Oklahoma Term Royalty Deed

Description

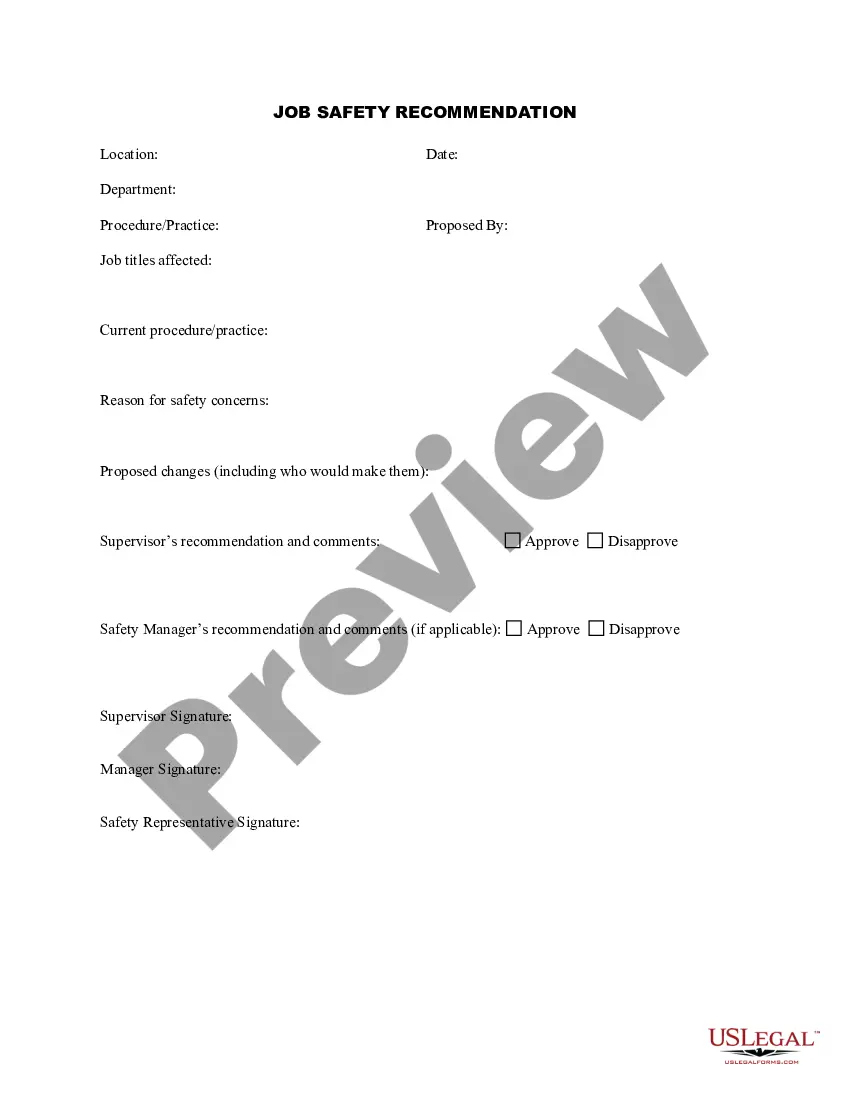

How to fill out Term Royalty Deed?

US Legal Forms - one of many greatest libraries of legitimate varieties in America - provides a wide array of legitimate record themes you may obtain or produce. Utilizing the website, you may get thousands of varieties for organization and specific uses, categorized by groups, states, or search phrases.You can find the latest variations of varieties just like the Oklahoma Term Royalty Deed in seconds.

If you already have a subscription, log in and obtain Oklahoma Term Royalty Deed through the US Legal Forms library. The Obtain switch will show up on each and every kind you perspective. You get access to all previously acquired varieties from the My Forms tab of the bank account.

In order to use US Legal Forms the very first time, here are basic recommendations to get you began:

- Be sure to have picked out the best kind for your town/region. Select the Preview switch to analyze the form`s content material. Look at the kind information to ensure that you have selected the correct kind.

- If the kind doesn`t match your demands, use the Lookup area near the top of the display to find the the one that does.

- When you are pleased with the form, confirm your choice by simply clicking the Acquire now switch. Then, pick the rates strategy you prefer and provide your accreditations to register for the bank account.

- Approach the deal. Use your charge card or PayPal bank account to finish the deal.

- Select the file format and obtain the form on your device.

- Make adjustments. Complete, modify and produce and sign the acquired Oklahoma Term Royalty Deed.

Every single template you included in your account does not have an expiry particular date which is your own property permanently. So, if you wish to obtain or produce an additional backup, just check out the My Forms section and click on on the kind you want.

Gain access to the Oklahoma Term Royalty Deed with US Legal Forms, the most comprehensive library of legitimate record themes. Use thousands of professional and state-distinct themes that meet your small business or specific demands and demands.

Form popularity

FAQ

?To pay Lessor for gas (including casinghead gas) and all other substance covered hereby, a royalty of 3/16 of the proceeds realized by Lessee from the sale thereof.? This simply means the operator will pay a royalty of 3/16 of revenue generated from production on the property. Mineral Interest Owners: How to Know What You Own - Mercer Capital mercercapital.com ? energyvaluationinsights ? mi... mercercapital.com ? energyvaluationinsights ? mi...

An attorney can create a deed or assignment that conveys the mineral rights to the new owners. The original deed will need to be recorded in the county where the minerals are located. If there are producing wells on the property, each operator will need to be notified of the change in ownership. Transferring the Ownership of Mineral Rights - A Quick Guide bluemesaminerals.com ? transfer-mineral-rights-o... bluemesaminerals.com ? transfer-mineral-rights-o...

The value of mineral rights per acre differs from state to state. Typically, the price ranges from $100 to $5,000 per acre in several states. In Texas, the average price per acre for non-producing mineral rights is usually between $0 and $250 per acre, as a general guideline.

Yes, it can be beneficial to sell your mineral rights for a fair price, even producing rights. First, sellers must be aware of the different stages of the production process. They must also know the value their minerals and royalties command in every development stage. Why Sell Your Mineral Rights - 6 Factors to Consider pheasantenergy.com ? why-sell-mineral-rights pheasantenergy.com ? why-sell-mineral-rights

A royalty deed gives its holder the right to receive a percentage of the profits from the sale of the minerals, if and when they are actually produced. This kind of legal document does not convey all of the mineral rights to the holder, only the right to receive royalties. Conveyancing ? Royalty And Mineral Deeds - Brown & Fortunato bf-law.com ? blog ? conveyancing-royalty-... bf-law.com ? blog ? conveyancing-royalty-...

Cons of Selling Your Mineral Rights Loss of Potential Future Income: When you sell your mineral rights, you also give up any potential future income from those rights. This can be a significant loss if the mineral rights end up producing more than expected or if there are new discoveries in the future.

Taxes: The #1 reason for selling mineral rights is taxes. If you inherited mineral rights and then sold them for $100,000, you could pay only $5,250 in taxes and keep $94,750. If you collect royalty income of $100,000, you could pay $30,000+ in taxes and only keep $70,000 and it would takes years to collect.

Unsolicited purchase offers are happening in greater numbers and for greater ? sometimes much greater ? amounts than in the past. The upshot? Sometimes selling makes good sense. Indeed, depending on your situation, the sale of your mineral rights can represent a prudent ? and even compelling ? opportunity.