Oklahoma Amendment of common stock par value

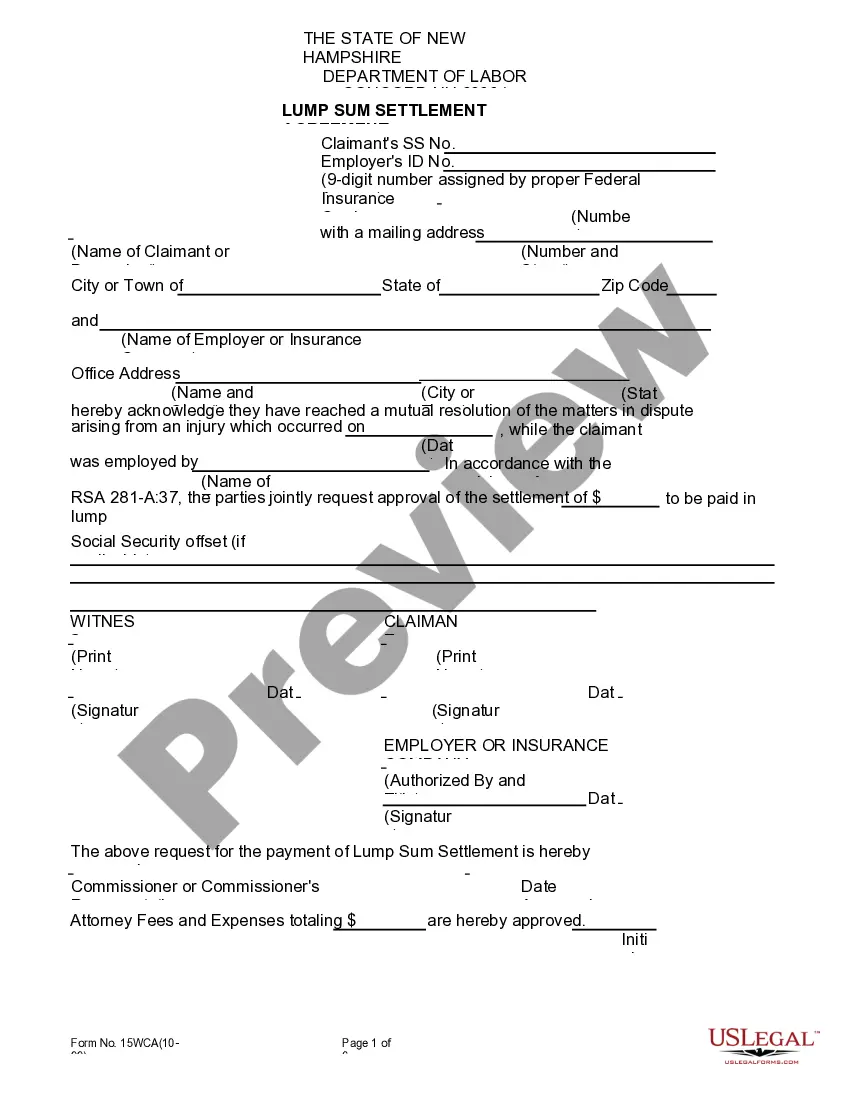

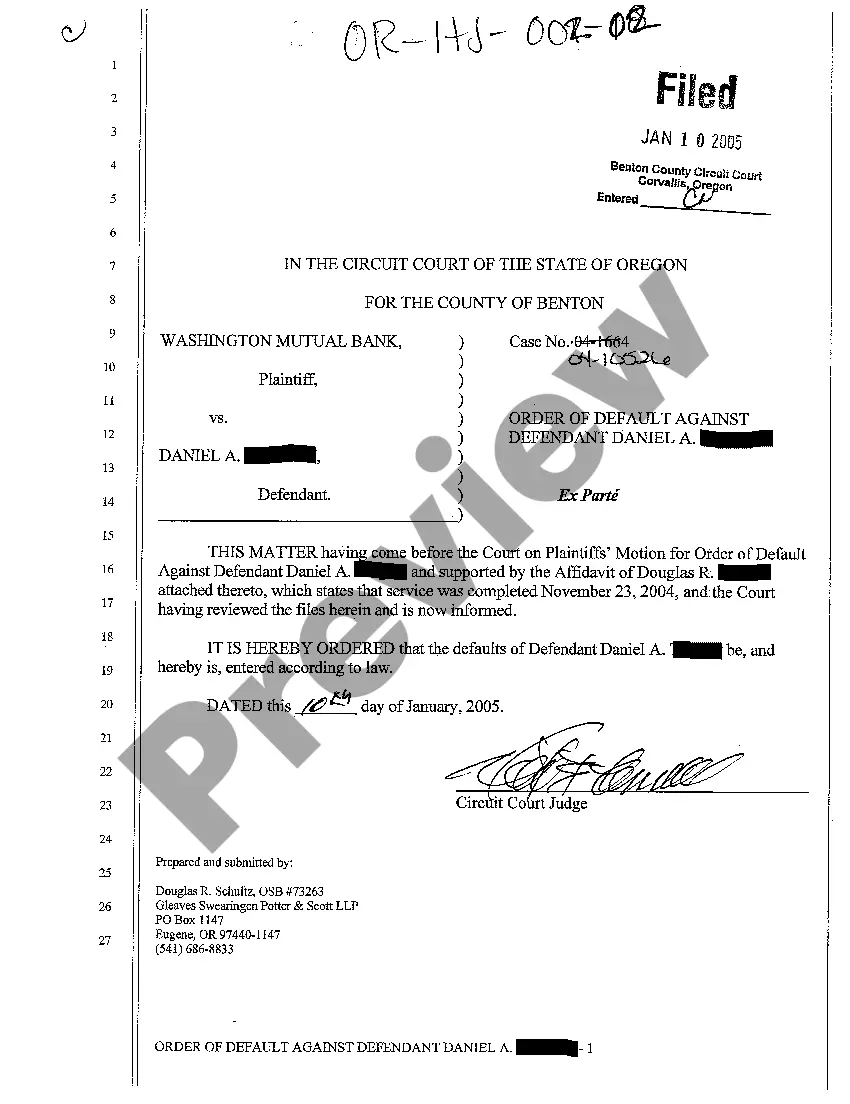

Description

How to fill out Amendment Of Common Stock Par Value?

If you want to full, obtain, or print authorized file layouts, use US Legal Forms, the greatest assortment of authorized forms, which can be found on the web. Utilize the site`s simple and practical look for to obtain the documents you need. A variety of layouts for enterprise and specific reasons are sorted by classes and suggests, or key phrases. Use US Legal Forms to obtain the Oklahoma Amendment of common stock par value within a few clicks.

When you are presently a US Legal Forms client, log in in your bank account and click the Download option to get the Oklahoma Amendment of common stock par value. You can also entry forms you previously downloaded in the My Forms tab of your own bank account.

If you are using US Legal Forms the first time, follow the instructions below:

- Step 1. Make sure you have chosen the form to the proper town/nation.

- Step 2. Utilize the Review solution to look over the form`s articles. Do not forget about to read the information.

- Step 3. When you are not satisfied with all the form, make use of the Research area near the top of the screen to find other models of the authorized form web template.

- Step 4. Once you have discovered the form you need, select the Get now option. Select the pricing plan you like and include your accreditations to register for the bank account.

- Step 5. Procedure the financial transaction. You can use your charge card or PayPal bank account to complete the financial transaction.

- Step 6. Choose the format of the authorized form and obtain it on your product.

