Oklahoma Sub-Advisory Agreement between Prudential Investments Fund Management, LLC and The Prudential Investment Corp. regarding provision of investment advisory services

Description

How to fill out Sub-Advisory Agreement Between Prudential Investments Fund Management, LLC And The Prudential Investment Corp. Regarding Provision Of Investment Advisory Services?

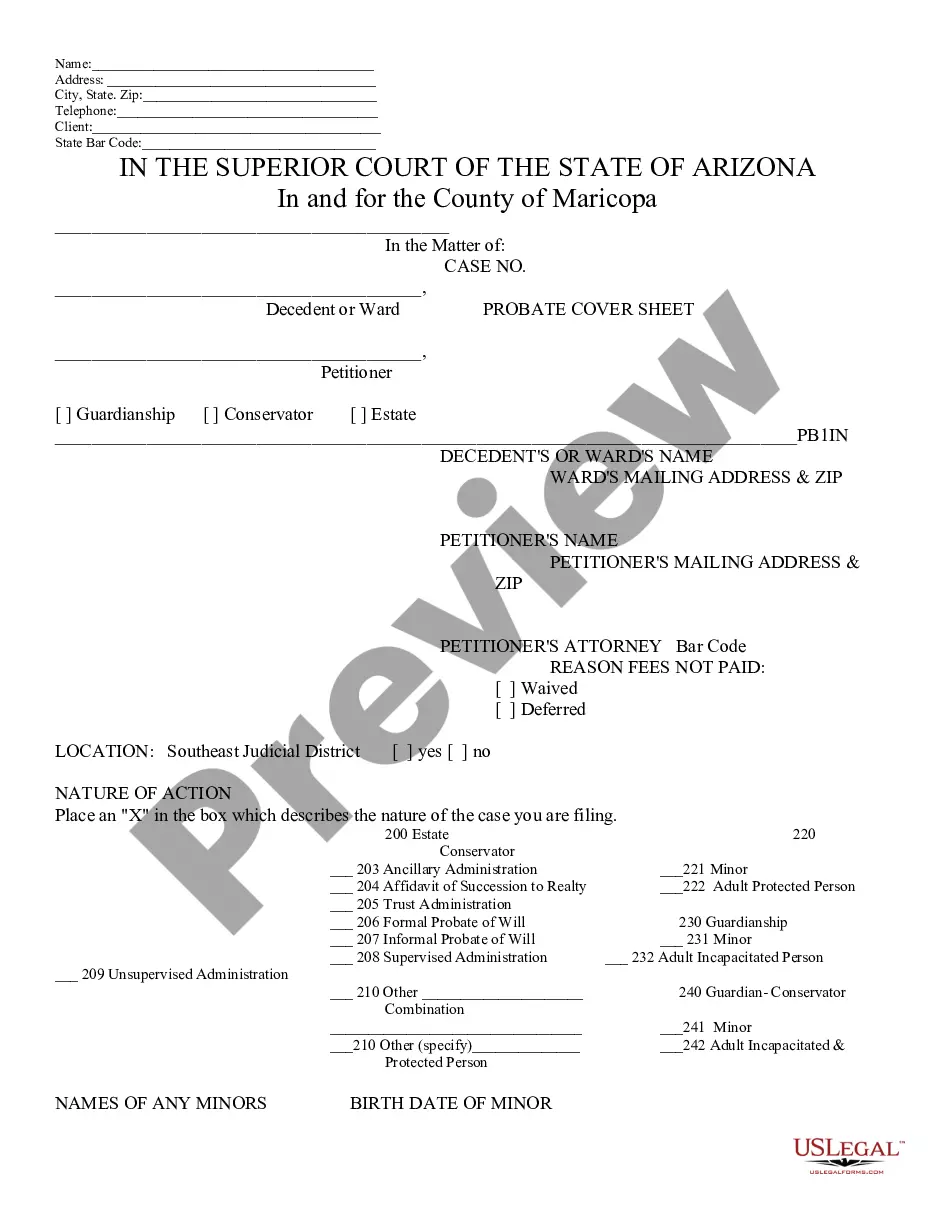

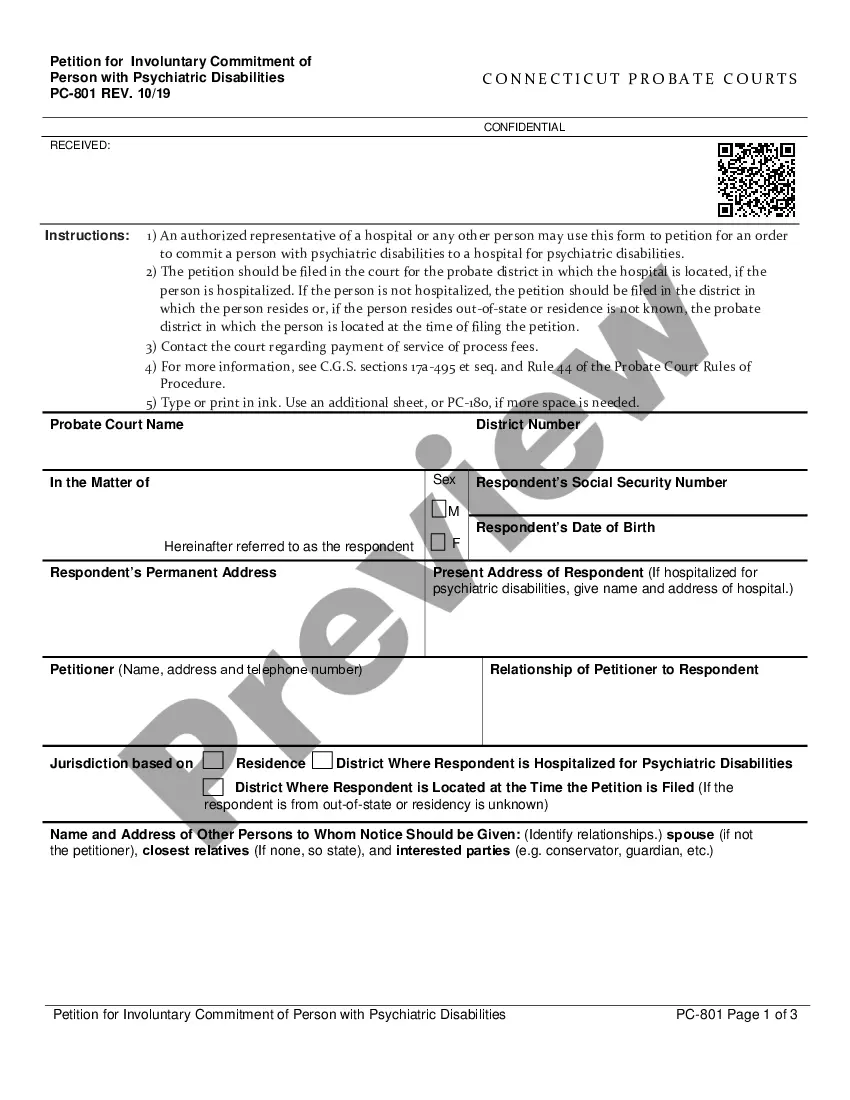

You may commit several hours on the Internet trying to find the lawful document web template that suits the federal and state requirements you want. US Legal Forms provides 1000s of lawful kinds which are analyzed by pros. It is possible to download or printing the Oklahoma Sub-Advisory Agreement between Prudential Investments Fund Management, LLC and The Prudential Investment Corp. regarding provision of investment advisory services from my services.

If you have a US Legal Forms accounts, you can log in and then click the Acquire option. Following that, you can full, modify, printing, or signal the Oklahoma Sub-Advisory Agreement between Prudential Investments Fund Management, LLC and The Prudential Investment Corp. regarding provision of investment advisory services. Every lawful document web template you buy is yours permanently. To have an additional backup associated with a acquired develop, go to the My Forms tab and then click the related option.

If you work with the US Legal Forms internet site initially, keep to the basic recommendations under:

- Very first, make certain you have selected the best document web template for your region/area of your choice. Browse the develop information to make sure you have picked out the appropriate develop. If available, make use of the Review option to check with the document web template as well.

- In order to locate an additional edition of the develop, make use of the Research field to discover the web template that meets your needs and requirements.

- Once you have found the web template you need, simply click Purchase now to carry on.

- Find the rates strategy you need, key in your accreditations, and register for an account on US Legal Forms.

- Comprehensive the financial transaction. You can use your credit card or PayPal accounts to purchase the lawful develop.

- Find the format of the document and download it for your device.

