Oregon New Employee Survey

Description

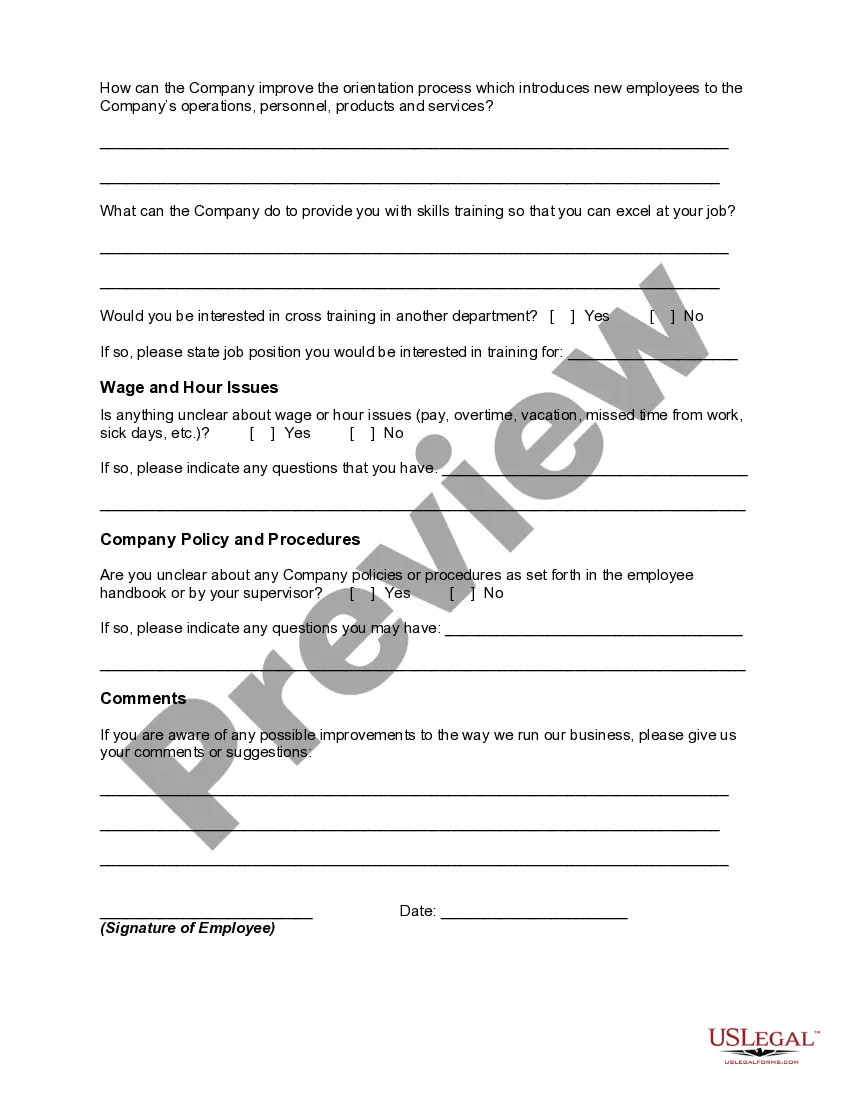

New employee surveys can be done for many purposes. One of them is the new employee orientation survey. This survey is generally done after a few days of orientation to determine any potential issues relating to productivity, turnover, attitudes and other aspects. It would also help the management to understand the productivity of the orientation or training program that the new employee went through in the initial days. The employee's experiences in the early days of employment are also important determinants, since they represent the company's image through the eyes of a new person.

Another kind of new employee survey can be undertaken to know whether the employee has completely understood all the aspects of the new job or not. This can include the job analysis and description, the basics of the job, the most enjoyable and least enjoyable parts of the job, and so on. New employee survey can include information relating to corporate culture, training, supervisor relations, work environment, pay and benefits, communications, feedback, leadership, corporate vision, and overall satisfaction.

How to fill out New Employee Survey?

Are you in a situation where you require documents for either commercial or specific purposes almost every day.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of document templates, such as the Oregon New Employee Survey, designed to comply with federal and state regulations.

Select the pricing plan you prefer, provide the necessary information to create your account, and pay for the order using your PayPal or credit card.

Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents menu. You can obtain another copy of the Oregon New Employee Survey anytime if needed. Just click the required form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Oregon New Employee Survey template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the correct area/county.

- Utilize the Preview option to review the document.

- Read the information to confirm that you have selected the appropriate form.

- If the form is not what you are looking for, use the Search field to locate the form that suits your needs.

- Once you have found the right form, click Buy now.

Form popularity

FAQ

In an Oregon New Employee Survey, it’s useful to utilize diverse types of survey questions to gain comprehensive insights. You can incorporate open-ended questions, multiple choice, Likert scale (rating), demographic questions, rank order, and dropdown questions. Each type serves a unique purpose, allowing you to capture qualitative data and quantitative metrics effectively. Understanding these types will help you design a balanced survey for better insights.

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

Steps to Hiring your First Employee in OregonStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.More items...?

One document of ID - passport or driving licence. One document showing proof of address utility bill, bank statement, credit card statement, driving licence (only if driving licence shows the applicant's current address and has not also been used as ID document)

Steps to Hiring your First Employee in OregonStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.More items...?

Contact Employer Services at 1-866-907-2857 or by email at EmplNewHire.help@doj.state.or.us if you have questions or need help reporting new hires. For your employee's privacy and security, please do not email the employee's full Social Security number.

Rates vary by state, but a 2014 report PDF from the state of Oregon noted that the median rate is around $1.85 per $100 of payroll, or 1.85 percent of an employee's salary.

Newly hired employees must complete and sign Section 1 of Form I-9 no later than the first day of employment. Generally, only unexpired, original documentation is acceptable (i.e., driver license or passport). The only exception is that an employee may present a certified copy of a birth certification.

They could determine the size and delivery of your paycheck, for example.5 forms to complete when starting a new job. You might be wondering why you need to be prepared for your new-hire paperwork.I-9 documents.W-4 form.Direct deposit form.Benefits enrollment.Company-specific paperwork.

If there is a conspiracy between the employer and employee not to report, that penalty may not exceed $500 per newly hired employee. States may also impose non-monetary civil penalties under state law for noncompliance.