Generally, the members of a nonprofit corporation must exercise their control of corporate policies at regularly called meetings of the members. A corporation has a duty to keep a record of the meetings of its members, showing the dates such meetings were held and listing the members present or showing the number of voting shares represented at the meeting in person or by proxy. It is the duty of the secretary to prepare and enter the minutes of such meetings in the corporate records.

Oregon Minutes of Annual Meeting of a Non-Profit Corporation

Description

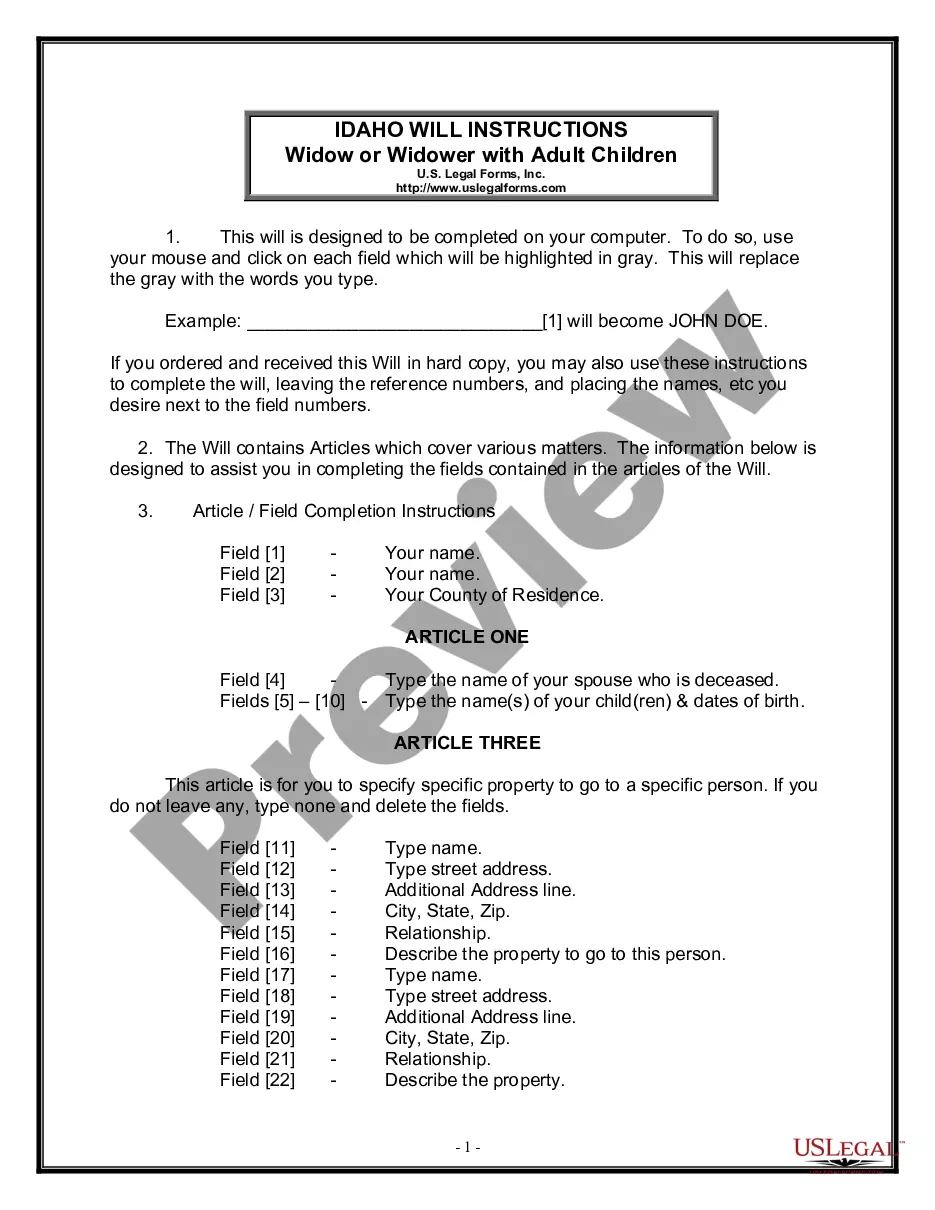

How to fill out Minutes Of Annual Meeting Of A Non-Profit Corporation?

