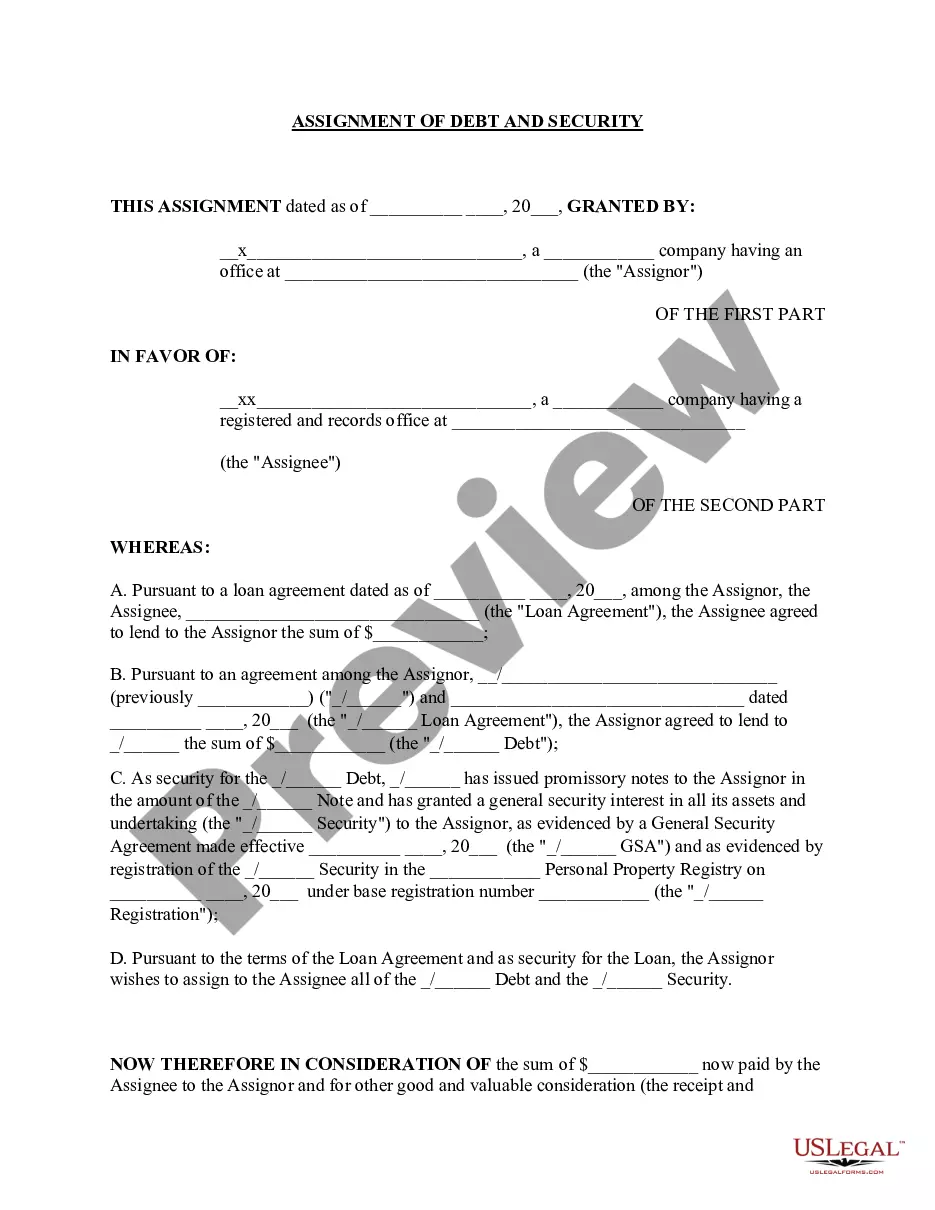

Oregon Assignment of Debt

Description

How to fill out Assignment Of Debt?

Have you ever been in a situation where you require documentation for either business or specific activities almost every day? There are numerous legal document templates available online, but finding ones you can trust is challenging.

US Legal Forms offers a vast selection of templates, including the Oregon Assignment of Debt, that are designed to meet state and federal requirements.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Oregon Assignment of Debt template.

- Obtain the document you need and ensure it corresponds to the correct state/region.

