Oklahoma Catering Services Contract - Self-Employed Independent Contractor

Description

How to fill out Catering Services Contract - Self-Employed Independent Contractor?

US Legal Forms - one of the foremost collections of legal documents in the United States - offers a vast selection of legal template files that you can either download or print.

While navigating the website, you will encounter numerous forms for both business and personal use, organized by categories, states, or keywords.

You can swiftly find the latest versions of forms such as the Oklahoma Catering Services Agreement - Independent Contractor in just seconds.

If the form does not meet your requirements, use the Search box at the top of the screen to find the one that does.

Once you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, choose your preferred pricing plan and provide your information to register for an account.

- If you already have an account, Log In to access and download the Oklahoma Catering Services Agreement - Independent Contractor from the US Legal Forms library.

- The Download button will appear on every document you view.

- You can retrieve all previously downloaded forms from the My documents section of your account.

- To utilize US Legal Forms for the first time, here are some straightforward instructions to get you started.

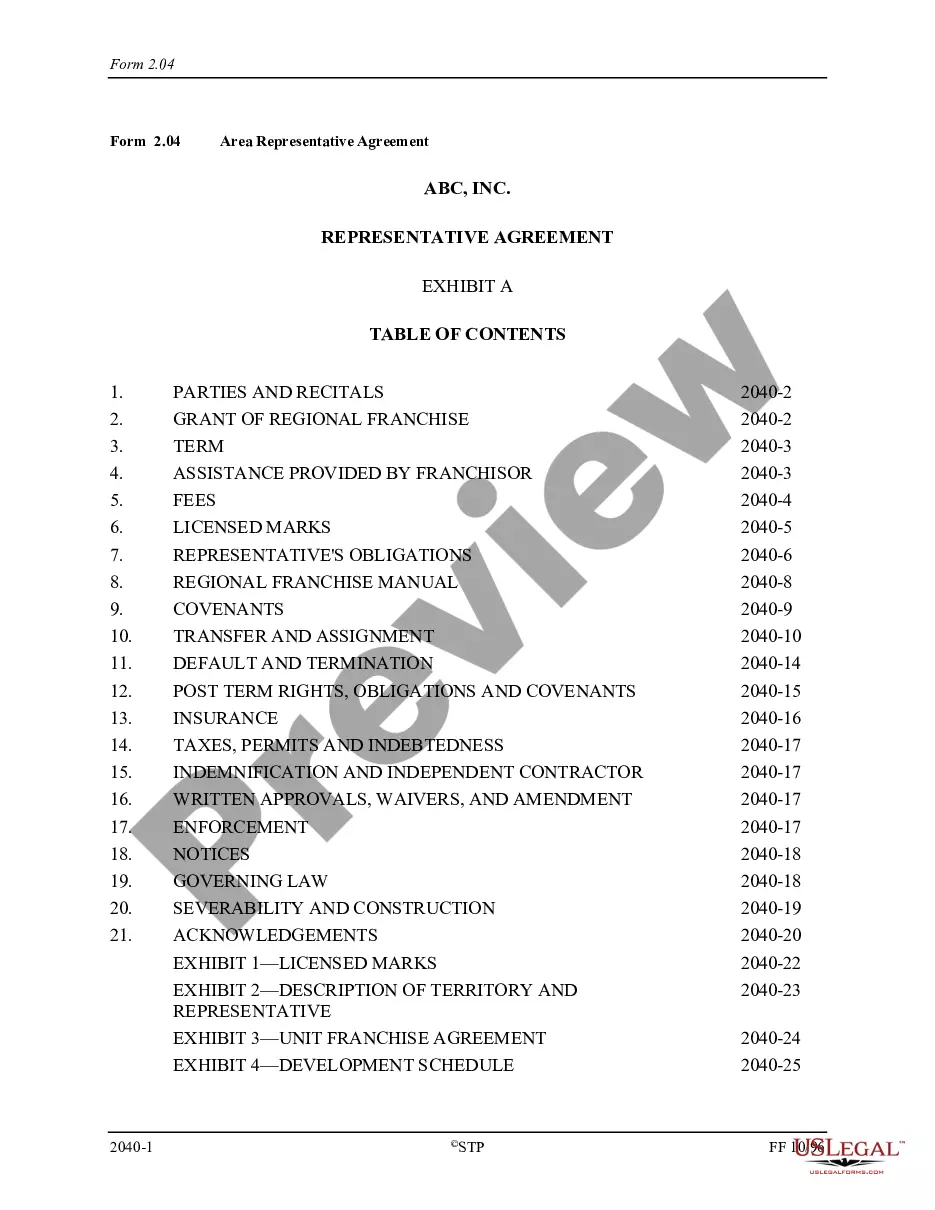

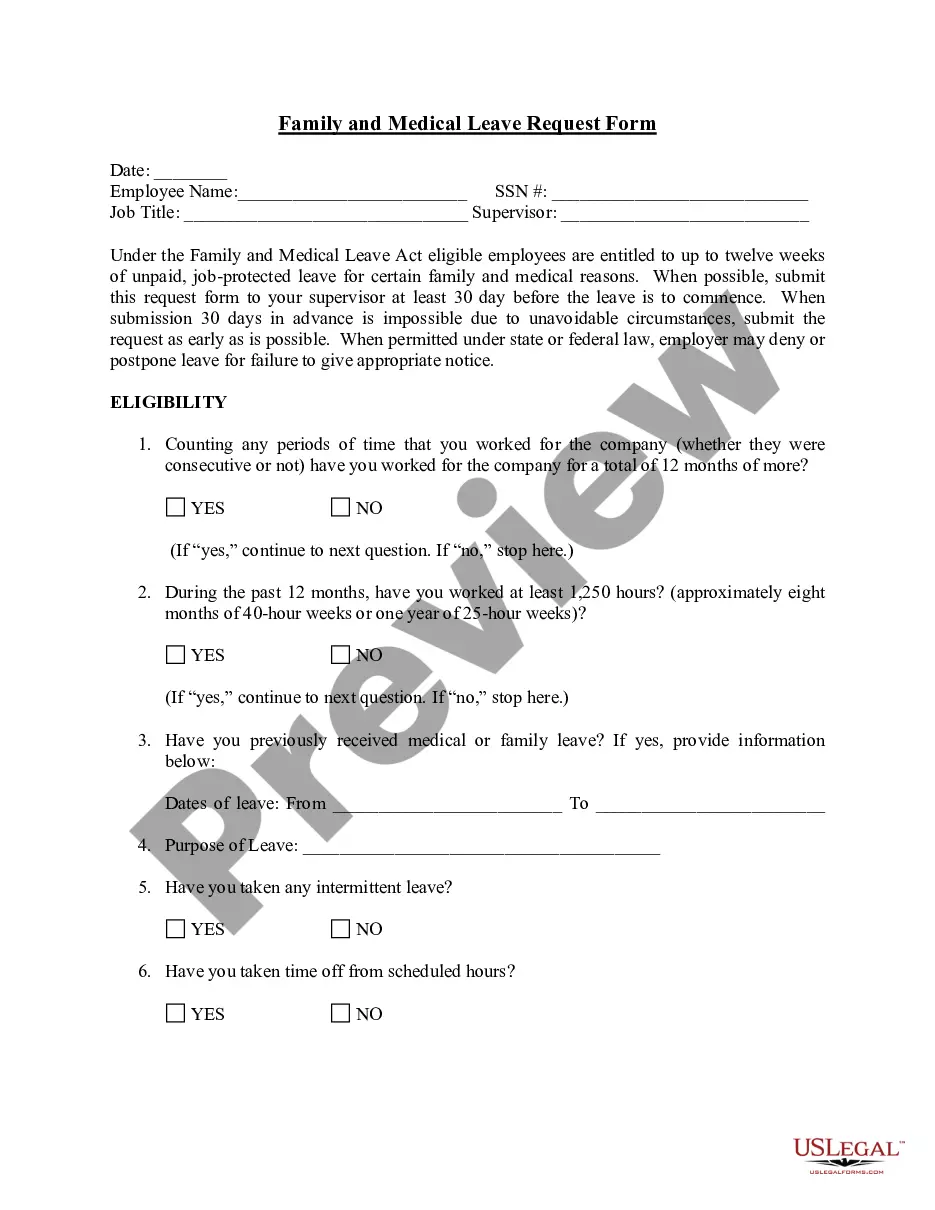

- Make sure you select the right form for your city/state. Click the Review button to examine the form's content.