You can spend hours online trying to locate the authentic document template that complies with the federal and state requirements you need.

US Legal Forms offers a vast array of official forms that are vetted by experts.

It is easy to download or print the Oregon Minutes of Annual Meeting of a Non-Profit Corporation from my service.

If available, use the Preview button to view the document template simultaneously.

- If you already have a US Legal Forms account, you can Log In and click the Acquire button.

- Then, you can complete, modify, print, or sign the Oregon Minutes of Annual Meeting of a Non-Profit Corporation.

- Every official document template you obtain is yours permanently.

- To obtain another copy of any downloaded form, go to the My documents tab and click the relevant button.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document template for the location/city of your choice.

- Review the form details to confirm you have chosen the appropriate template.

Form popularity

FAQ

Filing an Oregon annual report is straightforward. Access the Oregon Secretary of State's website, select the annual report section, and provide the required organizational details. As you prepare your submission, refer back to the Oregon Minutes of Annual Meeting of a Non-Profit Corporation to ensure all information is accurate and up-to-date.

To file CT 12 online in Oregon, visit the Oregon Secretary of State's website and locate the online filing section. Fill out the necessary information regarding your corporation’s business activities. Ensure your documentation aligns with the Oregon Minutes of Annual Meeting of a Non-Profit Corporation to avoid any discrepancies during the filing process.

Taking minutes for a nonprofit meeting involves recording key discussions, decisions, and actions taken during the meeting. Focus on what is essential, including attendees, motions, and outcomes. For the Oregon Minutes of Annual Meeting of a Non-Profit Corporation, ensure that you finalize and distribute these minutes to board members promptly after the meeting to keep everyone informed.

Setting up an annual report involves gathering necessary information about your nonprofit’s activities, finances, and governance. Ensure that you reference the Oregon Minutes of Annual Meeting of a Non-Profit Corporation for accurate details on board decisions from the past year. Structuring the report clearly and presenting the information cohesively will enhance its effectiveness.

To file an annual report in Oregon, you should visit the Oregon Secretary of State's website and access the appropriate forms. You can fill out the required information regarding your nonprofit. Once complete, submit the forms online, and ensure that the information aligns with the Oregon Minutes of Annual Meeting of a Non-Profit Corporation to facilitate smooth processing.

Filing an annual report for a nonprofit corporation in Oregon requires collecting essential information. This includes the organization’s name, address, and details about the board members. The report must be submitted in compliance with the specific regulations governing the Oregon Minutes of Annual Meeting of a Non-Profit Corporation to keep your nonprofit in good standing.

Nonprofits in Oregon are not required to publish their meeting minutes publicly. However, maintaining accessible minutes of the Oregon Minutes of Annual Meeting of a Non-Profit Corporation is crucial for transparency and accountability. Keeping these minutes available for stakeholders and members can foster trust and demonstrate good governance.

Yes, nonprofit board minutes generally need to be signed to ensure their authenticity. The minutes of the Oregon Minutes of Annual Meeting of a Non-Profit Corporation should be reviewed and signed by the board chair or secretary after approval. This practice maintains a clear record of the decisions made during the meeting and reinforces their legitimacy.

To take nonprofit board meeting minutes effectively, begin with the meeting's basic details, such as date and location. Capture key points discussed, decisions made, and any tasks assigned to members. The goal is to create informative and clear Oregon Minutes of Annual Meeting of a Non-Profit Corporation that reflect the true essence of the meeting.

In Oregon, nonprofits are primarily regulated by the Oregon Secretary of State. This office oversees the incorporation and ongoing compliance of non-profit organizations. For more detailed guidance on compliance, including maintaining proper Oregon Minutes of Annual Meeting of a Non-Profit Corporation, consider consulting resources like uslegalforms.