Oregon Certificate of Corporate Vote - Corporate Resolutions

Description

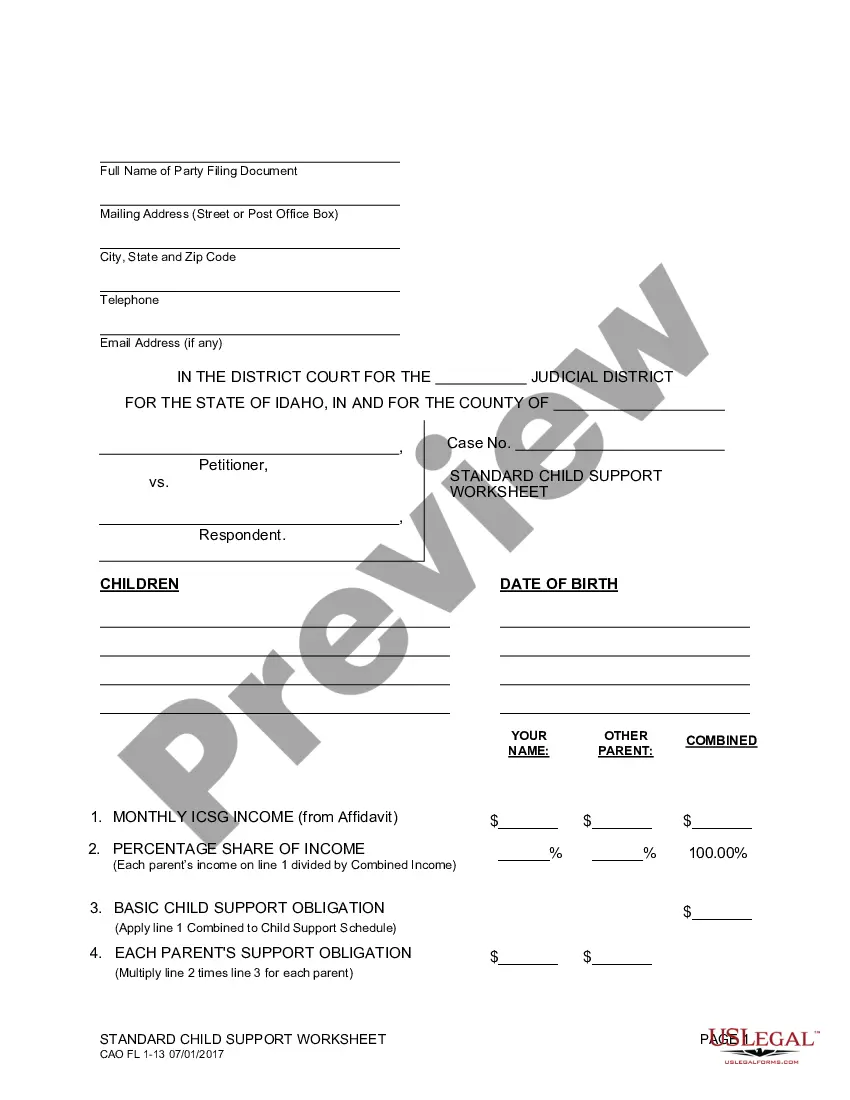

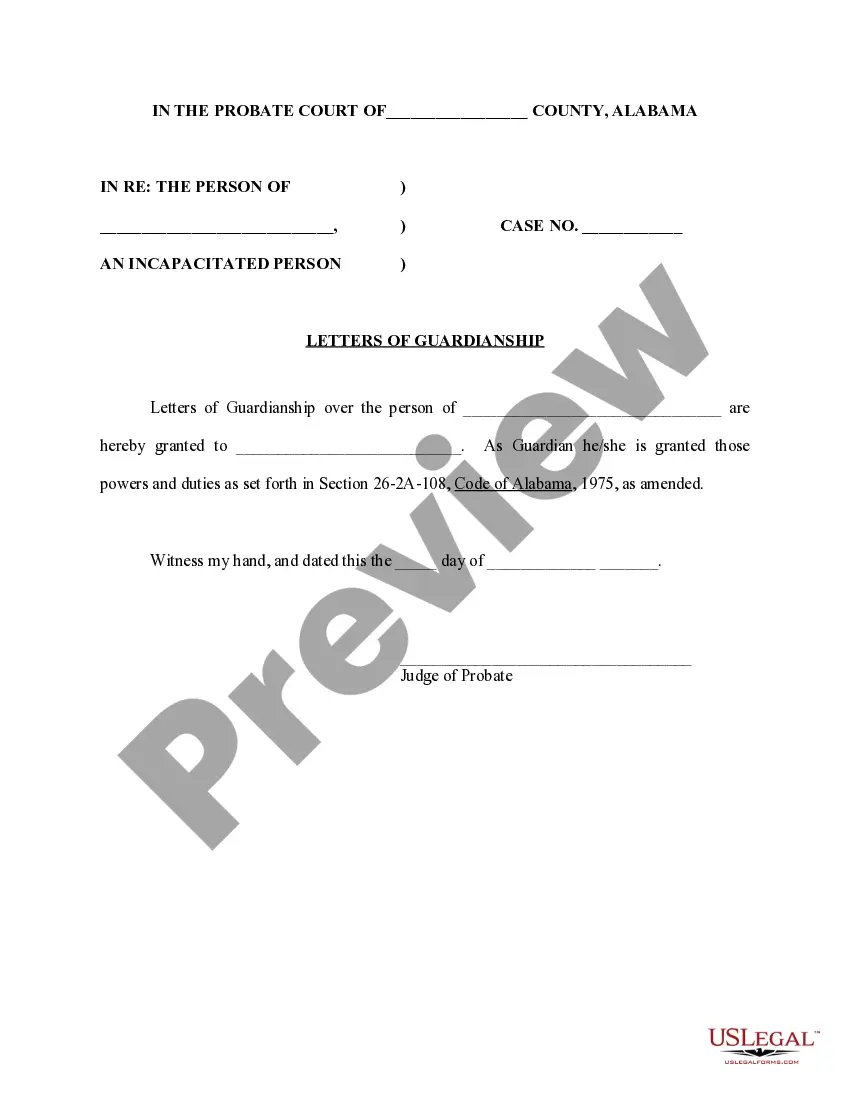

How to fill out Certificate Of Corporate Vote - Corporate Resolutions?

You may commit several hours on the Internet searching for the legitimate document format that meets the state and federal specifications you will need. US Legal Forms provides a large number of legitimate varieties that happen to be examined by professionals. It is possible to down load or print the Oregon Certificate of Corporate Vote - Corporate Resolutions from my service.

If you currently have a US Legal Forms accounts, you are able to log in and then click the Down load button. After that, you are able to complete, modify, print, or signal the Oregon Certificate of Corporate Vote - Corporate Resolutions. Every single legitimate document format you get is your own property permanently. To acquire one more backup of the purchased type, go to the My Forms tab and then click the corresponding button.

If you work with the US Legal Forms web site the first time, keep to the basic directions under:

- Very first, ensure that you have selected the best document format for your county/metropolis of your choice. See the type outline to ensure you have picked the right type. If offered, make use of the Review button to appear from the document format as well.

- In order to find one more variation of your type, make use of the Look for industry to discover the format that fits your needs and specifications.

- When you have found the format you need, click on Acquire now to continue.

- Choose the prices strategy you need, type your qualifications, and register for a merchant account on US Legal Forms.

- Complete the transaction. You should use your charge card or PayPal accounts to pay for the legitimate type.

- Choose the file format of your document and down load it to your device.

- Make changes to your document if needed. You may complete, modify and signal and print Oregon Certificate of Corporate Vote - Corporate Resolutions.

