Oregon Sample Letter for Authorization for Late Return

Description

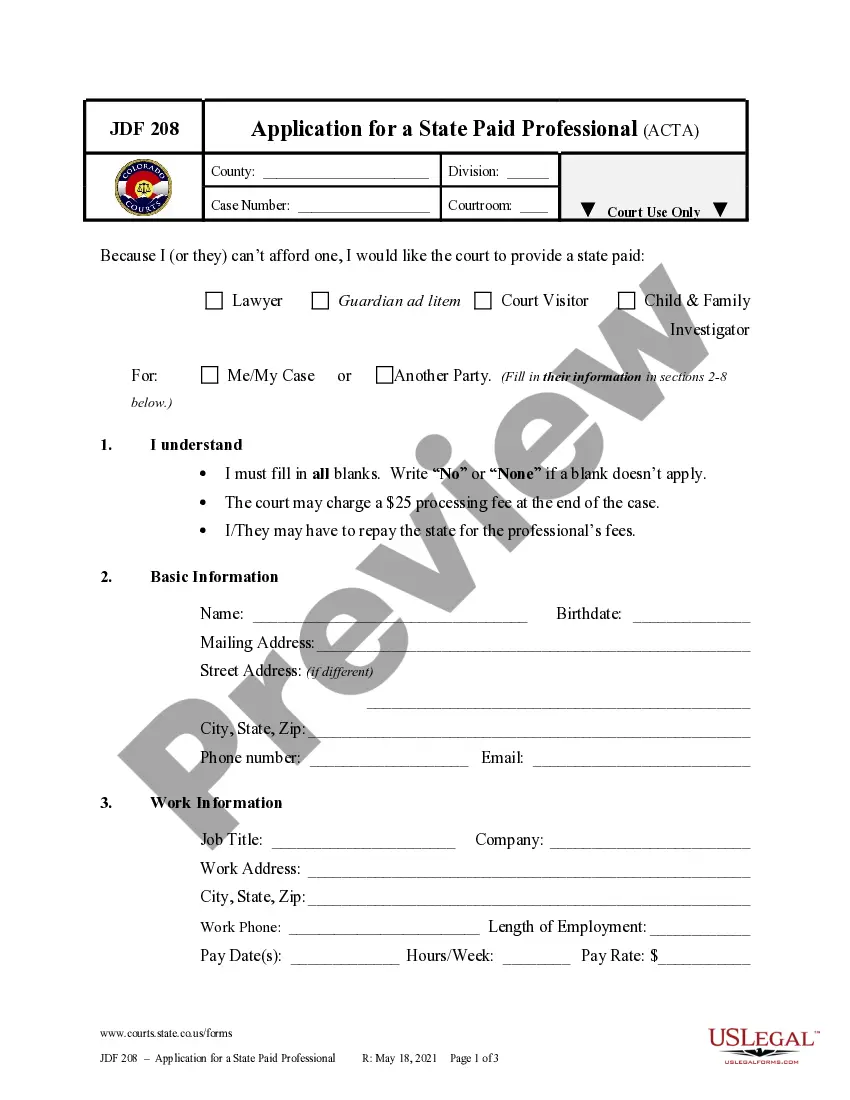

How to fill out Sample Letter For Authorization For Late Return?

If you wish to finalize, retrieve, or create legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Employ the website's simple and user-friendly search to locate the documents you require.

Various templates for business and personal purposes are organized by categories and titles, or by keywords.

Step 4. Once you have identified the document you need, click the Buy now button. Choose the payment plan that suits you and provide your details to register for an account.

Step 5. Complete the transaction. You can utilize your Visa or Mastercard or PayPal account to finalize the payment.

- Utilize US Legal Forms to find the Oregon Sample Letter for Authorization for Late Return in just a few clicks.

- If you are an existing US Legal Forms user, sign in to your account and click the Download button to access the Oregon Sample Letter for Authorization for Late Return.

- You can also access forms you have previously submitted electronically in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have chosen the form appropriate for your state/country.

- Step 2. Use the Review option to examine the form’s details. Be sure to read through the instructions.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the page to locate other versions of the legal document template.

Form popularity

FAQ

Yes, you can appeal a tax return in Oregon if you believe the tax authority has made an error in your assessment. The process involves filing a formal protest or appeal, depending on the specific circumstances of your case. Ensure that you gather all necessary documentation to support your appeal. If you need assistance, consider using the Oregon Sample Letter for Authorization for Late Return to communicate your appeal clearly.

The 200 day rule in Oregon refers to the timeframe within which a taxpayer can file a claim for a refund on an income tax overpayment. Generally, you must submit your claim within 200 days after the date of your tax return filing. Understanding this rule is crucial, as missing the deadline can result in losing your refund rights. In situations where you are late, the Oregon Sample Letter for Authorization for Late Return can provide guidance on your options.

Responding to your Oregon tax letter involves reviewing the contents of the letter carefully and addressing any specific requests it contains. Make sure to take note of deadlines mentioned in the correspondence. If needed, consider using an Oregon Sample Letter for Authorization for Late Return to respond effectively and ensure that your communication is clear and professional.

Yes, there are penalties for late payments on your Oregon tax account, which can increase the amount you owe. Familiarizing yourself with your payment schedule can help avoid missed deadlines and additional fees. If you find yourself facing a potential late payment, using an Oregon Sample Letter for Authorization for Late Return could be a proactive way to address your situation and maintain communication with the tax authorities.

To amend your Oregon tax return, you will need to file Form OR-40-N or OR-40-P, depending on your specific tax situation. Ensure that you provide accurate details of the changes you are making. Amending a return helps clear any discrepancies and can even result in a refund. If you're unsure about the process, an Oregon Sample Letter for Authorization for Late Return can guide you through necessary communications.

If you have questions about your Oregon tax refund, you should contact the Oregon Department of Revenue directly. Their customer service line can provide you with the most accurate and up-to-date information regarding your refund status. Additionally, if you need a quick response, consider having your tax documents handy when you call. Remember, utilizing an Oregon Sample Letter for Authorization for Late Return can help clarify any delays in receiving your refund.

Receiving a letter from the Oregon Department of Revenue often indicates the need for additional information or the resolution of a filing issue. These letters are important for maintaining accurate tax records. If you are facing late filing, consider using an Oregon Sample Letter for Authorization for Late Return to explain your situation.

You can obtain your Oregon Form 40 by downloading it from the Oregon Department of Revenue’s website or visiting your local office. Make sure to check for the most current version to ensure compliance. If your filing is late, an Oregon Sample Letter for Authorization for Late Return can accompany your submission.

Certified letters from the Department of Revenue usually serve to convey important notices that require your immediate attention or action. This might include queries about your return or requests for additional documentation. If you are navigating late filings, consider referencing an Oregon Sample Letter for Authorization for Late Return in your response.

Yes, Oregon offers an efile form that allows for electronic submission of your tax return. This form simplifies the filing process and helps expedite refunds. If you happen to file late, an Oregon Sample Letter for Authorization for Late Return can be a useful tool to explain your situation.