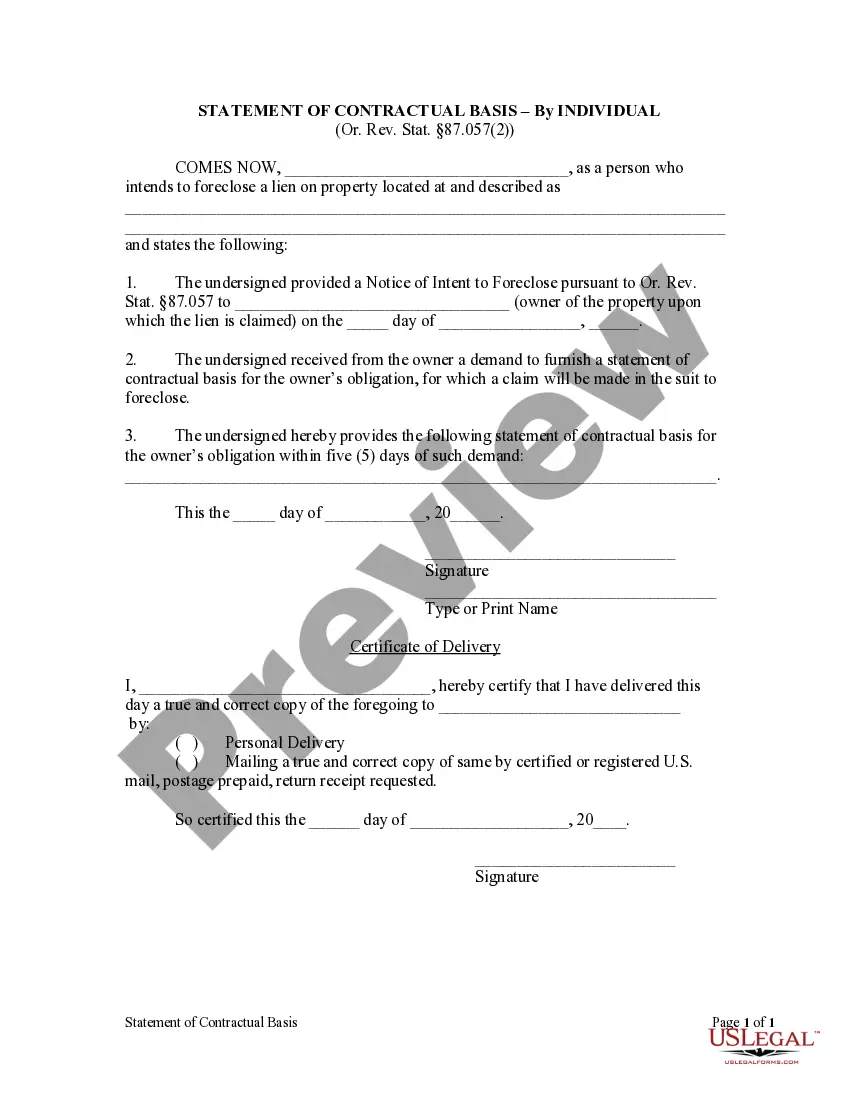

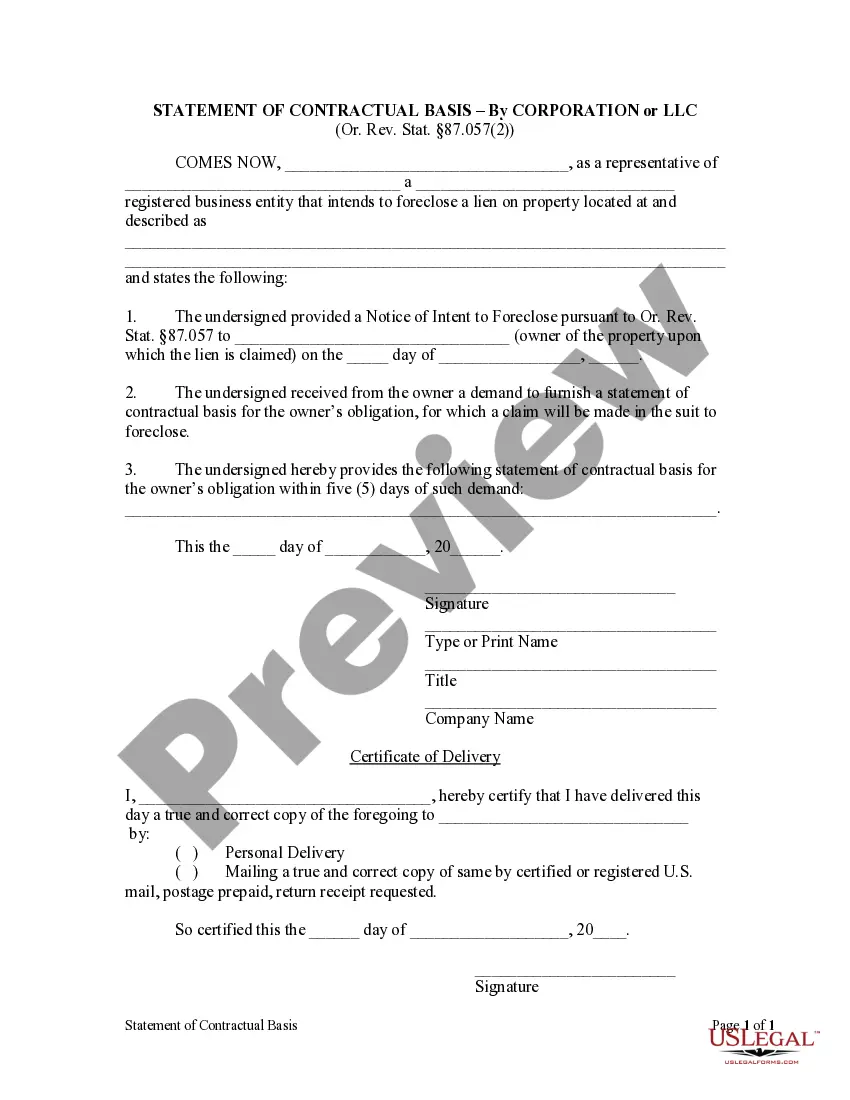

This Statement of Contractual Basis form is for use by a corporation that intends to foreclose a lien on property to respond to a demand the corporation received from the owner of the property upon which the lien is claimed within five days of such demand to furnish a statement of contractual basis for the owner's obligation, for which a claim will be made in the suit to foreclose.

Oregon Statement of Contractual Basis - Corporation

Description

How to fill out Oregon Statement Of Contractual Basis - Corporation?

In terms of filling out Oregon Statement of Contractual Basis - Corporation or LLC, you almost certainly imagine an extensive procedure that requires finding a perfect form among a huge selection of very similar ones and after that having to pay out a lawyer to fill it out for you. Generally, that’s a slow and expensive choice. Use US Legal Forms and select the state-specific form within clicks.

In case you have a subscription, just log in and click on Download button to get the Oregon Statement of Contractual Basis - Corporation or LLC sample.

If you don’t have an account yet but want one, keep to the point-by-point guide below:

- Be sure the file you’re saving is valid in your state (or the state it’s required in).

- Do so by looking at the form’s description and through clicking on the Preview option (if accessible) to see the form’s content.

- Click Buy Now.

- Choose the suitable plan for your financial budget.

- Sign up for an account and select how you want to pay out: by PayPal or by credit card.

- Save the document in .pdf or .docx format.

- Get the file on your device or in your My Forms folder.

Skilled legal professionals work on creating our templates to ensure after downloading, you don't need to bother about enhancing content outside of your personal info or your business’s information. Join US Legal Forms and get your Oregon Statement of Contractual Basis - Corporation or LLC example now.

Form popularity

FAQ

