Oklahoma Order Discharging Debtor After Completion of Chapter 12 Plan - updated 2005 Act form

Description

How to fill out Order Discharging Debtor After Completion Of Chapter 12 Plan - Updated 2005 Act Form?

Choosing the right legal papers template could be a struggle. Obviously, there are a lot of layouts accessible on the Internet, but how do you find the legal form you will need? Use the US Legal Forms site. The service offers 1000s of layouts, such as the Oklahoma Order Discharging Debtor After Completion of Chapter 12 Plan - updated 2005 Act form, that you can use for business and personal needs. All the kinds are checked by professionals and meet federal and state specifications.

If you are presently listed, log in in your bank account and click the Acquire button to find the Oklahoma Order Discharging Debtor After Completion of Chapter 12 Plan - updated 2005 Act form. Make use of bank account to look through the legal kinds you may have acquired previously. Check out the My Forms tab of your respective bank account and get another backup in the papers you will need.

If you are a new customer of US Legal Forms, listed here are easy guidelines that you should stick to:

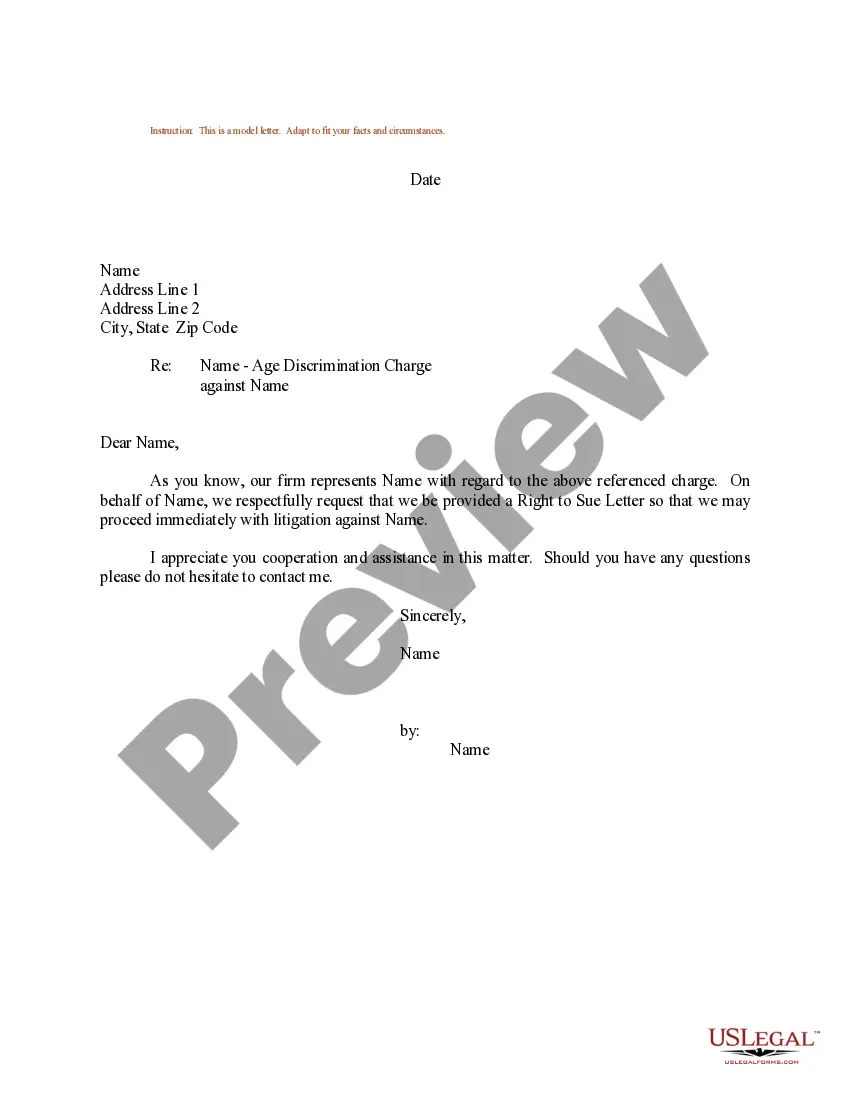

- Initially, be sure you have chosen the correct form to your metropolis/state. You are able to examine the form while using Review button and study the form outline to ensure it is the right one for you.

- In case the form does not meet your preferences, make use of the Seach field to get the correct form.

- When you are certain the form is proper, select the Acquire now button to find the form.

- Pick the costs program you need and type in the essential information and facts. Design your bank account and pay money for your order utilizing your PayPal bank account or charge card.

- Select the submit format and acquire the legal papers template in your product.

- Complete, edit and produce and indication the received Oklahoma Order Discharging Debtor After Completion of Chapter 12 Plan - updated 2005 Act form.

US Legal Forms is the greatest library of legal kinds that you will find a variety of papers layouts. Use the service to acquire skillfully-manufactured papers that stick to condition specifications.

Form popularity

FAQ

There are three ways you can annul your bankruptcy: Pay debts in full. This includes interest, realisations charges and your trustee's fees and expenses. ... Arrange a composition. Your creditors accept an arrangement we call a composition. ... Prove it in court.

Request a goodwill deletion If you've repaid the debt, write a letter requesting a goodwill deletion to remove the closed collection account from your credit report.

(b) Discharge by Court Order under section 33(3) of Insolvency Act 1967; This application is filed by the bankrupt anytime to the court at any time after a bankruptcy order has been made. The Court will scrutinize the report by DGI on the conduct of the bankrupt during the administration of the bankruptcy period.

A bankruptcy discharge, also known as a discharge in bankruptcy or simply as a discharge, is a permanent court order that releases a debtor from liability for certain types of debts at the end of the bankruptcy process.

The court will annul a bankruptcy order once the court is satisfied that the bankrupt's debt are paid in full. (b) Discharge by Court Order under section 33(3) of Insolvency Act 1967; This application is filed by the bankrupt anytime to the court at any time after a bankruptcy order has been made.

Courts can issue a discharge ruling when the debtor meets the discharge requirements under Chapter 7 or Chapter 11 of federal bankruptcy law, or the ruling is based on a debt canceling. A canceling of debt happens when the lender agrees that the rest of the debt is forgiven.

Your creditors are still allowed to list discharged debts on your credit report, but not as active or having any amount owed. Your bankruptcy-related debts can be listed as existing, but with zero balance.

You cannot remove a discharged debt from your credit report unless the information listed is incorrect. Even though you repaid the debt, partially or in full, or the lender stopped its collection attempts, the entry will remain on your report for seven years.

A debtor may repay a discharged debt even though it can no longer be legally enforced. Sometimes a debtor agrees to repay a debt because it is owed to a family member or because it represents an obligation to an individual for whom the debtor's reputation is important, such as a family doctor.

Loan forgiveness does not remove accounts from a credit report. Instead, the loans will be paid in full, and a borrower's debt-to-income (DTI) ratio will improve.