Oregon Non-Disclosure Agreement for Merger or Acquisition

Description

How to fill out Non-Disclosure Agreement For Merger Or Acquisition?

You can spend hours online looking for the legal document template that meets the state and federal requirements you have.

US Legal Forms provides thousands of legal templates that are reviewed by experts.

You can download or print the Oregon Non-Disclosure Agreement for Merger or Acquisition from our service.

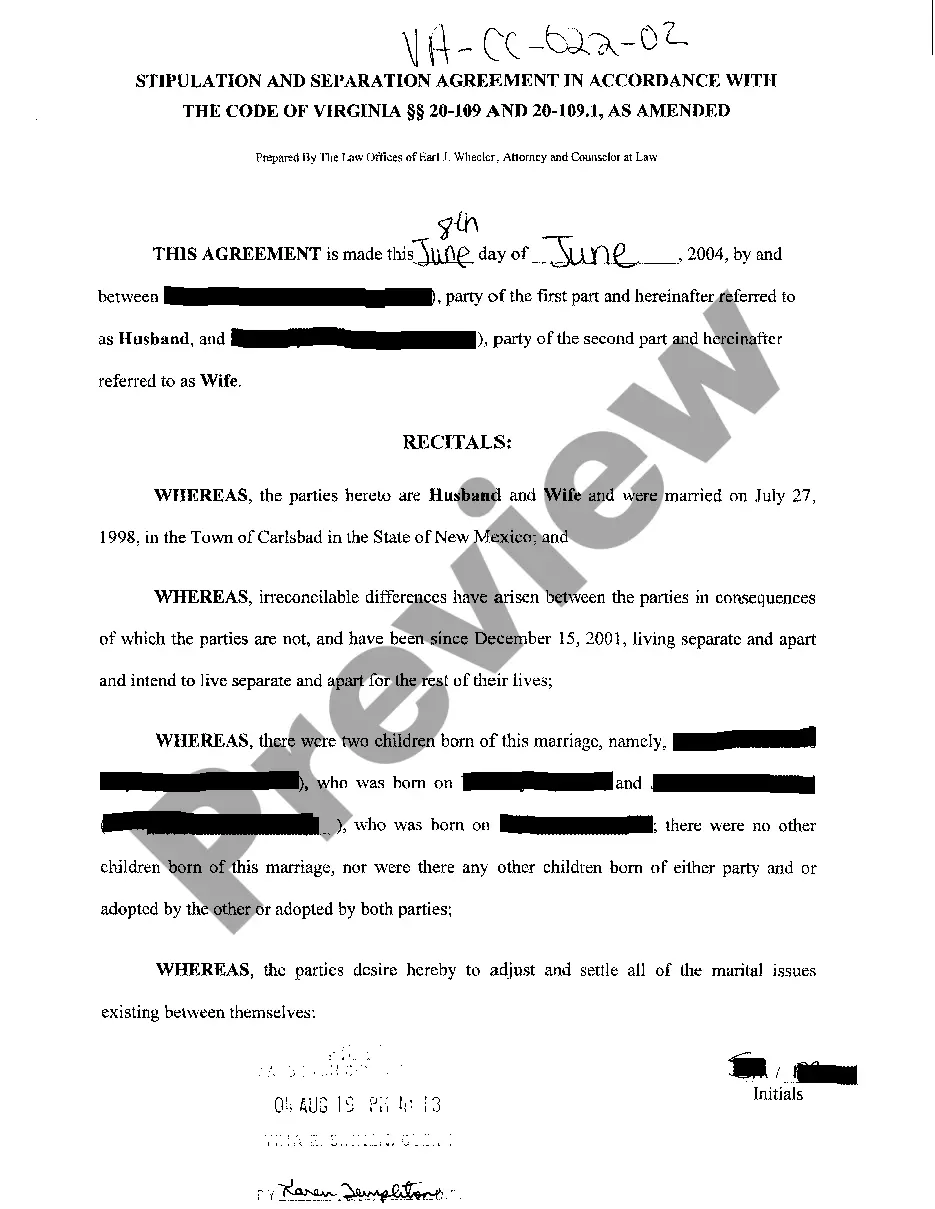

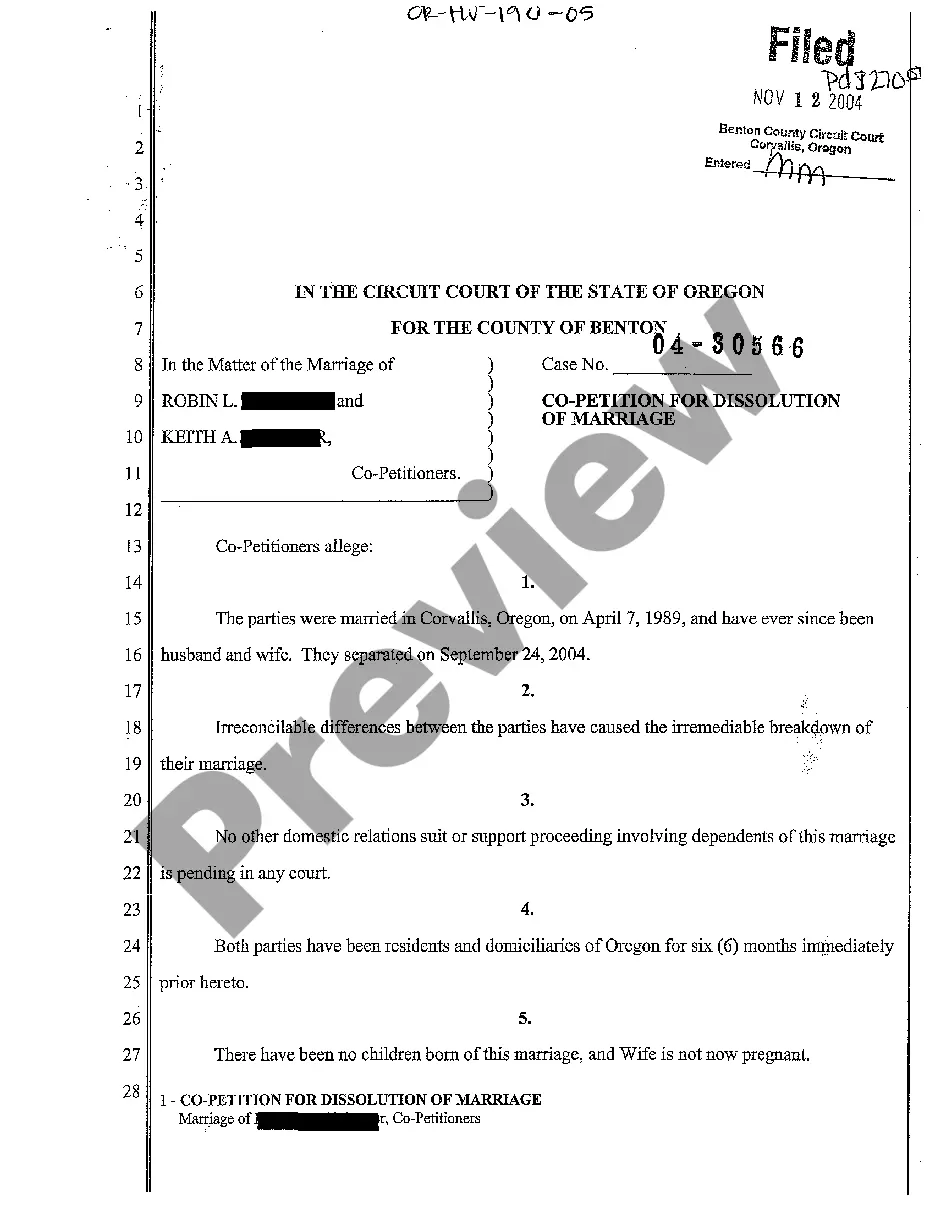

If available, utilize the Preview button to view the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- Afterward, you can fill out, modify, print, or sign the Oregon Non-Disclosure Agreement for Merger or Acquisition.

