify the drafting process and ensure compliance with legal standards.

Winding up a partnership involves settling all business affairs before dissolving it. First, the partners must execute the Oregon Agreement to Dissolve and Wind up Partnership with Sale to Partner along with Warranties and Indemnification. This document outlines how assets and liabilities will be handled, ensuring all obligations are met. It's essential to communicate with all partners during this process to ensure a smooth transition.

To write a letter to end a partnership, clearly state your intention to terminate the partnership in the opening sentence. Include details such as the partnership’s name and the proposed effective date. Additionally, mention the Oregon Agreement to Dissolve and Wind up Partnership with Sale to Partner along with Warranties and Indemnification to outline the next steps for handling financial obligations and asset division. Clearly communicate your desire for a smooth conclusion.

Removing a partner from a partnership agreement typically requires negotiation and mutual consent. Start by discussing your concerns with the partner in question. If they agree, the Oregon Agreement to Dissolve and Wind up Partnership with Sale to Partner along with Warranties and Indemnification can facilitate a structured buyout arrangement, ensuring that both parties are protected during the transition.

An example of a dissolution of a partnership can occur when two partners decide to separate their business interests after achieving their initial goals. One partner may buy out the other's share, and the Oregon Agreement to Dissolve and Wind up Partnership with Sale to Partner along with Warranties and Indemnification provides a framework for this transaction. Clearly documenting the process ensures both parties can conclude their business relationship amicably.