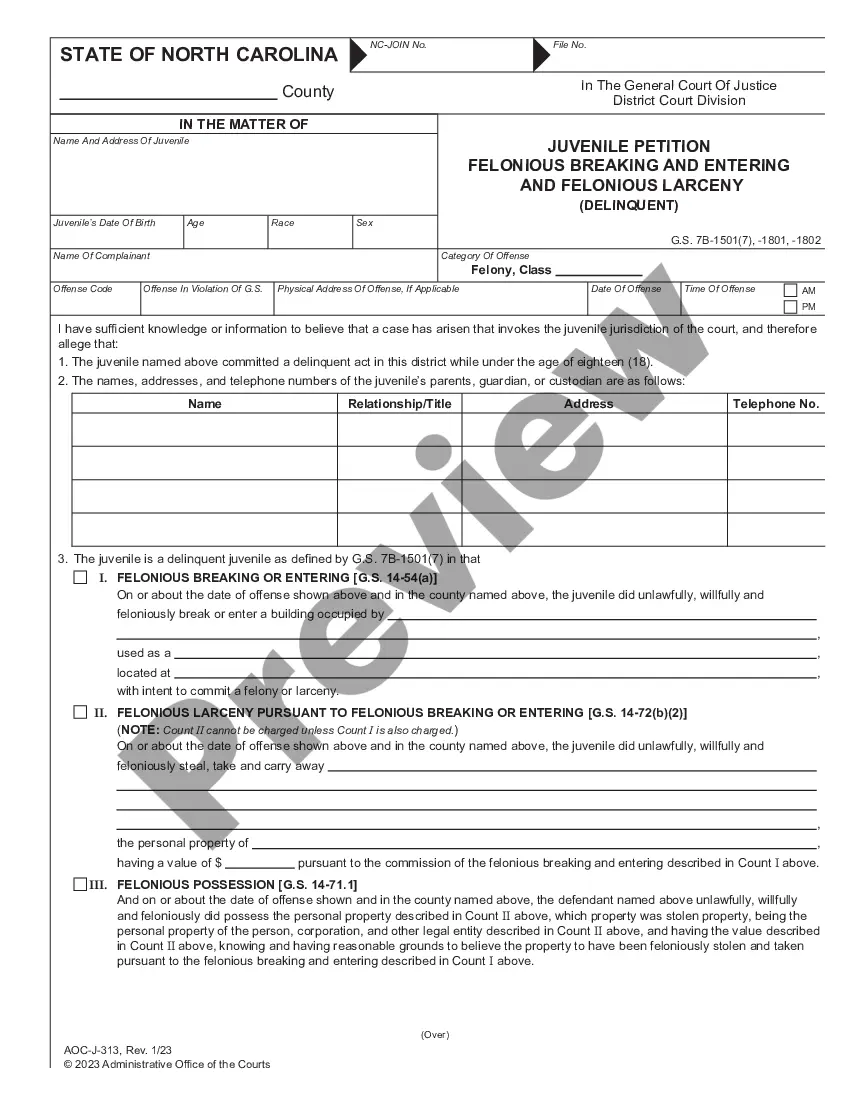

- Use the Review button to evaluate the form.

- Read the description to confirm you have selected the right document.

- If the document isn't what you're seeking, use the Research field to find the document that meets your needs and requirements.

- If you find the appropriate document, click Get now.

- Select the pricing plan you want, provide the necessary information to create your account, and pay for the order using PayPal or a credit card.

- Choose a preferred file format and download your version.

Form popularity

FAQ

The 11-word phrase to stop debt collectors is, 'I dispute this debt; please provide verification before further collection.' Utilizing the Oregon Assignment of Debt, you can strengthen your position during collection disputes. This phrase prompts debt collectors to pause their efforts until they validate the claim. You may also explore USLegalForms for comprehensive templates to assist in your communications with debt collectors.

An assignment for the benefit of creditors in Oregon allows a debtor to transfer their assets to a third party who will distribute the assets to creditors. This process provides a more organized method of debt resolution, enabling creditors to recoup some of their debts. By utilizing the Oregon Assignment of Debt, individuals can avoid lengthy bankruptcy proceedings while addressing financial obligations. You can find helpful resources and templates on USLegalForms to assist you in navigating this process efficiently.

In Oregon, unsecured debts typically become uncollectible after a statute of limitations period, usually extending up to six years from the date of default. This timeframe can vary based on the type of debt, but understanding the specifics of the Oregon Assignment of Debt is essential. Moreover, it is crucial to maintain proper documentation and seek guidance through platforms like UsLegalForms, which can offer support in navigating debt obligations and timelines.

The 777 rule with debt collectors is a guideline designed to regulate their conduct and protect consumers. A key aspect of this rule includes limitations on the times and methods that debt collectors can use to contact you about your debts. For those dealing with an Oregon Assignment of Debt, knowing your rights under this rule can provide peace of mind and help ensure respectful treatment from collectors.

Debt collection agencies in Oregon, especially regarding the Oregon Assignment of Debt, must adhere to certain laws that protect consumers. They cannot threaten you with violence, share your debt information with unauthorized parties, or call you at unreasonable hours. Being aware of these restrictions can help you recognize unfair practices and take appropriate action if necessary.

The 777 rule relates to the legal practices surrounding debt collection, particularly in relation to the Oregon Assignment of Debt. Under this rule, debt collectors must follow strict guidelines when attempting to collect outstanding debts. For instance, they cannot contact you at inconvenient times, and if they do, you have the right to demand they stop. Understanding this rule can empower you to better manage your debt collection experience.

Yes, an assignment of debt should be documented in writing to be legally binding and enforceable. Written agreements help clarify the responsibilities and rights of both parties involved. If you’re dealing with an assignment of debt, utilizing services like US Legal Forms can streamline the process and ensure all your documents are properly prepared.

Yes, companies can legally sell your debt to a collection agency, allowing the agency to attempt recovery. This practice is common and regulated under state and federal laws. Understanding the Oregon Assignment of Debt can prepare you for how to handle your obligations if your debt is transferred.

Proof of debt assignment refers to documentation that verifies a debt has been transferred from one party to another. This proof is essential for both debtors and creditors to understand the terms and obligations associated with the debt. If you're dealing with debt assignments, familiarizing yourself with the Oregon Assignment of Debt can help you ensure that your rights are protected.

After 7 years of non-payment, most debts will typically fall off your credit report, but it does not erase the debt itself. Creditors may still attempt to collect it, or even sell it to collection agencies. Knowing about the Oregon Assignment of Debt can help you understand the impact of unpaid debts on your financial record.