Debt of the S corporation does not result in basis for a shareholder, as there is nothing like the partnership-related IRC §752 for S corporation equity holders. Thus, the S corporation shareholder only receives basis for the PPP proceeds when forgiveness is recognized.

Computing Stock Basis. In computing stock basis, the shareholder starts with their initial capital contribution to the S corporation or the initial cost of the stock they purchased (the same as a C corporation). That amount is then increased and/or decreased based on the pass-through amounts from the S corporation.

PPP loan forgiveness is included as book income UltraTax CS reports this amount: On the Schedule M-1 as income on books not on return. For an S Corporation, the amount is treated as other exempt income.

The PPP rulesthey keep a-changin'. The owner-employee rules now apply to S and C corporation owners who have a 5 percent or greater ownership interest. No attribution rules apply for purposes of the 5 percent rule.

Stock basis is adjusted annually, as of the last day of the S corporation year, in the following order: Increased for income items and excess depletion; Decreased for distributions; Decreased for non-deductible, non-capital expenses and depletion; and.

With respect to partnerships and S corporations, the Act clarifies that any amount excluded from income due to PPP loan forgiveness will be treated as tax-exempt income and will increase an S corporation shareholder's stock basis and a partner's basis in their partnership interest.

For shareholders in an S-Corp only shareholder loans will give you debt basis. Debt basis will increase when a shareholder loans the S-Corp money and will be decreased when the loan is paid down.

S corporation shareholders are generally entitled to increase the basis of their holdings by their share of S corporation income, including tax-exempt income.

Since PPP loan forgiveness does not give rise to taxable income, and expenses funded with PPP loans are deductible, the IRS may not ever provide guidance on the timing issue.