- Make modifications for your document if required. You may full, modify and signal and printing Oklahoma Sub-Advisory Agreement between Prudential Investments Fund Management, LLC and The Prudential Investment Corp. regarding provision of investment advisory services.

Acquire and printing 1000s of document layouts utilizing the US Legal Forms site, that offers the greatest variety of lawful kinds. Use professional and state-distinct layouts to tackle your small business or specific requires.

Form popularity

FAQ

We are Prudential. For Every Life, For Every Future. Prudential plc provides life and health insurance and asset management to 18 million customers across 24 markets in Asia and Africa. We are headquartered in London and Hong Kong and are focused on four strategic regions: Greater China, ASEAN, India and Africa.

To see this page as it is meant to appear/function please use a Javascript enabled browser. Effective April 1, 2022, Empower officially acquired the full-service retirement business of Prudential.

An investment bond is a single-premium life insurance policy that can be used to hold investments in a tax-efficient manner. As with any investment, the value of the bond may go up or down depending on how well your investments perform. The investor might not get back their initial investment.

The Prudential Investment Plan is an investment bond where you can invest your money in a range of different funds that aim to increase the value of your investment over the medium- to long-term, so 5 to 10 years or more.

Your Prudential Investment Bond is an investment bond designed to provide you with medium to long term capital growth, with an element of life cover.

Our Prudence Bond and Prudence Managed Investment Bond are single premium investment bonds that let you invest your money in a range of different funds. Your bond started with a single payment. You can make additional payments at any time, make regular and partial withdrawals, or you can cash in your bond at any time.

Withdrawals after the 5% per annum allowance has been used for 20 years. If an investment bond has been paying a 5% per annum income for 20 years, HMRC deem this to be a return of the investor's original capital and any additional withdrawals would be considered chargeable events each time they are made.

Based on former employees' testimony, investors alleged that Prudential already knew in February that there had recently been an unexpected number of deaths among holders of 700,000 policies the company purchased from another insurer.