Oregon Sample Letter for Agreement to Compromise Debt

Description

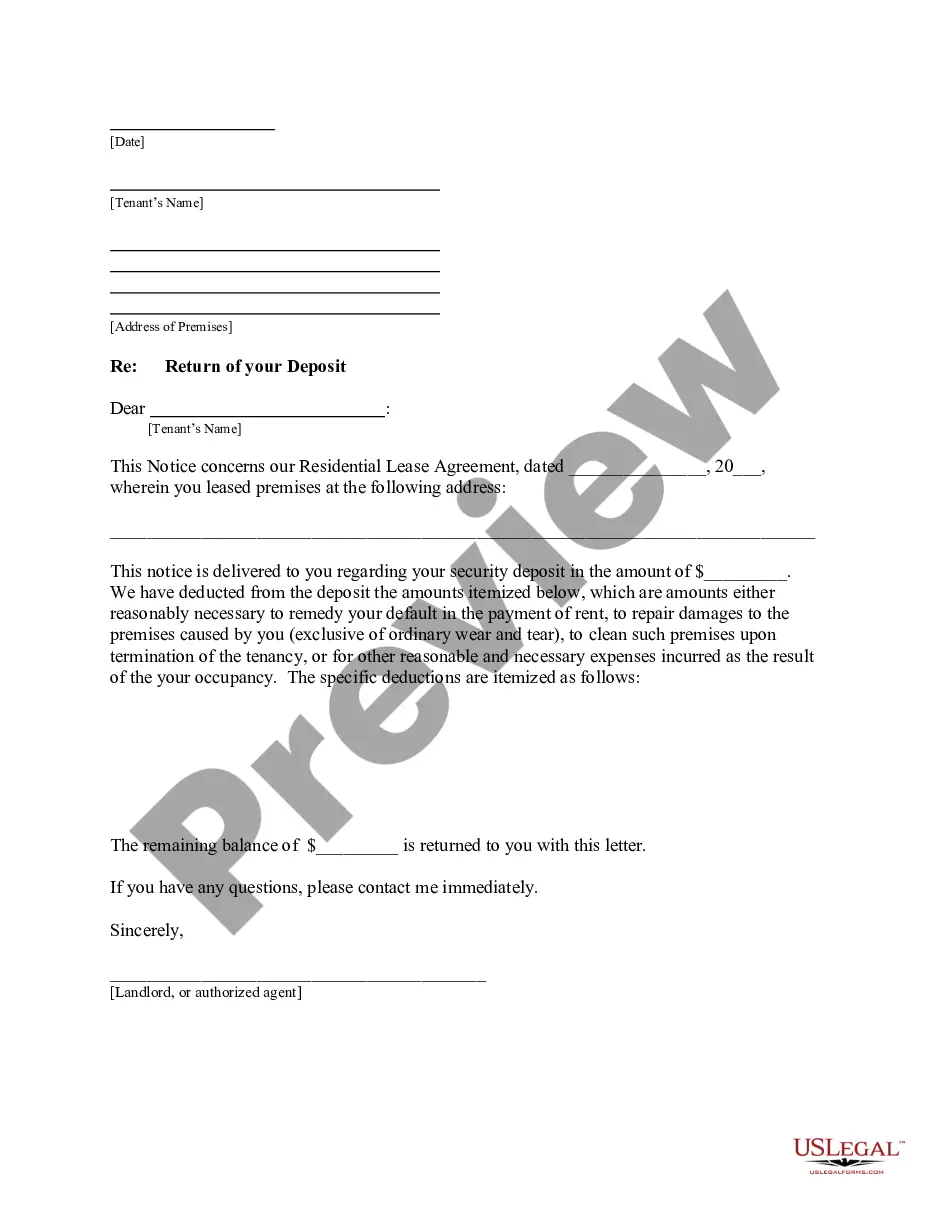

How to fill out Sample Letter For Agreement To Compromise Debt?

