Oklahoma Proposed Additional Compensation Plan with copy of plan

Description

How to fill out Proposed Additional Compensation Plan With Copy Of Plan?

Have you been inside a place that you require documents for both enterprise or specific reasons almost every working day? There are a lot of legitimate document templates accessible on the Internet, but finding ones you can rely on isn`t easy. US Legal Forms provides a huge number of type templates, such as the Oklahoma Proposed Additional Compensation Plan with copy of plan, that happen to be written to fulfill state and federal needs.

In case you are previously familiar with US Legal Forms website and also have an account, basically log in. Afterward, you are able to down load the Oklahoma Proposed Additional Compensation Plan with copy of plan design.

If you do not come with an bank account and need to begin using US Legal Forms, abide by these steps:

- Get the type you will need and ensure it is to the right area/region.

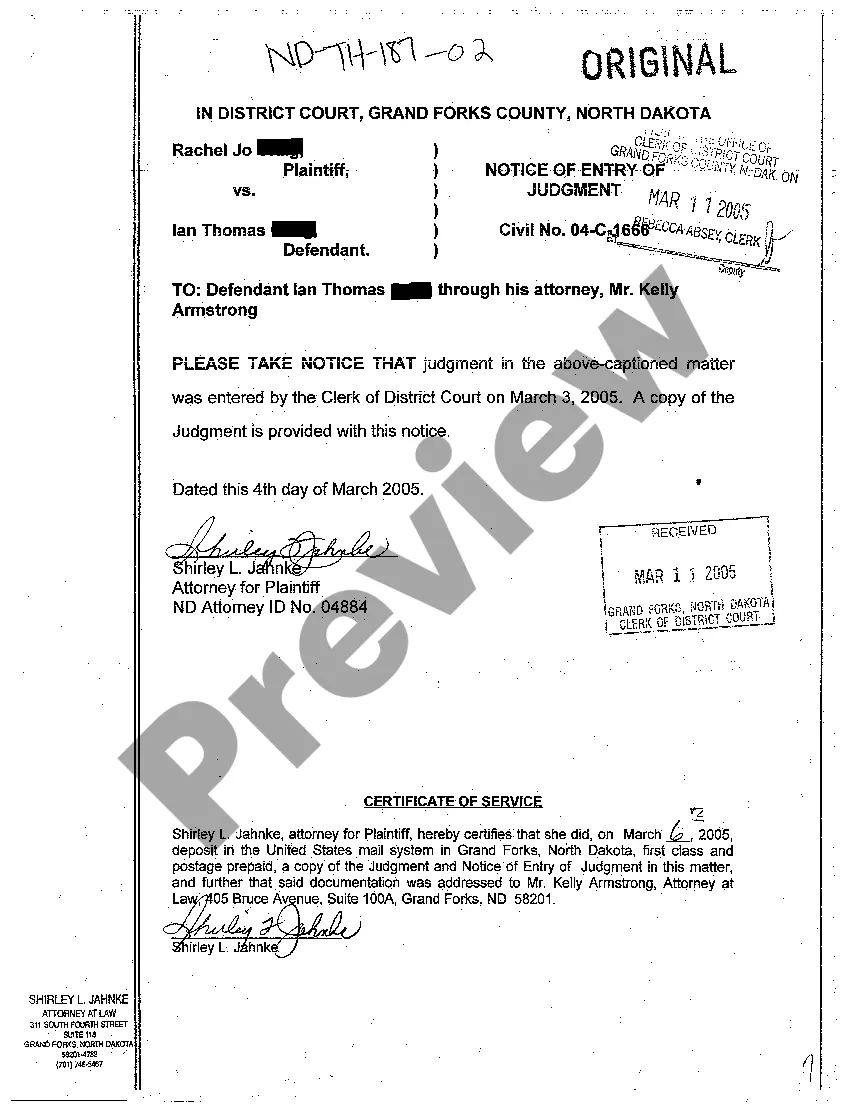

- Use the Review key to examine the shape.

- See the description to actually have selected the appropriate type.

- In the event the type isn`t what you`re seeking, use the Lookup area to discover the type that suits you and needs.

- When you get the right type, click on Purchase now.

- Opt for the pricing prepare you need, fill out the specified information and facts to produce your account, and pay money for the transaction utilizing your PayPal or charge card.

- Pick a practical paper file format and down load your version.

Get all of the document templates you may have bought in the My Forms menus. You may get a additional version of Oklahoma Proposed Additional Compensation Plan with copy of plan at any time, if needed. Just click the essential type to down load or printing the document design.

Use US Legal Forms, one of the most extensive variety of legitimate forms, in order to save time and stay away from mistakes. The services provides appropriately created legitimate document templates that can be used for a variety of reasons. Create an account on US Legal Forms and start producing your daily life a little easier.

Form popularity

FAQ

Section 3-1-11 - Overpayment of wages (a) If an employer determines that an employee has been overpaid, the employer may recover the overpaid sum from the employee in one of two ways: (1) Lump sum cash repayment; or (2) Agreement for payroll deduction in a lump sum or in installments over a term not to exceed the ...

Oklahoma employers don't have to offer meal or rest breaks. In Oklahoma, no law gives employees the right to time off to eat lunch (or another meal) or the right to take short breaks during the work day. Employees must be paid for shorter breaks they are allowed to take during the day.

Pathfinder is composed of a 401(a) Plan for mandatory and matching contributions and a 457(b) Plan for additional voluntary contributions. With each paycheck you make a mandatory contribution of 4.5% of your pretax salary to the 401(a) Plan. Your employer also contributes 6% of your pretax salary into the plan.

Oklahoma employers don't have to offer meal or rest breaks. In Oklahoma, no law gives employees the right to time off to eat lunch (or another meal) or the right to take short breaks during the work day.

Employers must pay their nonexempt employees at least semimonthly on regular paydays the employer chooses in advance. They may pay exempt employees as well as state, county, and municipal employees monthly. The payday must be within 11 days of the end of the pay period.

If an employee works 8 or more consecutive hours, the employer must provide a 30-minute break and an additional 15 minute break for every additional 4 consecutive hours worked.

California Rest Breaks The amount of rest time the employee receives corresponds to the length of their shift. Employees must get 10 consecutive minutes for a break every 4 hours. If the employee works a fraction of their work that is 2 hours or more, then they must receive a break.

Oklahoma Labor Laws Guide Oklahoma Labor Laws FAQOklahoma minimum wage$7.25Oklahoma overtime1.5 times the regular wage for any time worked over 40 hours/week ($10.87 for minimum wage workers)Oklahoma breaksBreaks not required by law