US Legal Forms - among the largest libraries of legal kinds in the States - provides a variety of legal papers web templates you are able to down load or print. Utilizing the internet site, you can find thousands of kinds for business and specific reasons, categorized by classes, suggests, or key phrases.You can get the newest types of kinds just like the Oregon Assignment of Life Insurance Proceeds to a Funeral Home for the Purpose of Pre-Arranging a Funeral within minutes.

If you already have a subscription, log in and down load Oregon Assignment of Life Insurance Proceeds to a Funeral Home for the Purpose of Pre-Arranging a Funeral in the US Legal Forms local library. The Down load key can look on every single kind you view. You gain access to all in the past acquired kinds from the My Forms tab of your own profile.

If you would like use US Legal Forms initially, here are straightforward guidelines to help you get began:

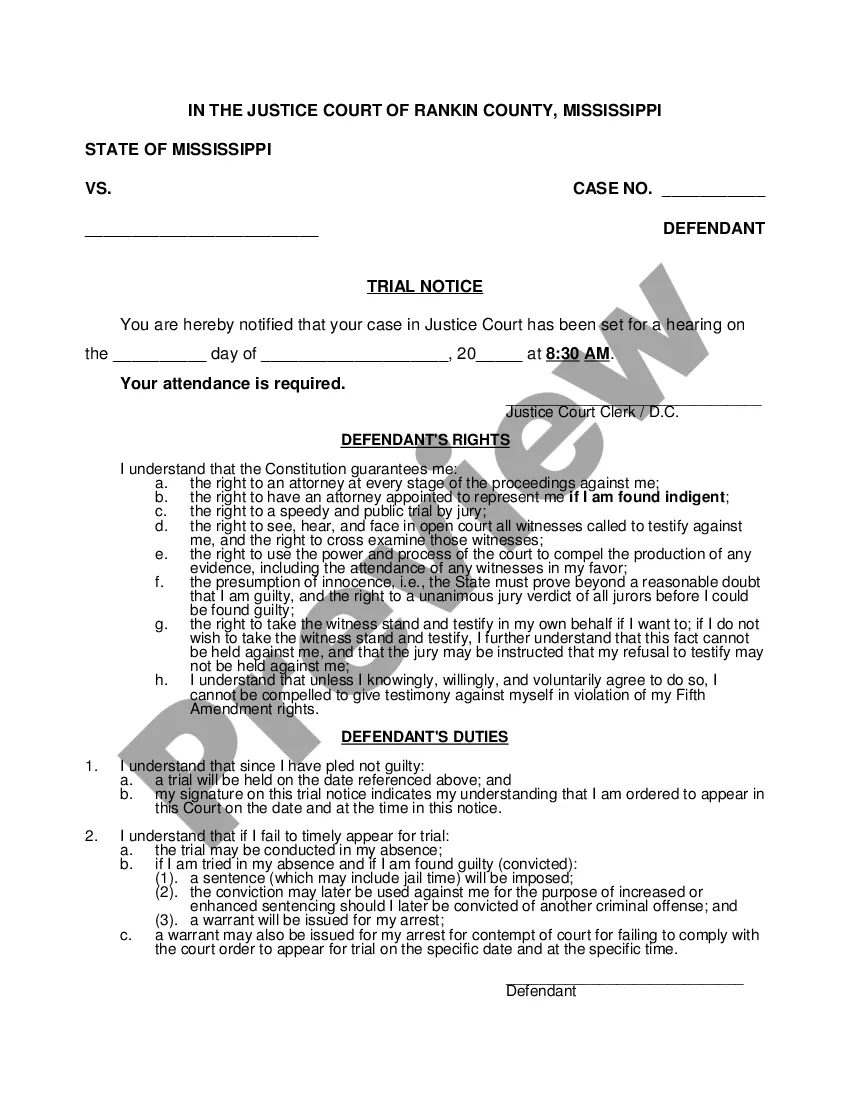

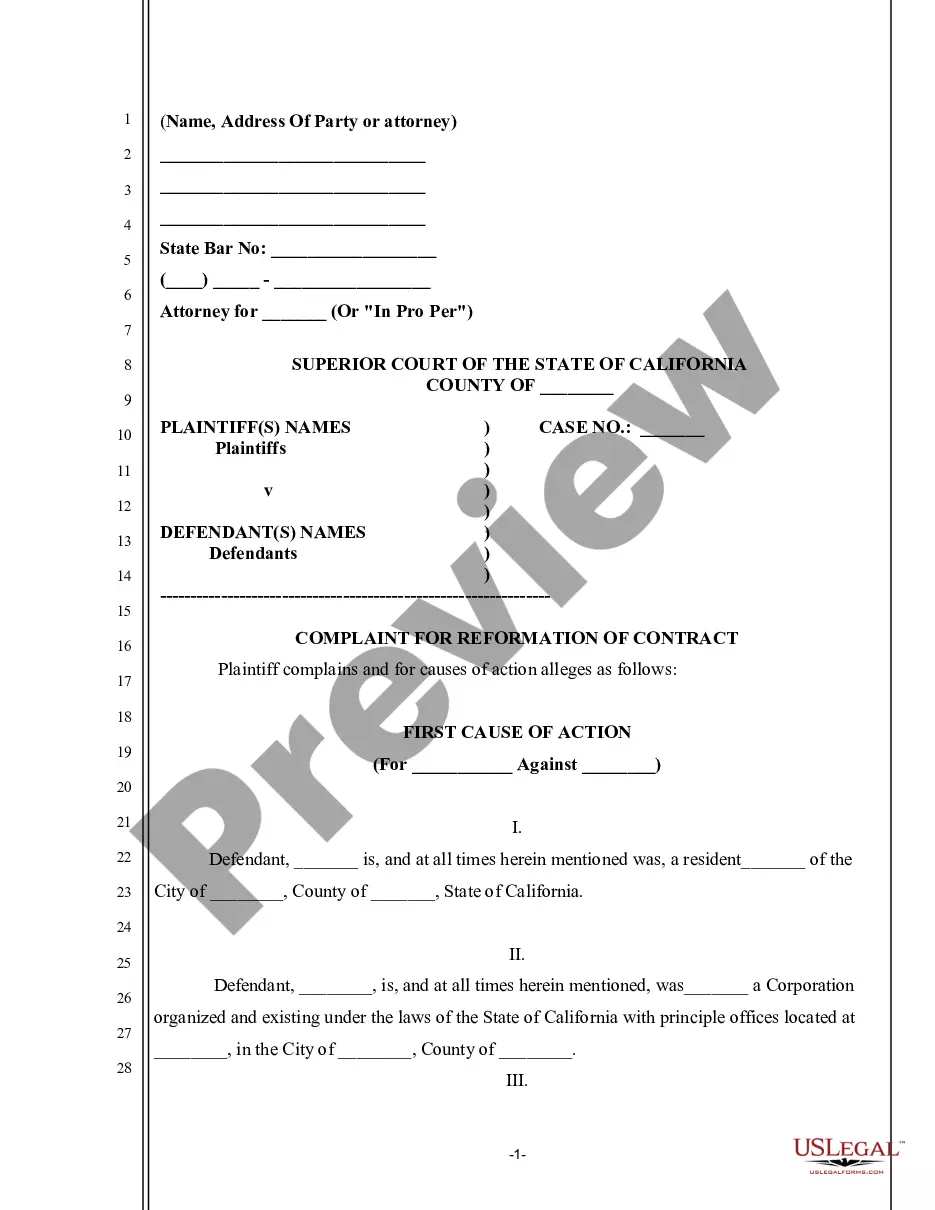

- Ensure you have picked out the best kind to your town/area. Select the Preview key to check the form`s articles. Browse the kind information to ensure that you have selected the appropriate kind.

- In case the kind does not fit your requirements, use the Research area at the top of the display screen to discover the one that does.

- If you are pleased with the shape, verify your decision by clicking on the Get now key. Then, pick the rates prepare you favor and supply your qualifications to sign up for an profile.

- Approach the purchase. Make use of Visa or Mastercard or PayPal profile to complete the purchase.

- Pick the file format and down load the shape on your own system.

- Make adjustments. Fill out, change and print and signal the acquired Oregon Assignment of Life Insurance Proceeds to a Funeral Home for the Purpose of Pre-Arranging a Funeral.

Every web template you put into your bank account does not have an expiration day and is also the one you have eternally. So, in order to down load or print one more backup, just check out the My Forms segment and click around the kind you want.

Gain access to the Oregon Assignment of Life Insurance Proceeds to a Funeral Home for the Purpose of Pre-Arranging a Funeral with US Legal Forms, probably the most substantial local library of legal papers web templates. Use thousands of professional and express-distinct web templates that satisfy your small business or specific requires and requirements.