Down load and print a large number of document themes using the US Legal Forms site, which provides the largest variety of legitimate varieties. Use professional and status-certain themes to tackle your company or person requirements.

Form popularity

FAQ

Corporate bylaws are legally required in Oregon. Rev. Stat. § 60.061, corporate bylaws shall be adopted by the incorporators or the corporation's board of directors. Bylaws are usually adopted by your corporation's directors at their first board meeting.

An owner of a professional corporation remains liable for their own negligence or malpractice, but will not be personally liable for the negligence or malpractice of other owners. Professional corporations are commonly identified by adding "PC" or "P.C." to the end of their name.

Oregon allows professionals, such as accountants, attorneys and physicians, to form a professional corporation (PC). After forming a corporation, you must undertake certain steps on an ongoing basis to keep your business in compliance.

Bylaws document the rules for how the corporation shall be governed. Resolutions are prepared as needed to document important decisions and actions taken by the board of directors on behalf of the corporation.

The difference between LLC and PC is straightforward. A limited liability company (LLC) combines the tax benefits of a partnership and the limited liability protection of a corporation. A professional corporation (PC) is organized ing to the laws of the state where the professional is licensed to practice.

A failure to do so can result in limited or no liability protection, which is often called "piercing the corporate veil."

Limited liability companies organized under Oregon statute are "domestic" limited liability companies. Those formed under the laws of other states, but transacting business in Oregon, are "foreign" limited liability companies.

A professional corporation (PC) or professional limited liability company (PLLC) is a C corporation, S corporation, or limited liability company (LLC) organized to provide professional services in industries that require a state license in order to practice.