- Every legal document template you purchase is yours forever.

- To obtain another copy of any purchased form, go to the My documents section and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure that you have selected the correct document template for the region/city of your choice.

- Check the form description to ensure you have chosen the right form.

Form popularity

FAQ

The three primary types of NDAs include one-way agreements, mutual agreements, and three-way agreements. One-way NDAs protect one party’s information, while mutual NDAs safeguard information for both parties involved. For situations like an Oregon Non-Disclosure Agreement for Merger or Acquisition, understanding these types is vital for effective and secure negotiations.

way NDA, also known as a triparty NDA, involves three parties agreeing to protect shared confidential information. This type of agreement is particularly useful when multiple parties are involved in a project or negotiation. If you are considering an Oregon NonDisclosure Agreement for Merger or Acquisition that includes several stakeholders, a threeway NDA can effectively manage confidentiality among all parties.

Creating a non-disclosure agreement involves identifying the parties, defining the confidential information, and outlining the terms of the agreement. It's essential to ensure clarity in your language to avoid ambiguity. For those drafting an Oregon Non-Disclosure Agreement for Merger or Acquisition, using a reliable platform like US Legal Forms can simplify the process and provide templates tailored for your specific situation.

A mutual NDA involves both parties exchanging confidential information, whereas a one-way NDA allows only one party to share sensitive details. Choosing the right type is crucial, especially when preparing an Oregon Non-Disclosure Agreement for Merger or Acquisition. Understanding your needs and the nature of your relationship will guide you in selecting the most appropriate option.

The three types of disclosure are public disclosure, selective disclosure, and complete disclosure. Public disclosure involves sharing information openly, while selective disclosure limits access to certain individuals or groups. In the context of an Oregon Non-Disclosure Agreement for Merger or Acquisition, complete disclosure is vital for ensuring all parties are aware of critical information needed for negotiations.

Yes, there are several types of Non-Disclosure Agreements, each serving a specific purpose. The most common are one-way NDAs, where only one party discloses information, and mutual NDAs, which require both parties to share confidential information. If you're considering an Oregon Non-Disclosure Agreement for Merger or Acquisition, understanding these types can help you choose the right one for your needs.

You can obtain an Oregon Non-Disclosure Agreement for Merger or Acquisition through various methods. Many online platforms, like USLegalForms, offer customizable templates that you can easily tailor to your needs. Alternatively, you could consult with a legal professional who specializes in mergers and acquisitions to draft an agreement that meets your specific requirements. Whichever route you choose, ensure that the agreement protects your confidential information throughout the merger or acquisition process.

Filling out a non-disclosure agreement (NDA) for a merger or acquisition in Oregon requires careful attention to detail. Start by identifying the parties involved and clearly defining the confidential information that needs protection. Next, outline the obligations of each party, specifying how the information should be handled and the duration of confidentiality. For a seamless process, consider using US Legal Forms, which offers ready-to-use templates for an Oregon Non-Disclosure Agreement for Merger or Acquisition, ensuring you cover all necessary aspects without missing important details.

The primary difference between an NDA and a Mutual Non-Disclosure Agreement (MNDA) lies in the party obligations. An NDA typically involves one party sharing confidential information, while an MNDA includes both parties exchanging sensitive data. The Oregon Non-Disclosure Agreement for Merger or Acquisition can take either form, depending on the nature of the transaction and the needs of the involved parties.

The confidentiality clause in an M&A context ensures that both parties agree to keep shared information private. This clause is a critical component of the Oregon Non-Disclosure Agreement for Merger or Acquisition, specifying what information is confidential and the duration of confidentiality obligations. By including this clause, businesses can confidently share insights that are vital to the deal.