Oregon Letter to Report False Submission of Deceased Person's Information

Description

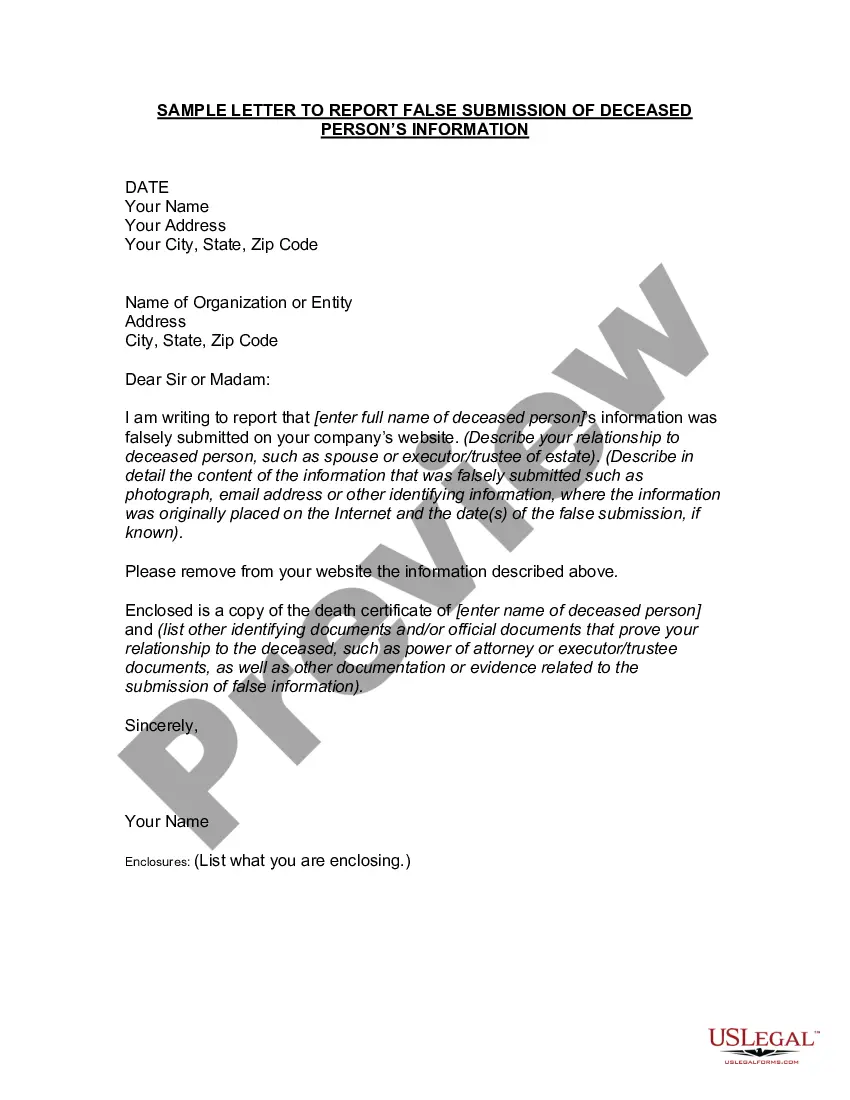

How to fill out Letter To Report False Submission Of Deceased Person's Information?

Finding the appropriate legal document format can be challenging. It goes without saying that there are numerous templates available online, but how do you find the legal form you require? Utilize the US Legal Forms website. This service offers an extensive collection of templates, including the Oregon Letter to Report False Submission of Deceased Person's Information, suitable for both business and personal purposes. All forms are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Acquire option to obtain the Oregon Letter to Report False Submission of Deceased Person's Information. Use your account to browse through the legal forms you have previously purchased. Visit the My documents tab in your account to acquire another copy of the document you need.

If you are a new user of US Legal Forms, here are simple guidelines you should follow: First, ensure you have selected the correct form for your city/state. You can view the form using the Preview option and examine the form summary to confirm it meets your needs. If the form does not satisfy your requirements, use the Search field to find the suitable form. Once you are confident that the form is accurate, select the Get now option to obtain the form. Choose the payment plan you prefer and enter the necessary information. Create your account and pay for your order using your PayPal account or credit card. Select the document format and download the legal document to your device. Complete, modify, print, and sign the obtained Oregon Letter to Report False Submission of Deceased Person's Information.

Make the most of your experience with US Legal Forms to access high-quality legal documents tailored to your needs.

- US Legal Forms is the largest repository of legal forms where you can find various document templates.

- Utilize the service to obtain professionally crafted documents that meet state requirements.

- The platform provides a wide range of legal documents for diverse applications.

- All forms are vetted to ensure they adhere to legal standards.

- You can easily navigate through available templates to find what you need.

- The site offers both personal and business-related legal document solutions.

Form popularity

FAQ

If you're a surviving spouse filing a joint return, or a court-appointed or court-certified personal representative filing an original return for the decedent, you don't have to file Form 1310.

Even if the executor is discharged from personal liability, the IRS will still be able to assess tax deficiencies against the executor to the extent the executor still has any of the decedent's property.

When filing as an executor of estate, on the Form 1040, include only income and expense items up to the date of death. You'll also file a return for the estate on Form 1041. Include only income and expense items after the date of death.

An estate remains a taxpayer even after the decedent's death. An estate's executor is responsible for filing all applicable tax returns on behalf of the estate.

Form 1310 is filed by the primary beneficiary of the estate of the deceased. This may be the spouse, a child, or another family member of the deceased. If the person did not leave a will, a probate court will name an executor. That person is then responsible for Form 1310.

The personal representative of an estate is an executor, administrator, or anyone else in charge of the decedent's property. The personal representative is responsible for filing any final individual income tax return(s) and the estate tax return of the decedent when due.

An heir of a deceased taxpayer must file Form OR-243 to claim a refund when there is no trustee or court appointed representative. If the court has appointed a personal representative, or a small-estate affidavit has been filed, Form OR-243 is used to request a replacement refund check in the name of the claimant.

If you don't file taxes for a deceased person, the IRS can take legal action by placing a federal lien against the Estate. This essentially means you must pay the federal taxes before closing any other debts or accounts. If not, the IRS can demand the taxes be paid by the legal representative of the deceased.