You might dedicate numerous hours online attempting to locate the legal document template that complies with the federal and state regulations that you require.

US Legal Forms offers thousands of legal forms that can be reviewed by professionals.

It is easy to download or print the Oregon Sample Letter for Agreement to Compromise Debt from our service.

Once you have found the template you desire, click Buy now to proceed.

- If you already have a US Legal Forms account, you can Log In and select the Download option.

- After that, you can complete, modify, print, or sign the Oregon Sample Letter for Agreement to Compromise Debt.

- Each legal document template you obtain is yours forever.

- To obtain an additional copy of any downloaded form, go to the My documents section and select the appropriate option.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure you have chosen the correct document template for your county/city of preference.

- Review the form description to confirm you have selected the right form.

- If available, utilize the Preview option to view the document template as well.

- If you wish to obtain another version of the form, use the Search field to find the template that meets your needs and specifications.

Form popularity

FAQ

To write a letter requesting proof of debt, clearly state your request at the beginning. Include specific details about the debt in question, such as the original creditor's name and the amount owed. It's essential to keep your tone professional while indicating your wish to see documentation supporting the claim against you. You can also refer to an Oregon Sample Letter for Agreement to Compromise Debt for a structured approach, as it provides a template that ensures you cover all necessary points effectively.

Filling out a debt validation letter involves stating your name, address, and the debt in question. You should clearly request verification from the collector, including proof of the debt's legitimacy. By sending a well-crafted letter, such as an Oregon Sample Letter for Agreement to Compromise Debt, you can exercise your rights and properly address any inaccuracies before moving forward.

The 777 rule refers to a guideline that protects consumers from aggressive debt collection practices. Under this rule, debt collectors cannot call you more than seven times in a week or at inconvenient times. This ensures that you have some peace while dealing with debt matters. If you're being harassed, consider using an Oregon Sample Letter for Agreement to Compromise Debt to negotiate more favorable terms.

To write a good settlement offer, start by clearly outlining the terms you want to propose. Be specific about the debt amount you are willing to compromise and the payment timeline. Using an Oregon Sample Letter for Agreement to Compromise Debt can guide you in structuring your offer in a professional manner. This approach not only increases your chances of acceptance but also demonstrates your commitment to resolving the debt.

The percentage you should offer to settle a debt generally ranges between 30% to 70% of the total owed. Factors affecting this include how long the debt is overdue and the creditor’s willingness to negotiate. Utilizing the Oregon Sample Letter for Agreement to Compromise Debt can help you structure your offer effectively and professionally.

To write a debt settlement agreement, clearly state the total amount due and the settled amount. Include a timeline for payments and any specifics related to the agreement's enforcement. You can draft this document more easily using the Oregon Sample Letter for Agreement to Compromise Debt, which ensures you include essential elements.

Yes, a debt agreement is often a strategic move for those looking to manage or reduce their financial obligations. It allows you and your creditor to find a common ground, enabling a successful outcome that benefits both parties. As you consider this option, the Oregon Sample Letter for Agreement to Compromise Debt can serve as a valuable guide.

A letter of negotiation for debt collection is a formal document where a debtor proposes alternative payment terms to their creditor. This letter aims to initiate a discussion around altering the original agreement, often leading to a more manageable debt resolution. Crafting such correspondence can be simplified with resources like the Oregon Sample Letter for Agreement to Compromise Debt.

Writing a debt agreement involves clear communication between both parties about the terms of repayment. Start by outlining the amount owed, payment schedule, and any interest involved. For additional support, consider using the Oregon Sample Letter for Agreement to Compromise Debt as a template to ensure you cover all necessary points.

The 777 rule is a guideline that debt collectors must follow to correctly report debts. It suggests that creditors must have a valid basis for any collection action. Understanding this rule can empower you when dealing with debt issues, especially when you utilize tools like the Oregon Sample Letter for Agreement to Compromise Debt.