- Step 7. Complete, change and print or indicator the Oklahoma Amendment of common stock par value.

Each authorized file web template you get is yours forever. You possess acces to every form you downloaded inside your acccount. Select the My Forms section and pick a form to print or obtain again.

Be competitive and obtain, and print the Oklahoma Amendment of common stock par value with US Legal Forms. There are many skilled and express-specific forms you can utilize to your enterprise or specific demands.

Form popularity

FAQ

Typically, you can't just make an amendment saying you now have a new par value. Instead, the most common way that corporations change their par value is with a stock split (or reverse stock split). A stock split is exactly what it sounds like: a division of shares.

Key Takeaways. A par value for a stock is its per-share value assigned by the company that issues it and is often set at a very low amount such as one cent. A no-par stock is issued without any designated minimum value. Neither form has any relevance for the stock's actual value in the markets.

?Par value? or ?face value? is the lowest price for which a company can sell stock. ?Fair Market Value? is the notional value of stock on the market at the time of sale. A reasonable par value for an early stage company can be as low as $0.00001. Setting a par value low can avoid tax liabilities later.

The company's par value is calculated by multiplying the par value per share by the total number of shares issued. That means you'll just need to grab your calculator and key in the math.

Small corporations that intend to have only one or a few shareholders sometimes issue stock at $1 par value. If you have printed stock certificates, their par value should be printed on the certificate.