- Read the form description to confirm that you have chosen the correct document.

Form popularity

FAQ

To write a contract as a self-employed independent contractor, you need to start with a clear title, such as 'Oklahoma Catering Services Contract - Self-Employed Independent Contractor.' Include essential details like the scope of work, payment terms, and deadlines. Additionally, outline the responsibilities of both parties and include a section for dispute resolution. Using a reliable platform like US Legal Forms can streamline this process, ensuring your contract meets legal standards and protects your interests.

A vendor qualifies as an independent contractor if they are in control of how they complete their work, providing services to clients without being subject to the company's direct supervision. Additionally, they should have a signed Oklahoma Catering Services Contract - Self-Employed Independent Contractor, which outlines the terms of their services. Key factors include their ability to operate independently and the level of financial risk they undertake. To ensure compliance and clarity, using US Legal Forms can be a great advantage.

To become an independent contractor in Oklahoma, begin by determining your business structure and registering it with the appropriate state authorities. Next, familiarize yourself with Oklahoma laws governing independent contractor agreements, specifically the Oklahoma Catering Services Contract - Self-Employed Independent Contractor. Lastly, consider utilizing US Legal Forms to access reliable resources and templates that can help you navigate compliance and registration smoothly.

Yes, you can create your own legally binding contract, provided it meets specific legal requirements. Ensure that your Oklahoma Catering Services Contract - Self-Employed Independent Contractor includes essential elements such as offer, acceptance, and consideration. Clarity and specificity in language will help prevent misunderstandings. Moreover, using resources from US Legal Forms can help you draft a contract that holds up in court.

To create an independent contractor contract, start by outlining the specific services you will provide as an independent contractor. Include details such as payment terms, project deadlines, and responsibilities. Additionally, it's essential to specify that you are entering into an Oklahoma Catering Services Contract - Self-Employed Independent Contractor agreement. Utilizing platforms like US Legal Forms can simplify this process by providing templates tailored to your needs.

Yes, self-employed individuals can claim food expenses that are business-related. If the food expenses are incurred while fulfilling obligations under an Oklahoma Catering Services Contract - Self-Employed Independent Contractor, they may be deductible. It's essential to document these expenses properly to satisfy IRS requirements and ensure successful claims.

The $2500 expense rule simplifies the deductibility of certain business expenses. If an independent contractor spends less than $2500 on a single item, they can often write it off easily without extensive documentation. This rule is beneficial for those managing an Oklahoma Catering Services Contract - Self-Employed Independent Contractor, allowing for a more streamlined expense tracking process.

Independent contractors must comply with various legal requirements, including proper licensing, tax obligations, and contracts. Having an Oklahoma Catering Services Contract - Self-Employed Independent Contractor is essential for defining the terms of the work and ensuring clarity on payment, deliverables, and legal responsibilities. Consulting legal resources or platforms like US Legal Forms can provide necessary templates and guidance.

Yes, independent contractors can write off food expenses related to their business activities. If you provide meals for clients, employees, or yourself during a business event outlined in your Oklahoma Catering Services Contract - Self-Employed Independent Contractor, those costs may qualify as deductible. Always maintain detailed records to support your claims.

Yes, you can write off food as a business expense if it meets IRS guidelines. Meals incurred while entertaining clients or to further your business as defined in your Oklahoma Catering Services Contract - Self-Employed Independent Contractor can be deductible. It's important to keep detailed receipts and document the purpose of the business meal for tax purposes.