This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Oregon Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage

Description

How to fill out Complaint To Compel Mortgagee To Execute And Record Satisfaction And Discharge Of Mortgage?

Choosing the best lawful record web template might be a have a problem. Of course, there are tons of layouts available on the net, but how would you get the lawful develop you want? Use the US Legal Forms site. The services offers a huge number of layouts, including the Oregon Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage, which you can use for company and private requires. Every one of the varieties are inspected by experts and meet up with federal and state needs.

In case you are previously signed up, log in in your bank account and then click the Acquire switch to get the Oregon Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage. Use your bank account to look through the lawful varieties you might have ordered previously. Check out the My Forms tab of your own bank account and have another version of your record you want.

In case you are a brand new customer of US Legal Forms, here are basic recommendations that you should adhere to:

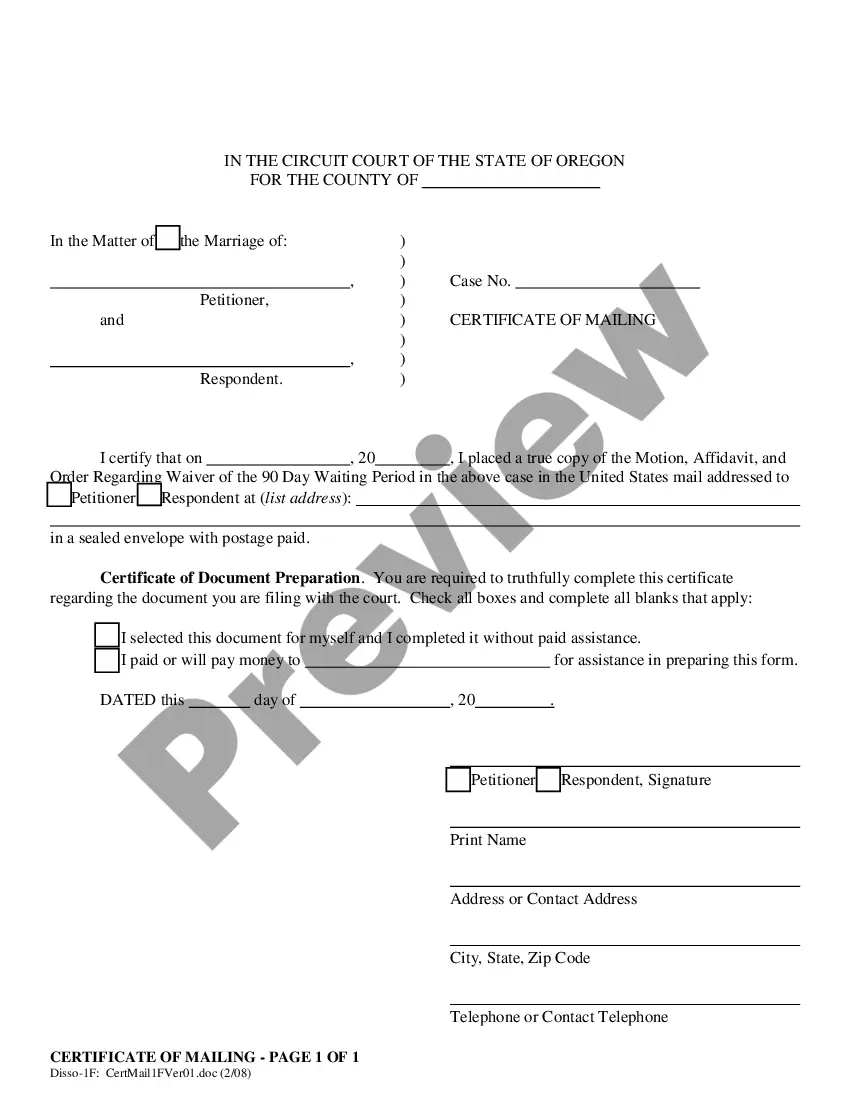

- Initially, make sure you have chosen the correct develop for the town/region. You are able to look over the shape utilizing the Preview switch and browse the shape information to make certain this is basically the best for you.

- If the develop fails to meet up with your needs, take advantage of the Seach discipline to obtain the appropriate develop.

- Once you are sure that the shape is suitable, click the Purchase now switch to get the develop.

- Select the prices strategy you need and enter the required information. Design your bank account and pay for the transaction using your PayPal bank account or Visa or Mastercard.

- Pick the document format and acquire the lawful record web template in your device.

- Comprehensive, change and print and signal the attained Oregon Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage.

US Legal Forms is definitely the greatest library of lawful varieties that you will find numerous record layouts. Use the service to acquire expertly-created papers that adhere to status needs.

Form popularity

FAQ

Oregon law allows for a redemption period after a foreclosure in some cases. Oregon laws allows for both judicial and non judicial foreclosures. If a lender pursues a foreclosure through the judicial system then the borrower has a 180 day right of redemption.

(8) "Trust deed" means a deed executed in conformity with ORS 86.705 to 86.815 that conveys an interest in real property to a trustee in trust to secure the performance of an obligation the grantor or other person named in the deed owes to a beneficiary.

Oregon allows for two different foreclosure processes: judicial and nonjudicial. Foreclosure can also occur when a homeowner does not pay their property taxes, a court judgment, or other liens on the property. This covers Nonjudicial Foreclosure.

In general, if you have a contractual debt in Oregon that you have not repaid, the creditor has six years to pursue you with legal action before the Oregon statute of limitations expires. This applies to medical, credit card, mortgage, and auto loan debt. There is no statute of limitations on a state tax debt.

The Division of Financial Regulation has regulatory authority over mortgage brokers, lenders, independent processor contractors, and mortgage loan originators conducting business in Oregon. Mortgage brokers and lenders are required to obtain a license as a mortgage lender in Oregon.

A trust deed can be foreclosed by a lawsuit in the circuit court of the county where the property is located. This type of foreclosure is referred to as a judicial foreclosure and is now common for residential loans in Oregon.

The Oregon Trust Deed Act (OTDA) requires lenders to record all deed of trust assignments before initiating nonjudicial foreclosures.

Suppose a mortgage lender fails to record a Satisfaction of Mortgage document within 60 days from the final payment date. In that case, you can file a lawsuit against the mortgagee. Contact a local law firm to speak with an intake specialist about your legal options.